Novaland Group, a leading real estate investment corporation listed as NVL-HOSE, announces updates regarding the restructuring of its convertible bond offering.

The company has successfully concluded negotiations to restructure a nearly $299 million convertible bond issue with a 5.25% interest rate, maturing in 2026, convertible into common shares.

This international convertible bond offering by Novaland has undergone a restructuring agreed upon by bondholders and approved by the Singapore International Commercial Court (SICC) in late April.

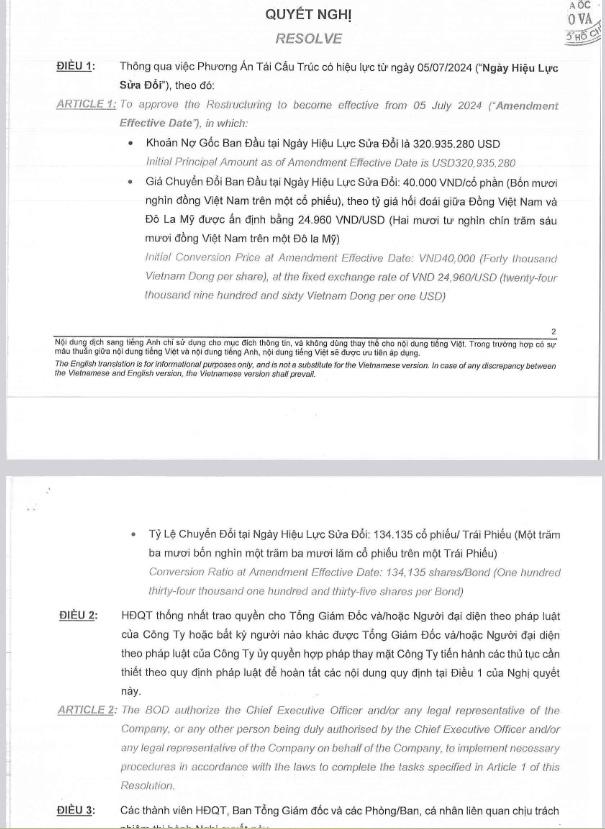

As per the new agreement, the repayment date is set for the bond’s maturity in June 2027, with potential early redemption options. The outstanding principal (after interest capitalization) corresponding to the effective date of the restructuring plan is $320,935,280.

The redemption value will be calculated at 115% of the principal amount (after conversion to shares) plus accrued interest. A 5.25% interest rate will be applied to the accrued interest.

Bondholders now have the option to convert their bonds into NVL shares at an initial conversion price of VND 40,000 per share (compared to a closing price of VND 13,200 per share on July 5, 2024, making the conversion price three times higher than the closing price on that date), with a conversion ratio of 134,135 shares per bond.

Previously, in late May, NVL received consent from bondholders holding at least 66% of the bond value to extend the deadline for finalizing the settlement agreement from May 20 to June 10.

The $300 million bond issue, with a 5.25% interest rate and a maturity date in 2026, is convertible into common shares. The Singapore International Commercial Court (SICC) approved the settlement agreement on April 26.

The Group announced that 25 bondholders, representing a debt balance of $284 million (over 95% of the total bond debt), agreed to Novaland’s conversion proposal in early April.

For the first quarter of 2024, the company reported a loss of over VND 600 billion, compared to a loss of over VND 410 billion in the same period last year, an increase of 46.5%. NVL attributed this decrease in profit to a 46.5% year-over-year decline in financial revenue.

Looking ahead to 2024, Novaland targets consolidated revenue of nearly VND 32,600 billion and a net profit of almost VND 1,080 billion, representing a sevenfold increase and a doubling, respectively, compared to 2023. The key projects expected to contribute to this revenue growth are Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram, and residential projects in Ho Chi Minh City.

Almost 7.4 trillion VND of TPDN acquired in January 2024, over 279 trillion VND due to mature throughout the year

According to data compiled by the Vietnam Bond Market Association (VBMA) from HNX and SSC, as of February 2nd, 2024, there have been two private placement bond issuances worth 1.65 trillion VND and one public offering worth 2 trillion VND in January 2024.