Today’s decisive selling pressure pushed prices lower, with VNI and VN30 closing at their lowest levels, and many stocks following suit. The market remains in a “murky” phase, and speculative opportunities should be short-term only.

The rapid weakening of blue-chips is the third time this group has hindered the indices in the peak-forming region. While foreign pressure is a factor, the main issue is the weak inflow of money into this group, even as the recent rebound offered decent profits. If even blue-chips are subject to short-term profit-taking, a market surge is unlikely.

The speculative stock group is starting to see strong differentiation, with increasing selling pressure and weakening demand. While a few dozen codes impressively bucked the trend today, the overall picture is one of selling and decline. In reality, the market hasn’t gone anywhere yet, still hovering within the old peak region, and the recent rise was just a normal technical recovery. The small amount of money involved reflects a wait-and-see or probing mentality, rather than large funds entering the game. Therefore, short-term profit opportunities are being taken with a conservative mindset.

Regardless of today’s adjustment reasons, the result stems from the dominant viewpoint. Waiting for news is one thing, but observing market dynamics is the deciding factor. Going from information to action requires decisiveness. The type of active selling to lower prices and match orders, which occurred in the peak region, always implies caution. A positive aspect today is that liquidity wasn’t too high, with the two exchanges matching about 19.2k billion. Compared to last week’s average of 14.1k billion per session, it’s still significantly higher. So, the market still has money absorbing short-term stocks. It’s now up to the big money to make a difference; if they remain cautious or choose to withdraw, the market cannot break through.

At this point, it’s advisable to maintain a balanced stock portfolio, with short-term holdings for quick profits, avoiding losses. Small investors should wait to see which side wins and then follow suit, preparing action plans for either scenario. It’s essential to remember that the market chooses the script, not personal opinions.

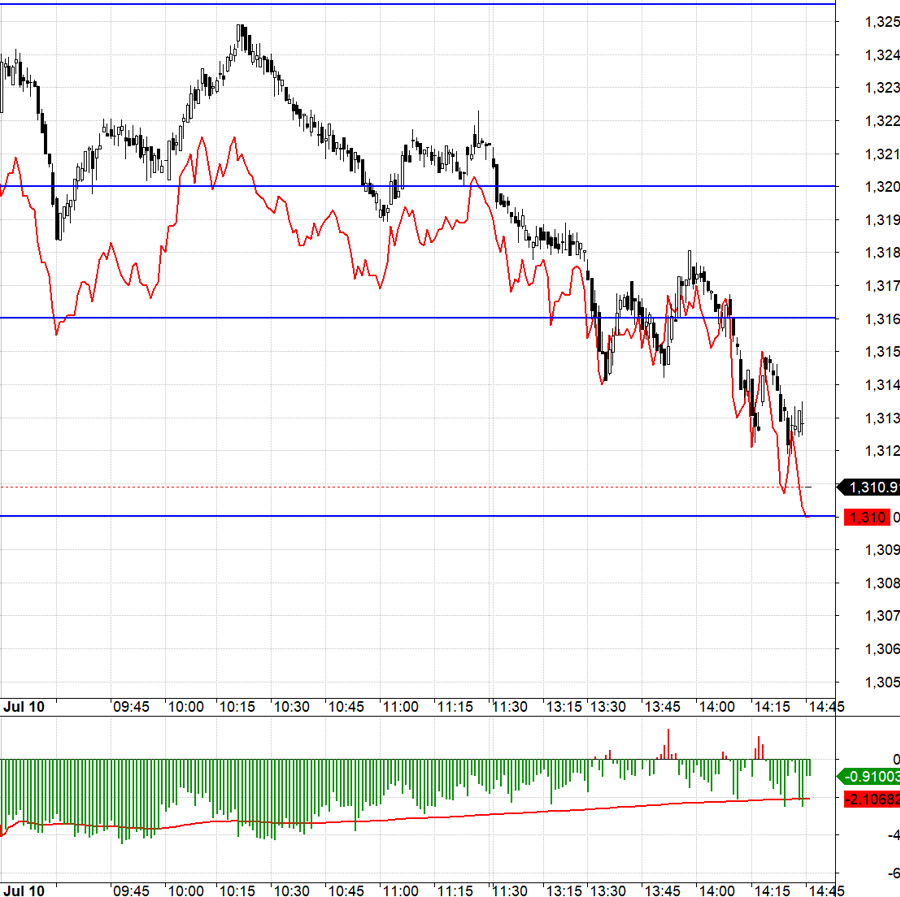

Today’s derivatives market was difficult to trade due to basis limiting the profit margins of both Long and Short positions. When VN30 successfully tested 1320.xx and rose to 1326.xx, F1 lagged. As VN30 fell from 1326 to 1320, the basis narrowed again. During the afternoon session, VN30 swung widely around 1316.xx, triggering stop losses. The easiest move to catch was the late decline from 1316.xx to 1310.xx, but the time was too short.

VN30 currently lacks clear momentum, with weak money inflows and no strong pillars. The likelihood of the index exploding is low. A higher possibility is the emergence of a small-amplitude adjustment. The strategy is flexible Long/Short, prioritizing Short.

VN30 closed today at 1310.91. Tomorrow’s nearest resistances are 1316; 1320; 1326; 1333; 1339. Supports are 1309; 1303; 1296; 1290; 1279.

“Stock Blog” reflects personal views and not those of VnEconomy. The opinions and assessments are those of individual investors, and VnEconomy respects the authors’ views and writing style. VnEconomy and the authors are not responsible for issues related to the published assessments and investment opinions.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.