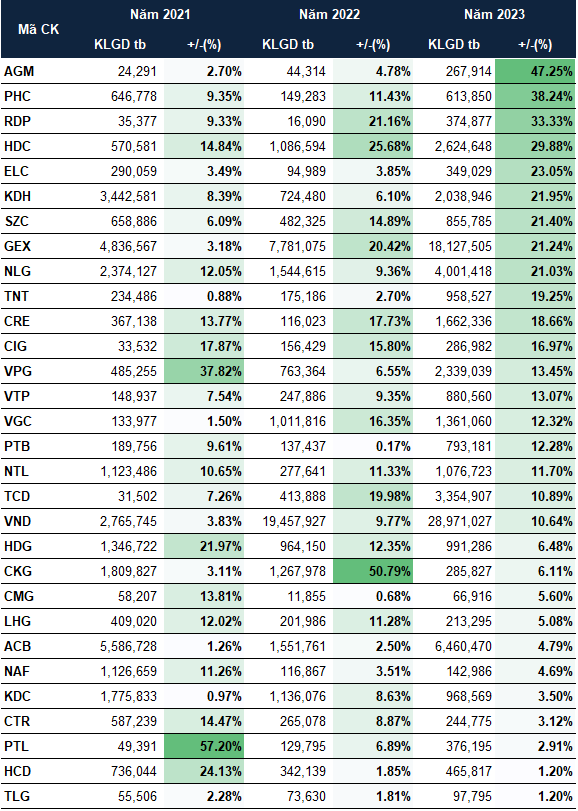

According to statistics from VietstockFinance, the HOSE floor recorded 30 rising stocks in July for three consecutive years from 2021 to 2023, including many stocks in the construction and real estate sector such as: NLG, KDH, HDG, LHG, CKG, NTL, and SZC.

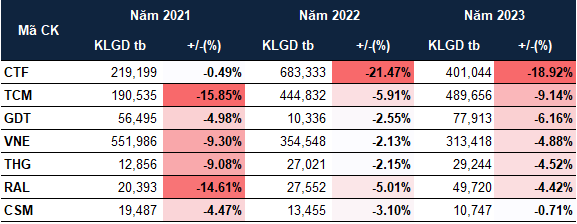

On the opposite side, only seven stocks declined, including CTF, TCM, GDT, VNE, THG, RAL, and CSM.

| | Stocks on the HOSE floor that increased in price in all of July from 2021-2023 |

| — | — |

|  | Source: VietstockFinance |

| Source: VietstockFinance |

| | Stocks on the HOSE floor that decreased in price in all of July from 2021-2023 |

| — | — |

|  | Source: VietstockFinance |

| Source: VietstockFinance |

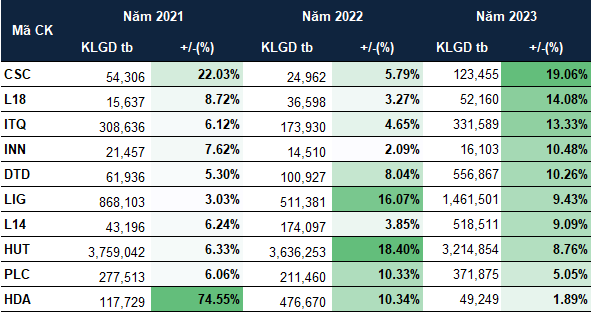

The HNX floor did not record any stocks that consistently declined during July for the three consecutive years from 2021 to 2023, while there were 10 stocks that consistently increased during this period, with notable names including LIG, L14, HUT, and PLC.

| | Stocks on the HNX floor that increased in price in all of July from 2021-2023 |

| — | — |

|  | Source: VietstockFinance |

| Source: VietstockFinance |

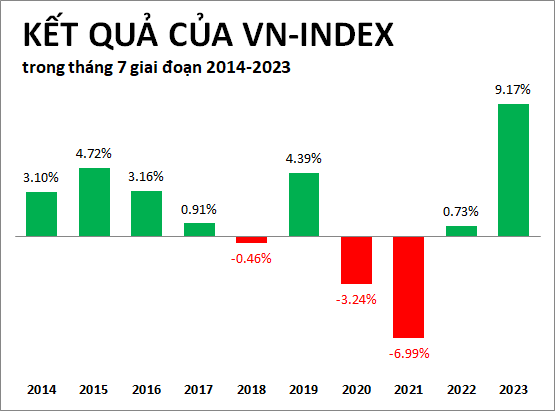

Looking at a broader decade-long perspective (2014-2023), the VN-Index usually performed well in July, with 7 out of 10 years of green marks and only 3 years of declines.

| | VN-Index performance in July from 2014-2023 |

| — | — |

|  | Source: VietstockFinance |

| Source: VietstockFinance |

As the month that kicks off the second half of the year, July is expected to bring about many positive changes in the market. According to TPS Research, the second half of 2024 will be the premise for the market’s uptrend from:

1. The story of the upgrade is brighter as Vietnam has improved the criterion of transferability in the MSCI assessment report for June 2024.

2. The KRX system is being urgently completed, expected to be deployed from September 2024, consolidating the possibility of an upgrade.

3. Important laws such as the Land Law, Real Estate Business Law, etc., will take effect from Q3/2024, creating momentum for the stock market to increase.

Ha Le