According to CSV, stock prices are directly influenced and dictated by the overall stock market conditions and investor sentiment. The consecutive 5-day surge in stock prices is beyond the Company’s control.

Based on the financial results, the CSV‘s Board of Directors and Executive Management believe that the Company is operating normally, and no significant changes have been identified that could impact its business operations. Therefore, the stock price is solely determined by market factors.

|

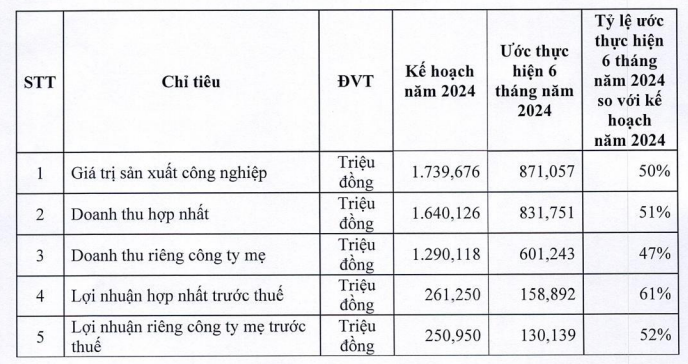

Estimated CSV’s business results for the first 6 months

Source: CSV

|

Specifically, for the first six months of 2024, CSV‘s industrial production value reached VND 871 billion, achieving 50% of the plan.

Consolidated revenue is estimated at VND 831 billion, achieving 51% of the plan. Consolidated pre-tax profit reached nearly VND 160 billion, completing 61% of the plan.

On July 10, CSV‘s streak of ceiling prices ended as the stock price rose slightly by almost 1% to VND 38,800/share. However, liquidity increased significantly compared to the previous sessions, reaching 3.5 million shares.

| CSV stock price continuously hit the ceiling price from July 3 to July 9 |

The Southern Basic Chemical Joint Stock Company was established in 1976 by the General Department of Chemicals. CSV‘s main business activity is the production of industrial chemicals, serving the needs of various industries such as food, pharmaceuticals, drinking water treatment, wastewater treatment, paper production, and oil and gas.

The company is a member of the Vietnam Chemical Group (holding 65% of capital as of Q1/2024).