Agriculture has been the backbone of Vietnam’s economy, even as the country strives to industrialize and modernize. In 2023, agriculture still holds significant weight in various national indicators, including rural population, which accounts for nearly 2/3 of the total; agricultural, forestry, and fishery labor, which makes up over 1/4; and the number of cooperatives and farms in these sectors.

Vietnam, located in the tropical monsoon region, boasts a favorable climate year-round, producing a variety of vegetables and fruits that are highly sought after and valued globally. With many neighboring countries undergoing industrialization and service sector development, there is a substantial demand for agricultural, forestry, and fishery imports. The contribution of these sectors to the GDP of various countries has decreased significantly, such as China at 7.3%, Japan at 1%, South Korea at 1.8%, Malaysia at 9.6%, the Philippines at 10.1%, and Thailand at 8.5%.

Many European countries have even lower contributions from these sectors to their GDP. Additionally, several African nations face significant shortages in labor and certain agricultural products. Meanwhile, Vietnam is predicted to be one of the countries most severely impacted by climate change and rising sea levels, with its coastal plains, rice bowls, and vegetable basins at risk of saltwater intrusion.

The supportive role of Vietnamese agriculture stems not only from the wise teachings of our ancestors, “phi nông bất ổn,” but also from our growing population, which increases by millions each year, including a significant number of immigrants. As we navigate through industrialization and modernization, a considerable area of agricultural land is being converted for other purposes annually.

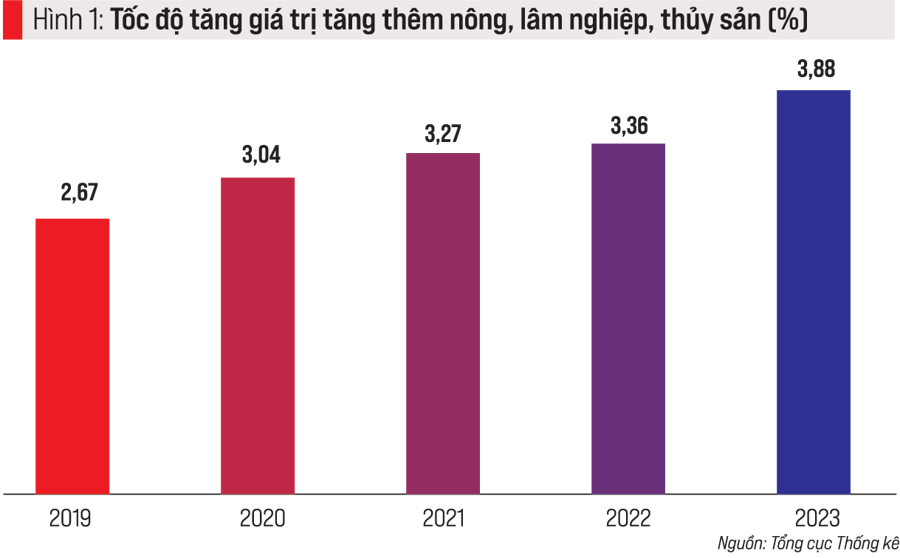

In 2023, the supportive role of agriculture became evident in several ways. Firstly, there was a notable increase in the added value of the agricultural, forestry, and fishery sectors from 2019 to 2023 (Figure 1). The growth rate in 2023 (3.88%) was the highest compared to the previous four years, including 2019, before the COVID-19 pandemic (2.67%). This growth outpaced the overall increase in 2020 (2.87%) and 2021 (2.56%), as well as the growth rate of the service sector in those years (2.01% in 2020 and 1.57% in 2021).

Over the past two years, agriculture has served as a safety net, accommodating millions of workers who had to leave urban areas and industrial and service centers.

