At the recent investment seminar themed “Welcoming the Recovery Cycle in the Second Half of 2024” organized by DSC Securities, Mr. Bui Van Huy, Executive Director of the Southern Branch of DSC Securities JSC, shared a positive outlook on the prospects of the stock market in the latter part of the year.

Mr. Huy believes that this will be a golden opportunity for investors to prioritize accumulating stocks with potential for market upgrade in 2025 and the long-term recovery cycle of the economy.

Regarding the forecast for the market index in the second half, Mr. Huy stated that there are too many variables affecting the market, making predictions potentially inaccurate. Moreover, the VN-Index’s numerical value is less important than selecting specific sectors and stocks.

Sharing his insights on potential sectors for the latter half of 2024, MSc. Nguyen Trung Hieu, CEO of NTP – AM Fund Management Joint Stock Company, offered several choices.

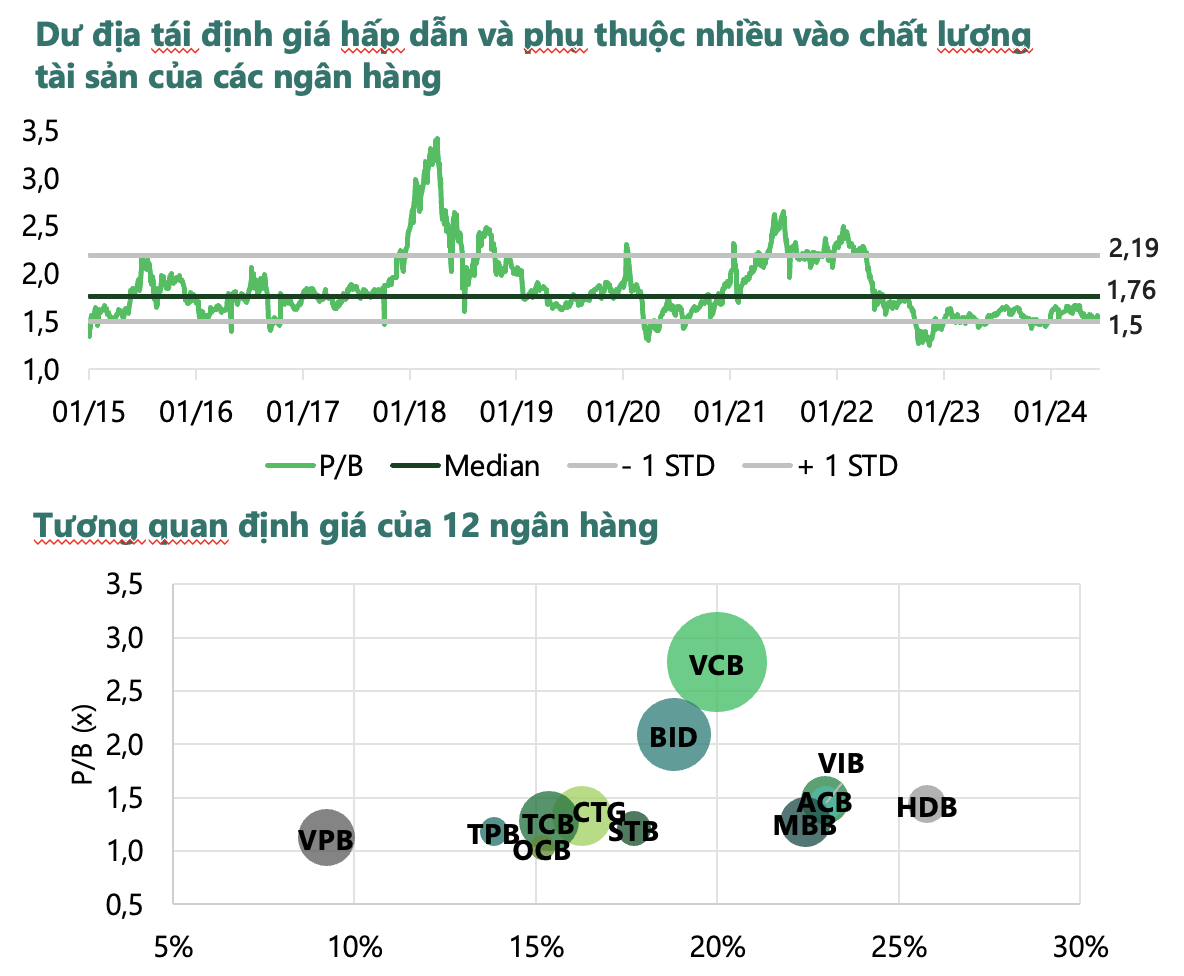

Firstly, the banking group is expected to benefit from gradually improving credit growth, well-managed asset quality, and attractive valuation. While the valuation of the banking group is currently below the 5-year average, there is significant room for re-rating, depending on the asset quality of the banks. It is crucial to balance risks with the prospects of expanding NIM, as increasing bad debts can put pressure on provisioning costs.

