Although the VN-Index managed to escape the sharp dip at the end of today’s afternoon session, it only gained a little over 3 points, confirming a significant slowdown in its upward momentum. While the selling pressure did not show any signs of strength, the lack of price chasing from investors caused the red to start spreading.

The HoSE floor closed with only 179 gainers and 207 losers. Although the difference was not significant, today was the first session where the breadth narrowed while the VN-Index rose. In the previous three sessions, the number of gainers had completely dominated, along with a clear upward index margin. This change reflects a weakening internal signal, even though the score still has a push-up pillar.

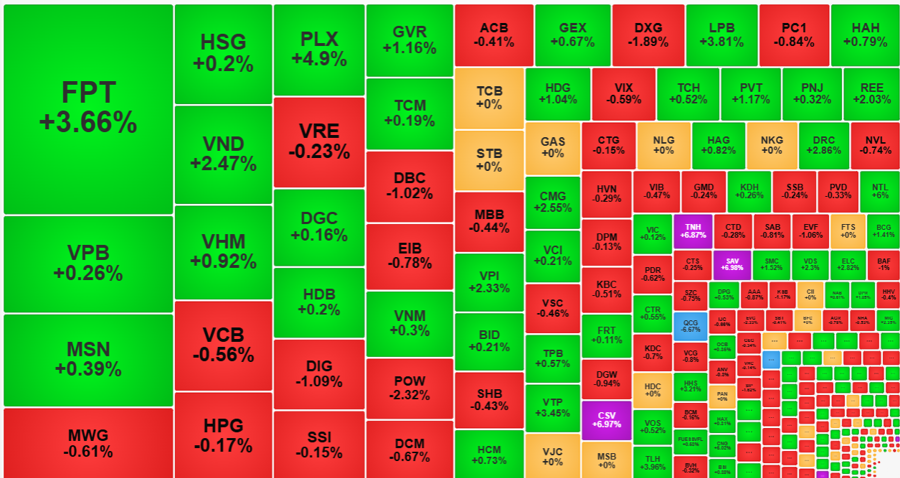

The VN30-Index also increased by 0.39%, but only 11 stocks rose while 15 fell. This afternoon, the number of stocks falling compared to the morning session far exceeded the number of risers. Fortunately, the VN-Index still had three strong pillars: FPT rose 3.66%, VHM increased by 0.92%, and GVR gained 1.16%. Both of these stocks are among the Top 10 in market capitalization. These two stocks alone contributed 2.5 points to the total increase of 3.04 points for the whole session. Even among the top 10 stocks pulling the index, only 5 were from the VN30 group.

The banking group’s weakness was evident, especially in the pillars. Only 4 bank codes in the blue-chip group increased, but they were all inferior: TPB rose 0.57%, VPB by 0.26%, BID by 0.21%, and HDB by 0.2%. The whole basket had only 10/27 green codes, and the three codes that increased by more than 1% were all small, less influential stocks: VBB by 4.81%, LPB by 3.81%, and KLB by 1.65%. The bank codes that made a breakthrough yesterday, such as VCB and TCB, weakened very quickly.

However, the market still had a few bright spots. FPT, for example, stood out as its price returned to its historical peak in June with the highest liquidity in the market. This stock successfully matched nearly 8.12 million shares, equivalent to 108.8 billion VND. FPT alone accounted for 8.4% of the total matching value on the HoSE floor. After days of extreme foreign investor selling, FPT was net bought back today at VND 21.6 billion. PLX also made a strong impression with a breakthrough session, a 25-month high, a 4.9% increase in trading volume, and was among the Top 19 strongest codes on the floor, reaching VND 258.7 billion. VND increased by 2.47%, LPB by 3.81%, and VPI by 2.33% were other notable stocks, all with liquidity of over VND 100 billion.

At the end of the session, the HoSE floor recorded 179 rising stocks, of which 78 increased by more than 1%. However, liquidity was too concentrated, with 78% belonging to the top 10 most actively traded stocks. This means that although the number of stocks with strong increases was large, the majority had meager liquidity, and large investors had no room to maneuver in this group.

The number of declining stocks this afternoon increased significantly to 207 codes (compared to 169 codes at the end of the morning session) but were mainly “light red.” Forty-seven codes in this group fell by more than 1%, with very low liquidity, and the whole group accounted for only 7.5% of the floor’s value. POW decreased by 2.32% with 165.3 billion, DXG by 1.89% with 141.2 billion, DIG by 1.09% with 199.2 billion, and DBC by 1.02% with 193.2 billion, were the only notable ones.

Overall, the market is being supported by the index, but the differentiation is more evident. This is a result of profit-taking in specific stocks. The positive fluctuation has been pulled for the fourth consecutive session, and it is normal for many stocks to start weakening. As the price goes up, fewer people will be willing to buy at high prices, while more will want to realize their profits. As in the afternoon session, there was a time when the VN-Index plunged below the reference by nearly 2.3 points before recovering in the last few minutes. The breadth at the bottom was very narrow, with 134 gainers and 273 losers. That was the clearest signal of profit-taking.

Foreign investors this afternoon increased their purchases to about 676.2 billion VND while selling about 876.7 billion VND, corresponding to a net sale of 200.5 billion VND. In the morning session, this group net sold 377.2 billion VND. The group that was sold the most was VHM -122.7 billion, VRE -111.3 billion, VCB -55 billion, HPG -50.5 billion, MWG -47.2 billion, VPB -37.6 billion, and POW -30.1 billion. Exclusively for stocks in the VN30 basket, 486.4 billion VND was net sold, accounting for almost all of the net sales on the HoSE floor.

The VN-Index has risen for the fourth consecutive session, returning to the old peak in June. However, the average liquidity from the beginning of the week has only reached about 12,628 billion VND in matching orders per day. This volume is 30% lower than the average of the previous week. The market has risen for four consecutive sessions, but there is no strong money flow, indicating that caution still prevails.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”