The VN-Index experienced a volatile trading week, with investor caution ahead of the Q2 2024 earnings season keeping the benchmark index within a narrow range.

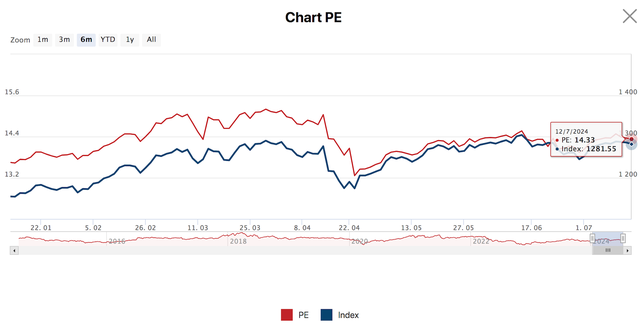

For the week ending July 12, the VN-Index fell 0.2% to 1,280.75. Market liquidity improved significantly, rising 33.9% from the previous week to VND 19,436 billion per session. Efforts to push towards the strong resistance level of 1,300 points have emerged, but they are not yet sufficient. Investors are now wondering about the VN-Index’s performance next week and which sectors are expected to show strong profit growth in Q2. We have discussed this with several experts.

VN-Index Could Surpass 1,300 Points Next Week

Mr. Ngo Minh Duc, Founder of LCTV Finance Investment Joint Stock Company

According to Mr. Ngo Minh Duc, the macroeconomic factors have shown improvement, and the stock market is only accumulating before surging. Investors have welcomed positive news about inflation and global interest rates. Major central banks have started an interest rate cut cycle. The central banks of Canada and the ECB were the first two major central banks to cut rates. It is also projected (with an 80% probability) that the Fed will initiate a rate cut as early as September. The DXY index and the yield on US 10-year Treasuries fell sharply as US inflation figures came in lower than expected, supporting the stability of the USD/VND exchange rate.

With the improved macroeconomic backdrop, the Q2 2024 earnings season approaching, and the relatively positive accumulation before the derivatives expiry, LCTV experts are optimistic that the market could surpass the 1,300-point threshold next week (July 15-19).

Commenting on the strong net selling by foreign investors, Mr. Duc pointed out several main reasons: (1) The USD/VND exchange rate slipped, (2) better opportunities in the Japanese and South Korean markets, and (3) corporate earnings recovered but fell short of expectations.

However, it is uncertain whether foreign investors have stopped net selling and returned to buying. The net selling by foreign investors is a common trend in Asian stock markets in 2024, and this trend has not shown signs of reversing (as observed through the monthly investment inflows and outflows in country-specific ETFs).

If foreign investors reduce their net selling, it could be a positive factor supporting large-cap stocks. However, even if foreign investors maintain their net selling, this is not overly concerning as they only account for about 10% of trading volume in the Vietnamese stock market, and domestic demand can easily “offset” the selling pressure from foreign investors.

Looking at Asian stock markets in 2024, the main growth driver in markets with rising indices and attracting capital inflows has been the recovery in corporate earnings. In Vietnam, while companies’ profits have improved compared to the low base in 2023, the pace of recovery is still slow. LCTV experts believe that when corporate profits recover stronger, the VN-Index will show more positive and clear price movements.

Looking ahead, the VN-Index is expected to rise in the 2024-2026 period, driven by (1) global monetary easing and (2) economic recovery and corporate earnings growth.

Some sectors that could achieve strong growth in the Q2 earnings season include:

Steel industry: By clearing high-cost inventories, steel companies have improved their profit margins. Additionally, domestic steel consumption has shown significant growth compared to the same period last year. With increasing revenue and stable profit margins, the Q2 2024 performance of the steel industry will be impressive compared to the previous year.

Transportation/Port: Since the beginning of the year, sea freight rates, as tracked by the WCI (World Container Index), have quadrupled. Therefore, stocks in the waterborne freight transportation and port industries will benefit, with revenue and profit growth.

Foreigners’ Net Selling Trend Will End Soon

Mr. To Quoc Bao – Head of Market Strategy, PSI Securities Joint Stock Company

Technical indicators currently show that the index is testing the support area around 1,270-1,280 points and is likely to soon re-approach and conquer the 1,300-point threshold. Mr. Bao predicts that the market index will continue to fluctuate in the short term and needs more time to accumulate before showing clear signs of breaking the peak.

