Attempts to maintain the acceleration of the VNI’s rise were unsuccessful due to a lack of consensus among leading stocks. While overall liquidity increased, it was not driven by blue-chip stocks or the strongest performers in the VN30 basket. There were signs of stronger cash flow in small and medium-sized stocks, creating short-term speculative opportunities, but this is unlikely to be sustainable given the unclear overall trend.

For most of today, the VNI hovered in negative territory, with the final upward pull only occurring in the last 10 minutes, too brief to be considered reliable. While the market is not in a bad state, maintaining a diverse range of stocks, a true upward trend cannot emerge from such trading conditions.

The total value of matched orders on the HSX and HNX exchanges increased by 15% from the previous session, reaching approximately VND 18.9 trillion, the highest in six sessions. The increase in liquidity is a positive sign, as the market has shown clear profit-taking in the last three sessions. The stability achieved is due to new money inflows, which also indicate a willingness to accept risk.

From this perspective, today’s market was even quite “aggressive.” Money pushed the prices of small, mostly speculative stocks, up sharply, with many reaching the daily limit. Three weeks ago, money flowed out of speculative stocks into blue chips, leading to a positive week of recovery. Now, with blue chips weakening, money is flowing back into smaller stocks, creating waves. This presents a good speculative opportunity, but it’s best to keep trades short.

Of course, there were also strong fundamental blue-chip stocks today, but the performance was uneven. The impact of second-quarter profits is not yet clear, even though those with a keen eye for news may already be aware. Today’s massive foreign selling is likely unrelated to the fundamentals of the business, and domestic capital continues to absorb well, as it has for many months.

In summary, the market should currently aim low, and the potential for the VNI to form a new high and a major trend is unclear. Earnings results are unlikely to create a market-wide wave. It is advisable to condense the portfolio to a 50/50 split and engage in some speculation with speculative stocks. Slower money flow in blue chips means that creating derivative waves will be favorable. This “battlefield” also offers opportunities for profit.

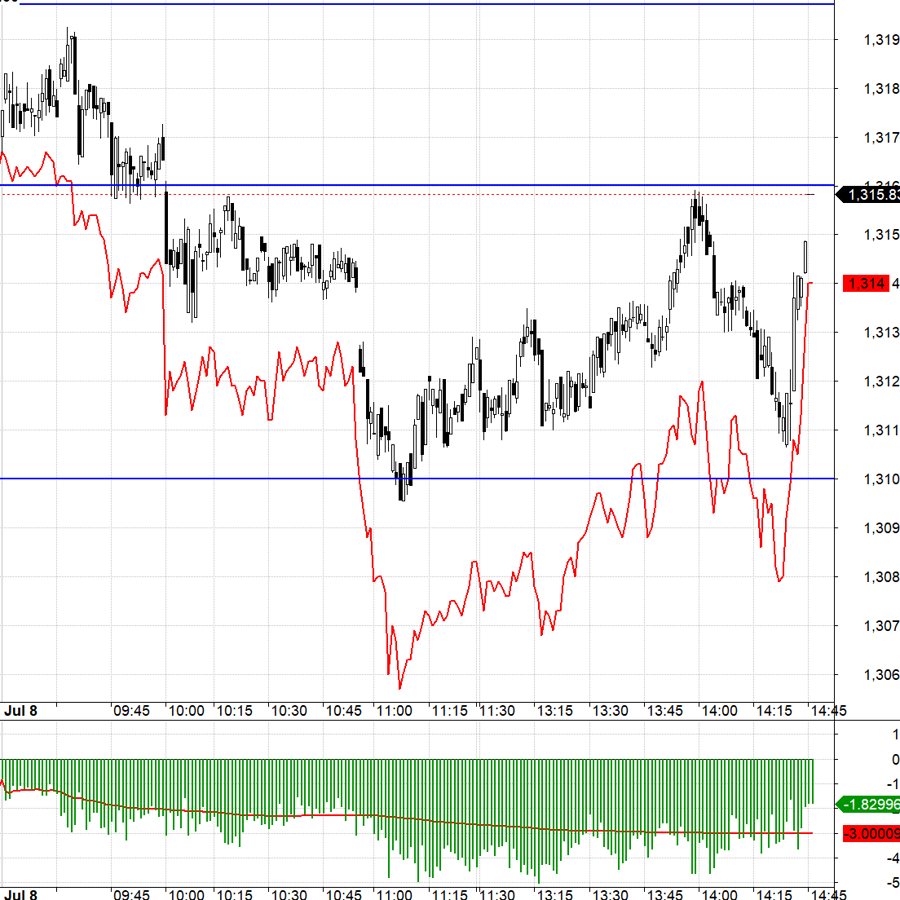

F1 today saw a significant expansion in discounts, and VN30 had two wide range openings: from 1316.xx down to 1310.xx and 1300.xx. Basis, from the start of the session, leaned towards the scenario of VN30 adjusting and running ahead. When VN30 broke 1316.xx at 10 with a strong push, F1 fell within a few seconds, expanding the basis to -4 points. This indicates that the profit margin for Short positions narrowed considerably as F1 had already dropped to near 1310.xx.

F1 was largely unprofitable as it traded sideways until nearly 11 am, when the second push occurred, pushing VN30 down to 1310.xx. F1 continued to expand the discount below 1306. Below the 1310.xx mark for VN30 is a wide range opening down to 1300.xx. For this to happen, the pillars must collapse sharply. However, VN30’s test of 1310.xx at 2 pm made it more unfavorable for Short positions than in the morning. Overall, the afternoon session was uneventful!

Today’s increased liquidity and new money inflows suggest that the market will likely continue to fluctuate within the index peak and perform strongly in individual stocks. The strategy is to look for profit-taking opportunities in speculative stocks, maintain a basic portfolio, and be agile with Long/Short derivative positions.

VN30 closed today at 1315.83. The nearest resistance levels for tomorrow are 1316, 1320, 1330, 1339, and 1349. Support levels are 1310, 1300, 1291, 1284, and 1277.

“Stock Market Blog” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, interpretations, and opinions expressed herein are those of the individual investor, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented herein.