The stock market recorded a recovery in the first trading week of Q3 2024 (July 1-5), with a differentiation among industry groups. Large-cap stocks drove the VN-Index’s gains, maintaining its green status and averting short-term risks. Overall market liquidity has narrowed, indicating investor caution. The VN-Index ended the week up 37.72 points (+3.03%) to 1,283.04.

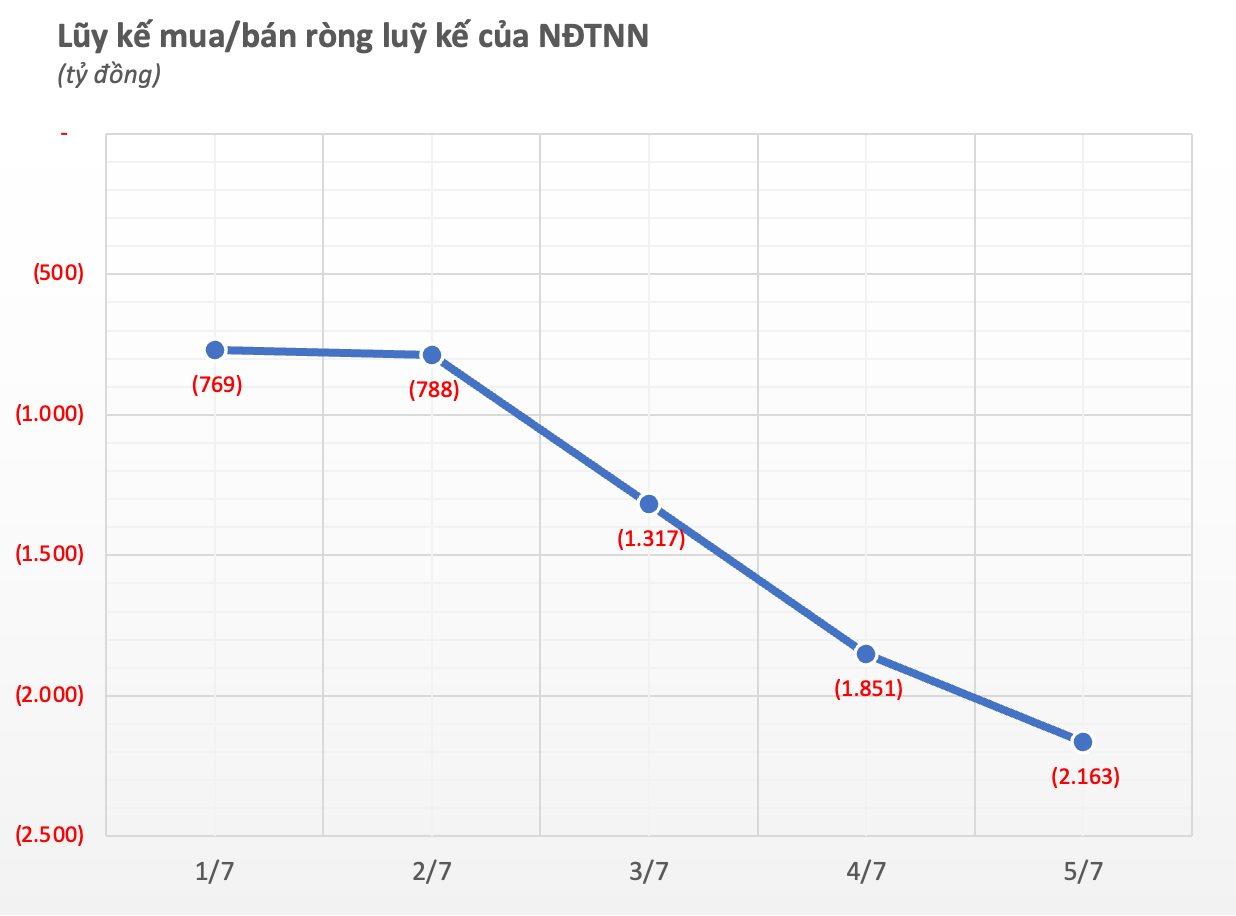

Foreign investors remained a significant drag, maintaining their net selling position, although the value narrowed thanks to negotiated deals. Cumulative over five sessions, foreign investors net sold VND2,163 billion in the entire market, including net selling of VND2,203 billion via order matching and net buying of VND40 billion via negotiated deals.

By exchange, foreign investors net sold VND2,308 billion on HoSE, net bought VND99 billion on HNX, and VND46 billion on UPCoM.

