MB Securities JSC (MBS) has announced that July 25th will be the record date for its upcoming cash dividend payment for the year 2023. The payment date is expected to be August 23, 2024. The dividend rate is set at 12% per share, meaning that shareholders will receive 1,200 VND for each share they own. With approximately 438 million shares currently in circulation, MBS will be distributing around 525 billion VND in this dividend payout.

Notably, this is the highest cash dividend payout in MBS’ history. Unlike many other companies, MBS does not have a consistent track record of paying cash dividends to its shareholders. The most recent dividend payments, from 2021 to 2023, were made in the form of stock dividends. Going further back, in 2020 and 2017, MBS did pay cash dividends, but at lower rates of 10% and 5%, respectively.

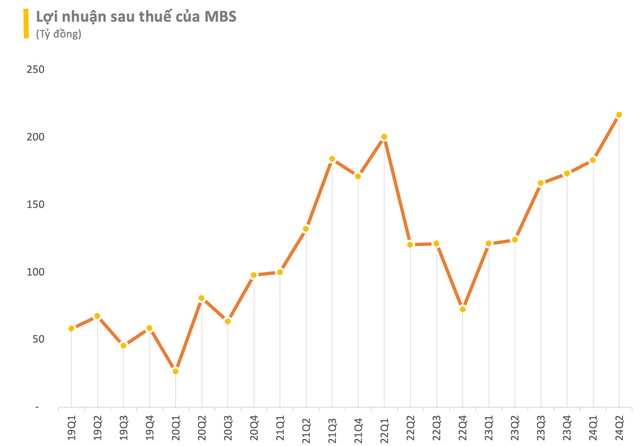

In other news, MB Securities has recently released its standalone financial report for the second quarter of 2024. For this quarter alone, MBS reported growth in almost all of its main business segments, with operating revenue reaching 883 billion VND, a 120% increase compared to the same period last year. The company’s pre-tax profit stood at 271 billion VND, a 75% jump from the second quarter of 2023. Net profit amounted to nearly 217 billion VND, a 74% increase from the previous quarter and the highest quarterly profit in the company’s history.

For the first six months of the year, MBS’ operating revenue reached 1,557 billion VND, an increase of 111% year-on-year. The company’s pre-tax profit grew by 63% to 500 billion VND, while net profit stood at 399 billion VND.

As of the end of the second quarter of 2024, MBS’ total loan balance stood at 9,979 billion VND, with margin loans accounting for nearly 9,823 billion VND, an increase of 549 billion VND from the previous quarter.

Looking ahead, MBS has set ambitious targets for the full year 2024, with total revenue expected to reach 2,786 billion VND and pre-tax profit targeted at 930 billion VND, representing year-on-year growth of 53% and 36%, respectively. With the strong performance in the first half of the year, the company has already achieved nearly 54% of its full-year profit target.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.