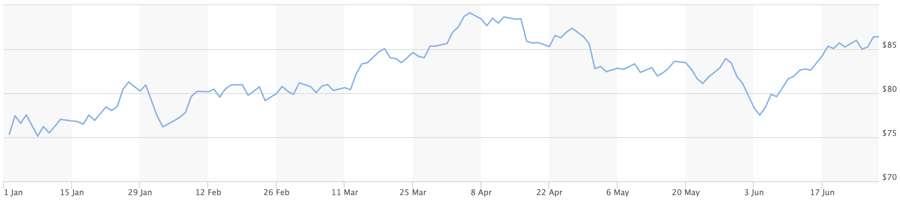

US stocks closed lower on Friday, June 28, despite positive inflation data and better-than-expected consumer sentiment. Oil prices also declined but finished a strong month on a high note.

At the close, the S&P 500 fell 0.41% to 5,460.48. The Nasdaq slipped 0.71% to 17,732.60, and the Dow Jones lost 45.2 points, or 0.12%, to 39,118.86.

According to the US Commerce Department, inflation slowed to its lowest level in three years. The Personal Consumption Expenditures (PCE) price index, excluding volatile food and energy costs, rose 0.1% in May from the previous month and was up 2.6% from a year earlier. These increases met the forecasts of economists in a Dow Jones survey.

The overall PCE price index was unchanged for May and rose 2.6% year-over-year, also in line with earlier predictions.

As the Federal Reserve’s preferred inflation measure, the core PCE index greatly influences market expectations regarding the Fed’s monetary policy.

“From a market perspective, today’s PCE report was just about perfect. It was actually a positive report,” said David Donabedian, chief investment officer of CIBC Private Wealth US.

On the same day, the University of Michigan’s consumer sentiment index for June came in higher than expected, rising to 68.2 from the preliminary reading of 65.5. Additionally, inflation expectations for the next 12 months fell to 3%, down from 3.3% in May.

Following these reports, the market bet on a 64.1% chance of the Fed cutting interest rates by September, according to the FedWatch Tool from CME Group, up from around 60% in the previous session. However, the market saw a slight decline as investors locked in profits at the end of the second quarter.

The session also marked the end of the first half of 2024, with all three indexes posting gains. The Nasdaq led the way with an 18.1% jump in the first six months, fueled by the ongoing artificial intelligence (AI) boom. The S&P 500 rose 14.5%, while the Dow Jones gained 3.8%.

“AI has been the dominant theme this year, leading to a concentration of the market’s gains in a small number of stocks,” said Mike Dickson, head of research at Horizon Investments.

One reason for the Dow Jones’ relatively weaker performance compared to the other two indexes is the blue-chip index’s typical second-quarter decline. While the Dow Jones fell 1.7% in the second quarter, the S&P 500 and Nasdaq posted gains of 3.9% and 8.3%, respectively, during the same period.

All three indexes accelerated in June, marking the seventh monthly gain in the last eight months. Once again, the Nasdaq led the way with a nearly 6% jump. The S&P 500 and Dow Jones rose 3.5% and 1.1%, respectively.

For the week, the Nasdaq gained 0.2%, while the Dow Jones and S&P 500 fell slightly by nearly 0.1% each.

“The stock market has shown resilience in the first half,” said John Luke Tyner, portfolio manager at Aptus Capital Advisors, in an interview with CNBC. However, for the market to continue breaking records in the second half, Tyner believes the rally needs to broaden beyond AI-related stocks and encompass more sectors.

According to Tyner, factors such as the US presidential election, the risk of the Fed further delaying rate cuts, or any signs of weakening consumer demand could put downward pressure on the market.

“If these risks materialize, the market could experience more volatility. Everyone is happy with what the market has delivered over the past ten months because it has been too easy. But there will come a time when this satisfaction will end,” Tyner added.

In the oil market, Brent crude for August delivery rose 0.02 USD to settle at 86.41 USD a barrel. WTI crude for August delivery fell 0.2 USD, or 0.24%, to settle at 81.54 USD a barrel.

So far this year, Brent crude has risen 12.1%, while WTI crude has climbed 13.8%. In June, both oil benchmarks rose over 6%. For the week, Brent crude inched up 0.02%, while WTI crude slipped 0.2%.

The initial boost to oil prices in June was driven by expectations of higher gasoline demand during the summer months in the US. More recently, as signs emerged that demand in the world’s largest economy might not be as strong as anticipated, oil prices found support in the escalating geopolitical tensions between Israel and Iran-backed Hezbollah.

According to a report by RBC Capital Markets, if war breaks out, Hezbollah could target Israel’s offshore gas facilities, and Israel could strike Iranian oil facilities. Additionally, there is a risk that Iran could attack tankers passing through the Strait of Hormuz or renege on its agreement with Saudi Arabia, leading to attacks on the latter’s oil infrastructure.

“Even if Iran and Saudi Arabia maintain their détente, we do not rule out the possibility of energy supply disruptions in the region and risks to other critical economic assets if the war spreads,” the RBC report stated.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.