Clear Signs of Reversal

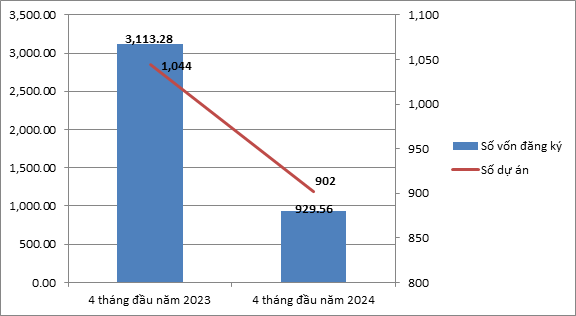

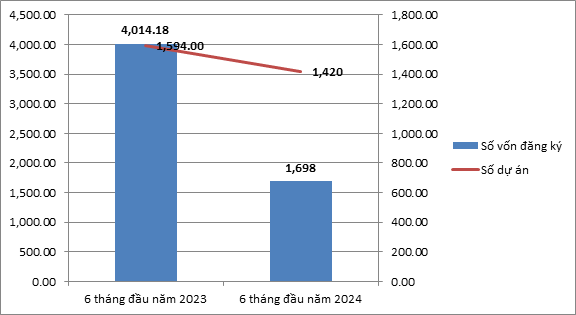

According to the Foreign Investment Agency under the Ministry of Planning and Investment, registered capital contributions and share purchases by foreign investors as of June 20, 2024, reached 1,420 turns with a total contribution value of $1.7 billion. Compared to the same period last year, this figure represents a 58% decrease in total contribution value and an 11% drop in the number of contribution and share purchase projects. Notably, this downward trend has been ongoing since the beginning of 2024. As reported by the Foreign Investment Agency, as of April 20, 2024, the number of contribution and share purchase turns by foreign investors had decreased by 13.6% year-on-year, while the contribution value had dropped by 70%.

|

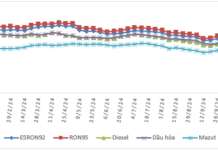

Situation of Capital Contribution and Share Purchase by Foreign Investors in the First Four Months of 2024

Source: Foreign Investment Agency

|

|

Situation of Capital Contribution and Share Purchase by Foreign Investors in the First Six Months of 2024

Source: Foreign Investment Agency

|

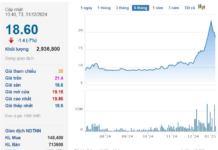

Additionally, the stock market has recently witnessed net selling by foreign investors, amounting to VND 44.6 trillion in the first six months of 2024, twice as high as the figure for the whole of 2023, which stood at VND 19.5 trillion.

Notably, on June 22, according to South Korean media, SK Group (the third-largest chaebol in the country) has been planning to withdraw part of its investment from Vietnam.

Earlier, Blackrock, the world’s largest asset management corporation, announced the closure of the iShares Frontier and Select EM ETF, which had the highest proportion of Vietnamese stocks (28%) in its portfolio, with total assets of $425 million, equivalent to more than VND 10,800 billion. The capital withdrawal by these large investment funds may lead to subsequent indirect capital outflows from other foreign investors from the Vietnamese market.

Overall, the decline in foreign capital inflows into the stock market, coupled with the increasing net selling value, indicates a lack of strong confidence among foreign investors in the economy’s prospects. There is even a risk of this investment capital being completely withdrawn from the country in search of higher returns elsewhere. As a result, the risk of a reversal in indirect FPI investment flows is more apparent than ever.

Continued Monitoring for Timely Intervention

The trend of foreign investors withdrawing capital from the financial market, particularly the Vietnamese stock market, warrants continued close monitoring by the competent authorities. A sudden and massive outflow of foreign capital could lead to a significant depreciation of the domestic currency. This, in turn, would compel the State Bank to intervene by selling foreign exchange reserves to stabilize the central exchange rate regime.

International experience provides valuable lessons in this regard. During the 1997-1998 Asian financial crisis, Thailand lacked sufficient foreign exchange reserves to intervene, while South Korea had to borrow USD from the International Monetary Fund under stringent conditions. Only Hong Kong had enough reserves to maintain exchange rate stability. This highlights the importance of not only having substantial foreign exchange reserves but also a strong commitment from the central bank to defend the domestic currency in the face of investment capital outflows. To this end, the State Bank should adopt a flexible exchange rate policy, widen the exchange rate band, and peg the domestic currency to strong foreign currencies to mitigate the impact of FPI on the local currency.

Furthermore, to effectively address capital outflows from the stock market, the State Bank should closely coordinate with relevant agencies, including the State Securities Commission (under the Ministry of Finance), to enhance information transparency, foster fair competition among investors, prevent fraudulent activities, ensure financial safety, and minimize risks for investors. These collective efforts aim to restore confidence among FPI investors in the Vietnamese stock market.

Crucially, to rebuild trust and halt the capital divestment by FPI investors, the government must enhance the effectiveness of macroeconomic management, improve the business investment environment, vigorously promote growth drivers, and strive to achieve the 6-6.5% growth target for 2024. By enhancing the country’s economic outlook in the eyes of foreign investors, Vietnam can retain existing capital and attract new FPI inflows into its market.

Nguyen Cong Toan – Dinh Tan Phong