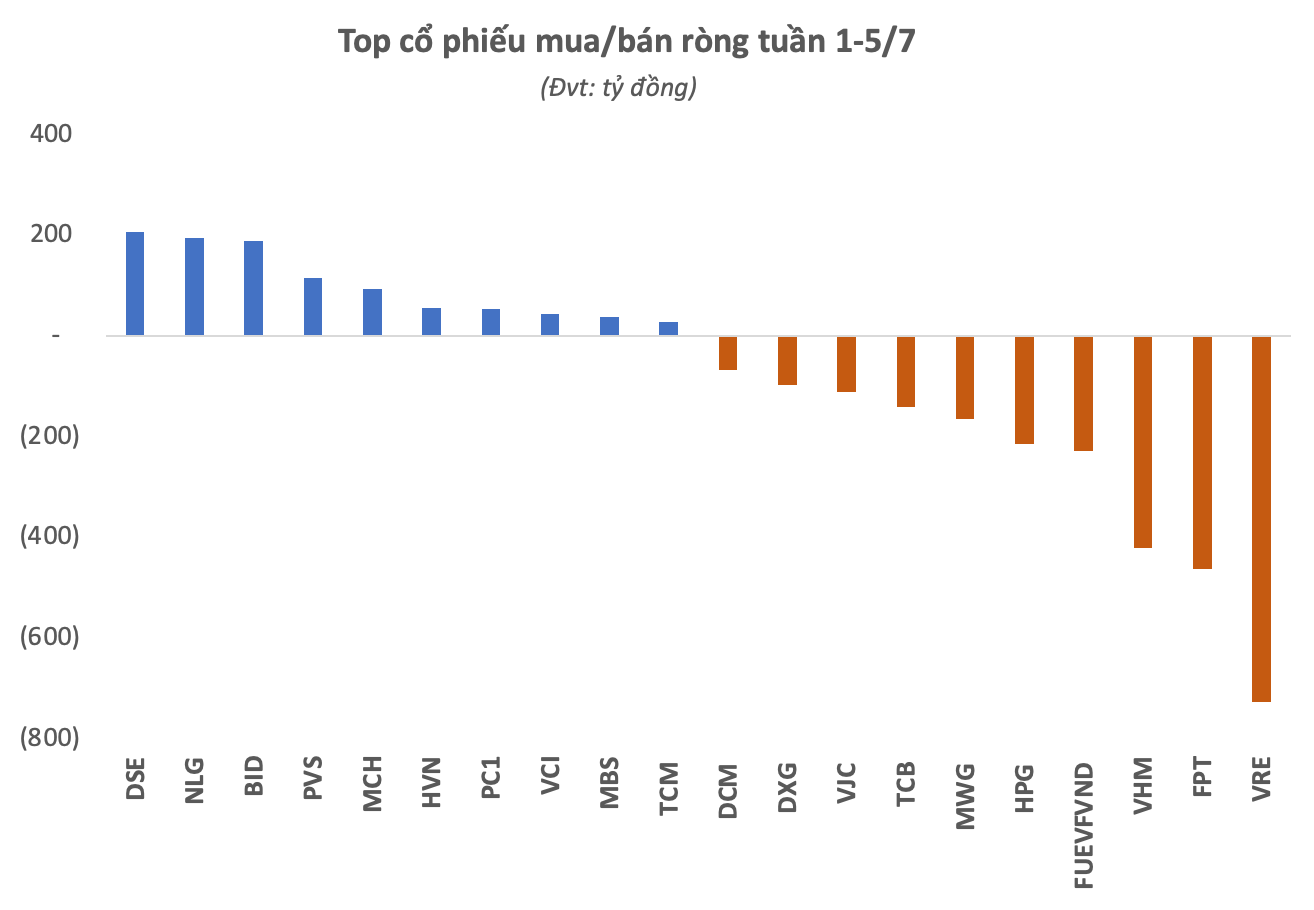

By stock, VRE was the focus of net selling this week, with a net sell-off of VND728 billion, all via order matching. Additionally, FPT and VHM were net sold VND463 billion and VND422 billion, respectively, mostly via order matching. The FUEVFVND fund also experienced significant net selling of VND228 billion.

The net selling list also included HPG and MWG, which were dumped VND214 billion and VND165 billion, respectively. TCB, VJC, DXG, and DCM were also among the stocks net sold by foreign investors over the week.