Secondly, the securities group is also anticipated to benefit from the recovery of market liquidity and expectations of market upgrade, which would attract foreign investment. However, the valuation of this sector remains high and is not particularly attractive. Risks to consider include the potential for delays in the KRX and market upgrade plans, as well as the slow capital increase of some securities companies, which could hinder the growth of their business plans.

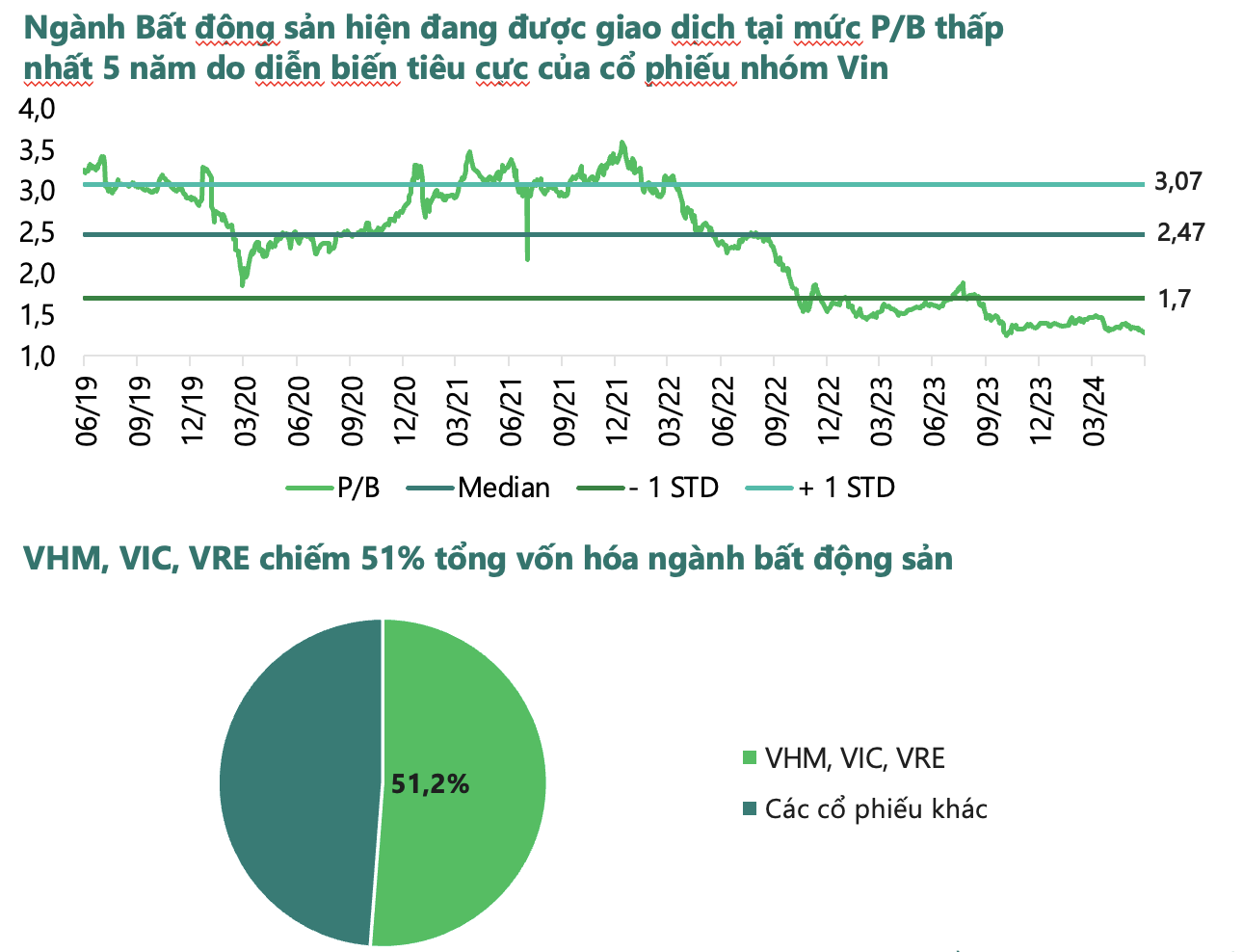

Thirdly, the industrial real estate group is expected to have positive prospects due to positive FDI inflows, while residential real estate is slowly recovering from mid-range products. Notably, the real estate group is currently trading at the lowest P/B ratio in 5 years due to the negative performance of “Vingroup” stocks. However, investors should be aware of the new real estate law, which stipulates that land price tables will be constructed annually, potentially increasing project development costs. Additionally, reducing the down payment ratio (not exceeding 5% of the selling price) and the maximum payment ratio (from 70% to 50%) for purchasing off-plan properties may create challenges for developers in raising capital.

