The VN-Index continued its recovery trend, opening the trading session on July 2nd with gains and maintaining a positive trajectory throughout the day. The benchmark index closed up 15.23 points (+1.21%) at nearly 1,270 points, buoyed by strong performance from large-cap stocks.

Despite the upbeat performance of the VN-Index, foreign investors remained net sellers on the market, offloading over VND 31 billion worth of shares across all exchanges. This marked the 18th consecutive session of net selling by foreign investors. However, it’s worth noting that the net selling value decreased significantly, partly due to the strong performance of DSE, a newly listed stock on the exchange.

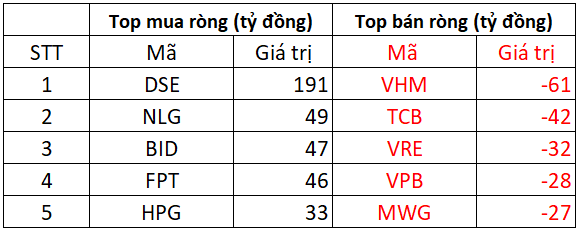

On the Ho Chi Minh Stock Exchange (HoSE), foreign investors net sold over VND 48 billion

DSE, the newly listed securities company on HoSE, was the most bought stock by foreign investors, with a net purchase of over 6.6 million shares worth VND 191 billion. On July 1st, 2024, 330 million shares of DNSE Securities Joint Stock Company officially debuted on HoSE under the ticker symbol DSE. By the end of the July 2nd trading session, DSE’s market price stood at VND 28,700 per share, translating to a market capitalization of nearly VND 9,500 billion. Notably, DNSE is the only securities company to go public and list on the stock exchange in the past five years.

It is worth mentioning that Consilium Investment Management (USA) bought more than 6.6 million shares of DSE in this session. Following this transaction, the fund now holds over 2% of DNSE’s capital. This indicates foreign interest and improved liquidity for DSE, despite its recent listing.

On the other hand, VHM witnessed the highest net selling value by foreign investors, amounting to VND 61 billion. TCB, VRE, VPB, and MWG also experienced notable net selling pressure, with each stock recording net selling values in the tens of billions of VND.

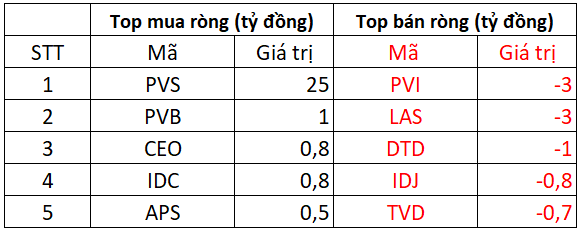

On the Hanoi Stock Exchange (HNX), foreign investors net bought over VND 18 billion

PVS was the most purchased stock on HNX by foreign investors, with a net buy value of VND 25 billion. Additionally, PVB, CEO, and IDC also witnessed strong net buying on HNX, although the values were relatively smaller at around VND 1 billion each.

On the selling side, PVI and LAS faced the highest net selling pressure, with foreign investors offloading VND 3 billion worth of shares in each stock. DTD, IDJ, and TVD also experienced net selling but to a lesser extent, with values below VND 1 billion each.

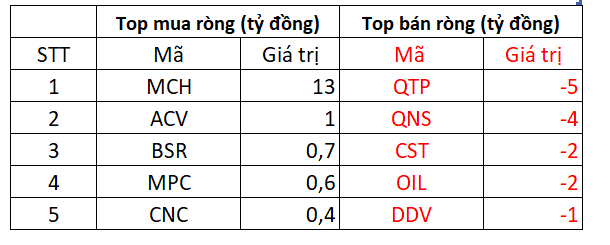

On the Unlisted Public Company Market (UPCOM), foreign investors net sold VND 1 billion

Conversely, QTP and QNS faced the highest net selling pressure, with foreign investors offloading VND 5 billion and VND 4 billion worth of shares, respectively. Additionally, stocks like CST, OIL, and DDV also experienced net selling by foreign investors.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.