According to cumulative statistics for the first six months of 2024, foreign investors have net sold nearly VND 52,134 billion, approaching the record net selling value of VND 56,208 billion in 2021. The net selling trend of foreign investors has slowed down, and the net selling value has cooled down, showing positive signs. “The story of net selling by foreign investors at this time is only a psychological factor and does not significantly affect the domestic stock market and is not overly concerning,” said the PSI expert.

According to Mr. Bao, the net selling trend of foreign investors will soon end as the State Bank of Vietnam has taken many steps to stabilize the exchange rate and gradually raise Vietnam’s interest rates. However, whether foreign investors will resume net buying strongly remains uncertain as the Fed has not yet shown a clear sign of lowering interest rates in the near future.

Regarding the drivers of the VN-Index’s increase, Mr. Bao believes that capital inflows are one of the main factors. Capital inflows into the stock market are relatively stable and tend to improve continuously. The expert assessed that the market would become more positive when large capital inflows return, and in fact, domestic capital inflows have always been the driving force and the main growth driver for the Vietnamese stock market.

In parallel, macroeconomic factors also provide a solid foundation for the stability of the stock market in the coming time as Vietnam’s economy has shown improvement in recent months due to increased domestic and international demand. Vietnamese enterprises have increased imports of raw materials and means of production to meet orders. The monetary and foreign exchange markets have also been stabilized, creating a favorable macroeconomic environment for development.

As the Q2 2024 earnings season approaches, the profits of listed companies are expected to continue to grow as profits bottomed out in 2023 and recovered in the most recent quarters.

In Q2 2024, sectors expected to maintain growth momentum and achieve outstanding profit growth include steel, retail, import-export, tourism & entertainment, information technology, oil & gas, and chemicals…

In the steel industry, the demand for construction steel has returned, continuously increasing product consumption and showing significant improvement compared to the same period. The application of anti-dumping measures against Chinese steel and the simultaneous easing of monetary policies in major consuming markets such as North America and Europe; selling prices have not improved much, but raw material prices remain low and are still in a downtrend. These factors will support the profits of enterprises in the industry.

In the retail sector, the consumption demand for retail goods has recovered strongly, with the total retail sales of goods and services in the first five months of 2024 estimated at more than VND 2.58 million billion, up 8.7% over the same period last year. The focus is on essential goods (department stores & pharmaceuticals).

At the same time, upstream companies in the oil and gas industry are expected to continue to maintain growth momentum in Q2 earnings. In addition, import and export activities are expected to remain vibrant, and statistics show that the economy’s recovery is still positive, which will be a significant driver for the performance of enterprises mainly operating in the import and export of goods.

Looking at investment opportunities in the second half of 2024, Mr. Bao predicts that groups benefiting from macroeconomic policies, public investment, and consumer demand and global commodity prices could include banks, real estate, construction – public investment, steel, seafood, retail, fertilizer – chemicals…

These are sectors expected to improve significantly in Q2 2024 earnings as imports and exports grow positively compared to the previous year due to increased international demand and domestic production recovery. New domestic and export orders have increased. Domestic consumption is showing signs of warming up, driven by the demand of local people and the tourism and travel services.

In addition, the economy’s recovery will accelerate the progress of capital disbursement for key projects. Especially for the real estate sector, the 2024 Land Law is expected to take effect from August 1, 2024, which will untie legal constraints and create a positive momentum for the real estate market in the coming time.

Investors Consider Increasing Stock Proportion

Mr. Dinh Quang Hinh – Head of Macroeconomics and Market Strategy, VNDIRECT Analysis Division

Last week, the US announced that the consumer price index (CPI) for June fell 0.1% from the previous month, the first monthly decline in more than four years. Year-on-year CPI also cooled to 3.0%, lower than the forecast of 3.1%. The inflation data reinforced the market’s confidence in the Fed’s interest rate cut scenario in the second half of this year. According to the FedWatch Tool of CME Group, traders now lean toward the scenario of the Fed cutting interest rates as early as the September meeting, with about two rate cuts this year.

After the positive inflation data, US stock indexes rose across the board, while the dollar strength index (DXY) and US Treasury yields plummeted. These developments will positively impact Vietnam’s macro balance, causing the USD/VND exchange rate to ease slightly in recent days, helping to gradually untie the big knot for the market – the exchange rate issue. This will improve investors’ sentiment and capital flows in the market in the coming weeks.

At the same time, the market is entering the Q2 earnings season, with many forecasts showing that profit growth momentum will continue. Therefore, if the market adjusts to the 1,260-1,270 point range, it will open up opportunities for investors to increase their stock proportion at more attractive prices, prioritizing sectors that have not increased strongly recently, such as banks, real estate, securities, electricity, and exports.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.