Fourthly, the logistics group, with a focus on seaports, is expected to perform well in terms of both volume and service rates. The sea transport group benefits from the tensions in the Red Sea, and the aviation group also recorded a positive year in the post-Covid recovery process.

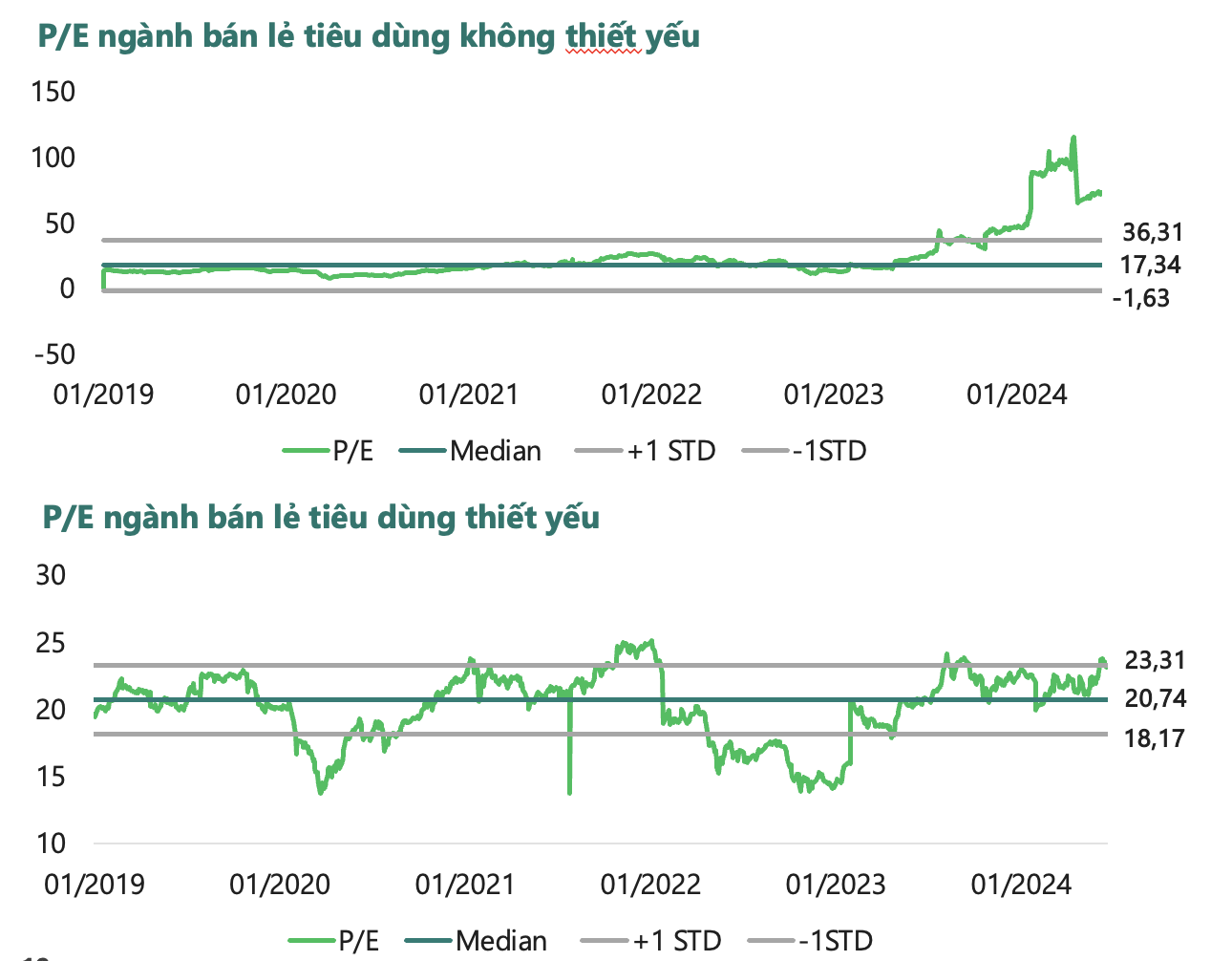

Fifthly, the consumer retail group will continue to be in the spotlight, as positive macro conditions boost consumption, and there is a trend towards consuming higher-value products. Additionally, there are signs of recovery from leading enterprises in the industry.

