The Vietnam Securities Depository (VSD) has released a statement regarding the number of domestic and foreign investor securities accounts as of June 30, 2024.

According to the report, domestic investors opened 10,580 new accounts in June, a decrease of over 25,000 accounts compared to the previous month’s figures.

In June, individual investors remained the driving force, opening 106,417 new accounts, while institutions opened 163 new accounts. As of the end of June 2024, the total number of domestic investor accounts reached nearly 8 million, the highest ever in the nearly 24-year history of the domestic stock market. Of these, individual investors held more than 7.98 million accounts, equivalent to 8% of the population.

The number of securities accounts declined in June as the market faced challenges around the strong resistance level of 1,300 points. The VnIndex closed June with a 1.3% loss.

AI illustration

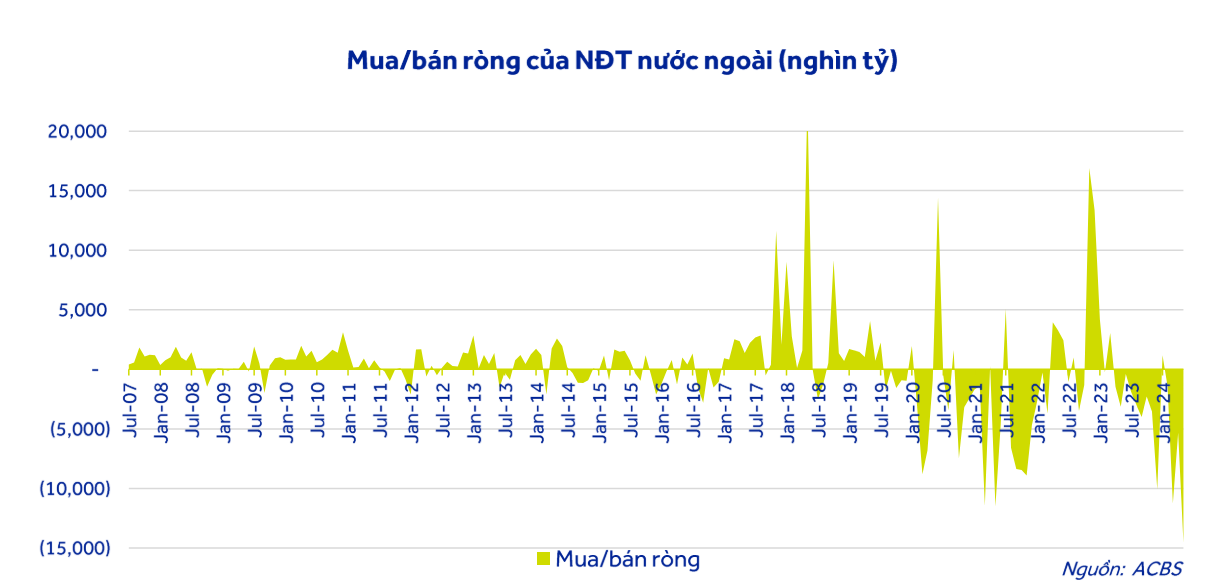

In June, foreign investors broke records once again by net selling nearly VND 16,600 billion on HoSE alone. Cumulatively, since the beginning of the year, foreign investors have net sold a total of VND 54,000 billion (USD 2 billion) on HoSE.

Commenting on this, ACB Securities Company (ACBS) stated in its market movement report that after a period of strong capital inflows into the Vietnamese stock market from 2017 to 2019, foreign investors started to net sell from 2020, and this pressure has continued to the present. The period of strong net buying by foreign investors was only brief in June 2020 and November-December 2022, which were two historical bottoms of the VnIndex.

“In general, the net selling pressure from foreign investors stems from a series of factors: the shift of capital flows away from emerging and frontier markets, exchange rates, VnIndex valuations, and divestment from a number of stocks in the Vingroup family,” ACBS said.

Source: ACBS

Giving a general assessment of the Vietnamese stock market in 2024, SSI Securities Company expects the stock market to continue to grow this year. Meanwhile, according to the Investment Strategy Report for the second half of 2024 by MB Securities Joint Stock Company (MBS Research), VnIndex is expected to reach 1,350-1,380 points by the end of 2024, after profits grow by 20% in the 2024 fiscal year and the target P/E is 12-12.5 times.

Sharing the same view in the Finance Magazine, Ms. Bui Thi Quynh Nga, Senior Macro and Strategy Analyst at PHS, forecast that the market-wide profit growth would increase by 18% in 2024, corresponding to a forward P/E (price-to-estimated-earnings ratio) of 12.2.

“This is quite an attractive level, and in a positive scenario, the VnIndex could touch 1,452 points. The government has also shown close direction with a determination to upgrade the market. This lays the foundation for the long-term development of the stock market alongside the growth of the economy,” she emphasized.

“Deposit interest rates have risen slightly but remain low, with 12-month term deposits at below 6% for joint-stock commercial banks and 4.7% for state-owned commercial banks, still less attractive than the expected rate of return on the VnIndex. Therefore, we believe that the stock market will continue to be a capital attraction channel for investors,” she shared in the Banking Times.