Cautious sentiment led to a choppy session for the VN-Index on Monday. The index closed slightly higher, up 0.52 points, at the 1,283.5 mark. While trading volume ticked up, liquidity remained low, with a turnover of over VND19.7 trillion on the Ho Chi Minh Stock Exchange (HOSE).

Foreign investors’ net selling was a downside, with a sudden spike to VND2,507 billion across the market. This marked the 22nd consecutive session of foreign outflows in Vietnam.

On the HOSE, foreign investors net sold VND2,317 billion.

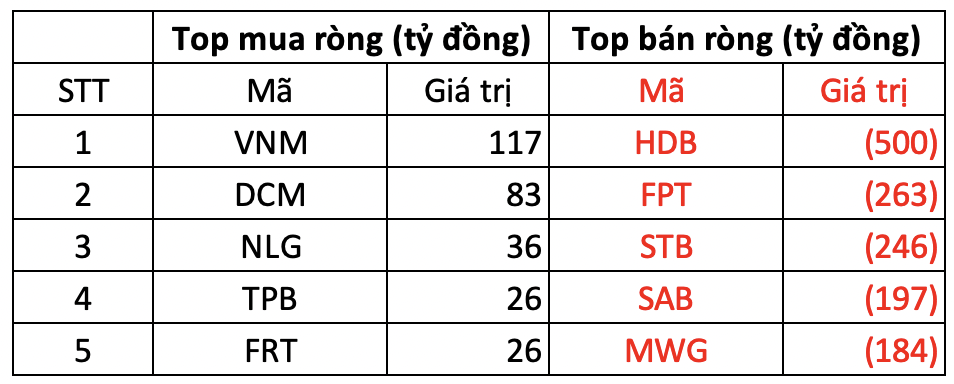

In terms of buys, VNM attracted the most foreign interest, with net purchases of VND117 billion. DCM and NLG followed suit, with net buys of VND83 billion and VND36 billion, respectively. TPB and FRT were also bought, with a net value of VND26 billion.

On the other hand, HDB faced the most significant selling pressure from foreign investors, with over 20.5 million shares sold, amounting to nearly VND500 billion. FPT and STB also witnessed outflows of VND263 billion and VND246 billion, respectively.

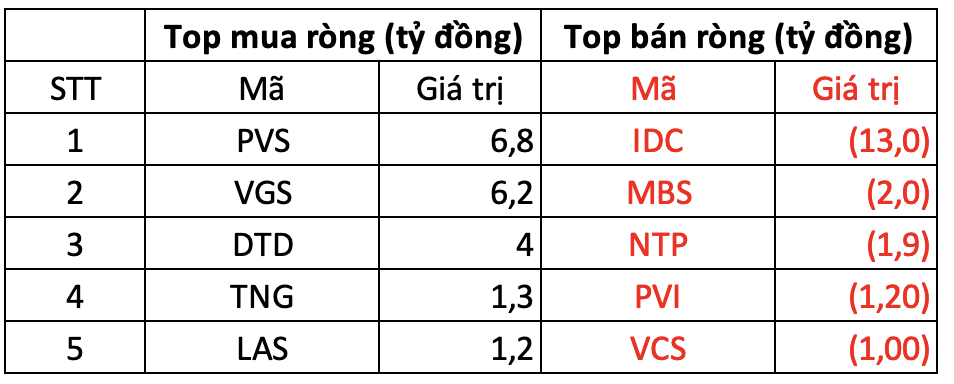

On the Hanoi Stock Exchange (HNX), foreign investors net bought VND0.3 billion.

PVS topped the buys, with a net value of VND6.8 billion. VGS followed closely, with net purchases of VND6 billion. Additionally, foreign investors also snapped up a few billion dong worth of DTD, TNG, and LAS.

On the selling side, IDC faced the most significant net selling pressure, with a value of nearly VND13 billion. MBS, NTP, and PVI also witnessed outflows of a few billion dong each.

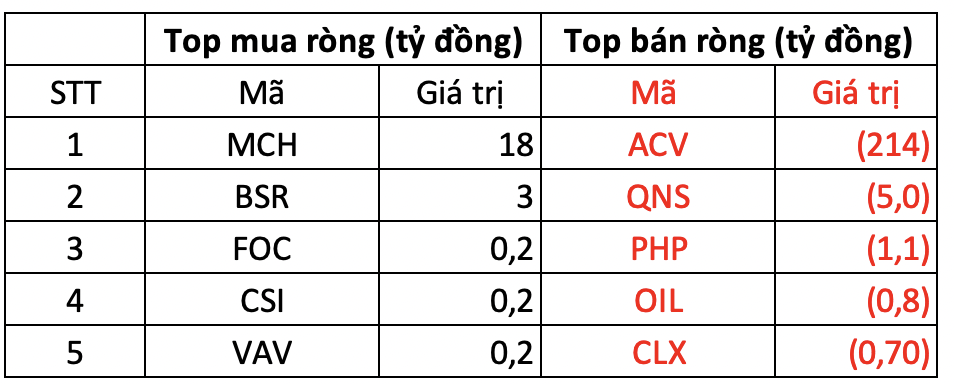

On the Unlisted Public Company Market (UPCOM), foreign investors net sold VND190 billion.

Conversely, ACV faced the most significant net selling pressure, with foreign investors offloading nearly VND214 billion worth of shares. QNS, PHP, and others also witnessed net selling by foreign investors…

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”