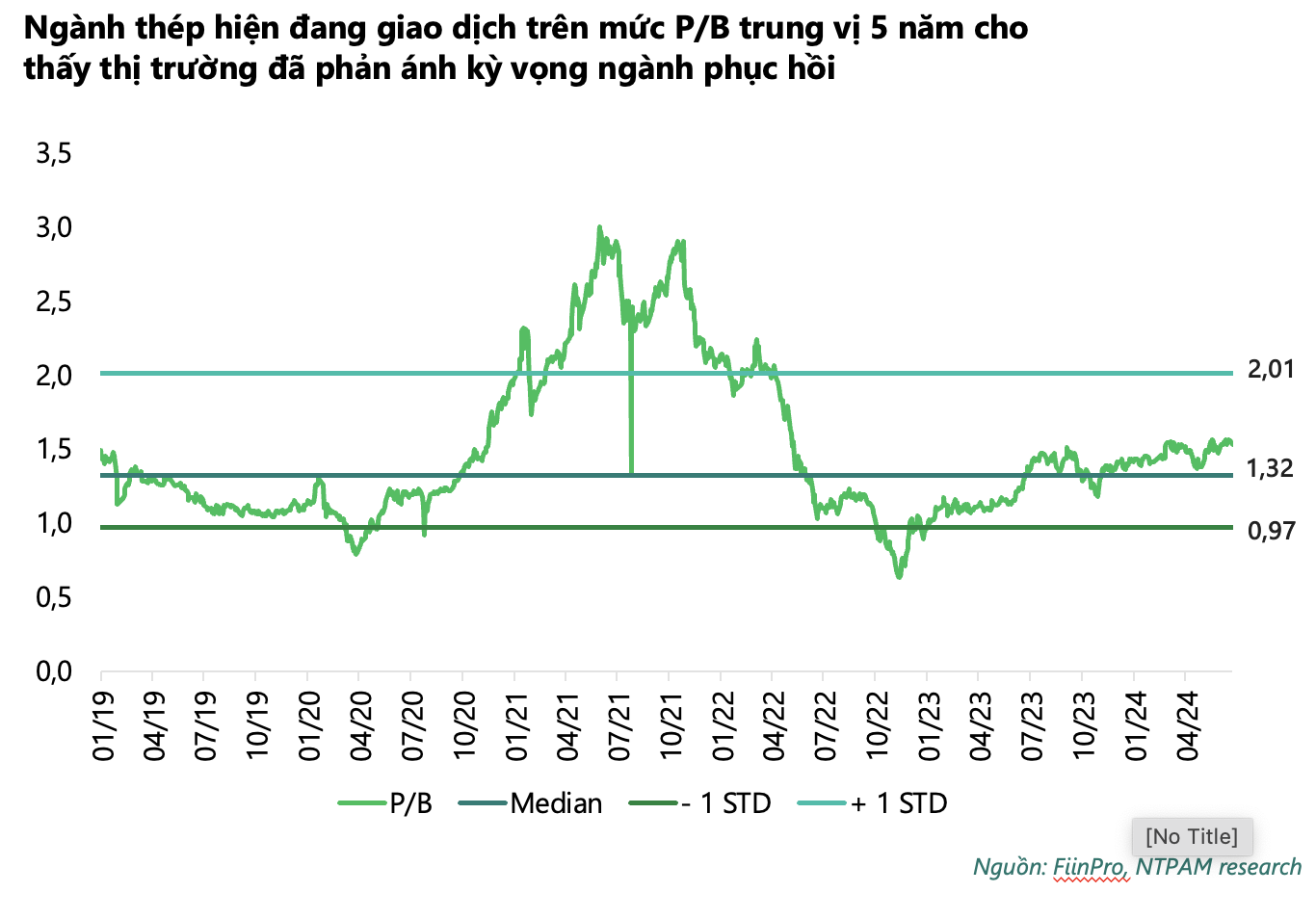

Sixthly, the steel group also has opportunities as input material prices stabilize and steel consumption volume gradually recovers. However, the industry’s valuation, which is already above the 5-year median P/B ratio, indicates that the market has priced in recovery expectations.

Choose La Mia Bao Loc – Embrace a Fulfilling Life with an Ideal Green Living Standard

Not just a perfect blend of art and inspired Italian-style resort, La Mia Dalat also effortlessly brings each resident to the standards of peaceful living, well-being, and balanced body-mind-soul.