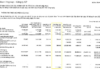

The latest strategic report for July by Rong Viet Securities (VDSC) predicts a rebound in the growth rate of total assets for companies listed on the HSX in Q2. This forecast is based on credit growth, which has increased by 4.5% year-to-date and approximately 14% year-over-year, according to the latest reports.

This prediction is rooted in the understanding that banks remain the primary channel for capital allocation in developing economies like Vietnam. As such, credit growth serves as a reliable indicator for gauging the close relationship with asset growth in the economy, a correlation that has been evident in recent years.

VDSC anticipates that asset turnover has bottomed out in Q1 2024 and will trend upwards in the upcoming quarters. The “declining lending rates and signs of bottoming out” effect will no longer overshadow the “credit growth” effect, which has been weak throughout 2023 and Q1 2024. Additionally, improved production and consumption growth figures across quarters provide a basis for expecting improved asset turnover in other sectors as well.

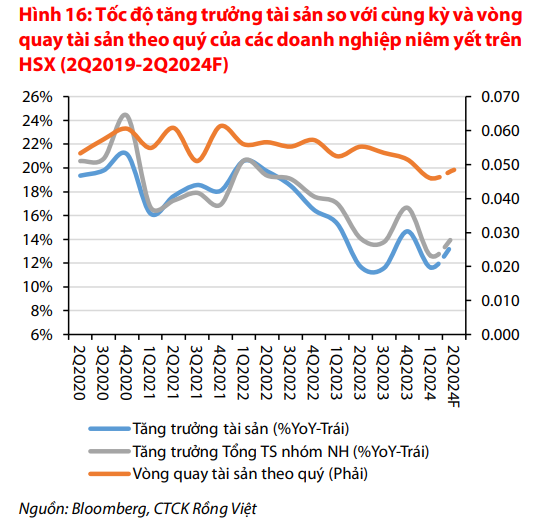

Regarding net profit margins, VDSC believes that seasonal factors and the potential for bad debt risks may lead to slight adjustments in net profit margins for the banking sector compared to Q1.

Considering these factors, VDSC forecasts a recovery in revenue compared to the previous quarter, although growth remains lower than the previous year. Estimated profit after tax is expected to increase by 13% year-over-year.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

Factors that can restrain credit growth

In addition to supportive factors, the goal of achieving a 15% credit growth this year may also face some challenges. What are those factors?