The growth in added value in 2023 was achieved across all three specific sectors: agriculture, accounting for the largest share (73.3%), followed by fisheries (22.1%), and forestry (4.6%). While this doesn’t fully reflect Vietnam’s position as a country with its “back against the majestic Truong Son range and its face towards the vast East Sea,” or its land composition of “Tam son, tu hai, nhat phan dien” (“Three mountains, four seas, and one-part field”), it does promise significant potential for leveraging our advantages.

In 2023, several key products in the agricultural, forestry, and fishery sectors achieved notable growth compared to 2022 (Figure 3). This contributed to meeting domestic consumption demands and increasing the country’s export turnover.

Notably, eight commodities in these sectors joined the “club” of items with a turnover of $1 billion or more, with some even surpassing the $3 billion mark (Figure 4). Among these, vegetables and fruits stood out with the highest growth rate (65.9%) and a record-breaking turnover of $5.574 billion. The largest market for these products was China, which reopened its doors after the pandemic and shifted to formal import procedures.

Rice exports also achieved remarkable milestones in 2023. Having joined the “billion-dollar club” since 1998, rice exports reached an all-time high of $4.816 billion in 2023, surpassing the previous record of $3.673 billion set in 2012. This success was made possible by exporting a record volume of 577,6000 tons of rice, breaking the previous record of 527,2000 tons in 2021.

Limitations and Challenges

However, the agricultural, forestry, and fishery sectors still face several limitations and challenges. One criterion for an industrialized country is having more than 50% of its population living in urban areas, which Vietnam has not yet achieved.

The percentage of Vietnam’s rural population over the years is illustrated in Figure 9. While it has consistently decreased, primarily through the “ly nông bất ly hương” approach, it is still far from the target and higher than many other countries (5th highest out of 11 Southeast Asian countries, 10th out of 41 Asian countries, and 15th out of 121 countries and territories worldwide with available data). It is also higher than the global average of 43.5%.

The proportion of workers in the agricultural, forestry, and fishery sectors (26.9%) is slightly higher than the target set for 2025 (26.5%). Meanwhile, labor productivity in these sectors reached only 81.1 million VND, approximately 43.1% of the national average. In many places and industries, labor-intensive methods remain prevalent.

The rate of informal employment, which indicates lower income and less secure livelihoods and healthcare in old age, stands at 74.1%, higher than the national average of 64.9%. Additionally, the participation rate in social insurance is only 32.7%, with health insurance at 90.2% and unemployment insurance at 28.5%, far below the target set for 2023 (93.2%). If we consider rural areas alone, these rates are even lower.

The percentage of trained workers in rural areas (24% in 2022) is lower than the national average (26.4%). The unemployment rate in rural areas remains at 2%, and the underemployment rate is 2.26%, higher than the national average. Notably, a significant number of rural residents are uninterested in agricultural work and migrate to cities to take up jobs like recycling, hairdressing, or motorbike taxi services.

Fifty out of sixty-three localities have a per capita GDP lower than the national average (95.6 million VND), with 23 localities falling below 60 million VND. Notably, nine localities have a per capita GDP of less than 50 million VND, with Ha Giang being the lowest at 33.5 million VND, followed by Cao Bang (39.6 million VND), Dien Bien (39.7 million VND), Bac Kan (46.9 million VND), Lai Chau and Yen Bai (47.5 million VND each), Son La (48.6 million VND), Nam Dinh (49 million VND), and Ben Tre (49.1 million VND). These areas are either mountainous, remote, or have an economy predominantly based on agriculture…

This article was published in the special edition of Kinh te 2023-2024: Vietnam & The World, released on 06/03/2024. We invite our esteemed readers to access the full publication at: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

Prime Minister: Where is the bottleneck causing businesses to complain about capital shortage?

The Prime Minister calls for the Chairmen and CEOs of commercial banks to come together and discuss, propose answers, and provide specific solutions to address the issues of why businesses are facing capital shortages and difficulties in accessing credit, while the amount of deposits from the economy and the public into the banking system is increasing, despite continuously decreasing deposit interest rates. Where is the bottleneck, what are the causes, is it due to regulations, management, caution, or local factors?