A reader, Mr. Hoang Le, reported to Bao Nguoi Lao Dong that he had just been informed by his company’s administrative department of a text message demanding repayment of a loan he allegedly took out two years ago. Mr. Le denied ever taking out an online loan or receiving credit from any financial institution.

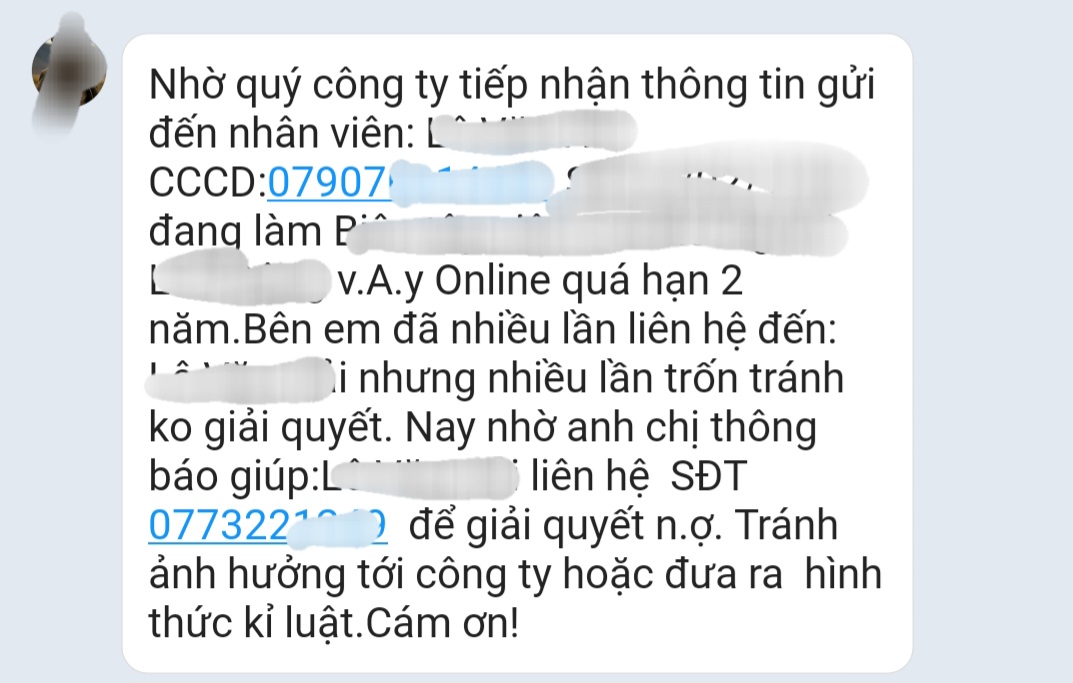

The text message, sent to the administrative department’s phone number, claimed that Mr. Le had borrowed money online two years ago but had repeatedly failed to make payments and was now evading his debt. It requested that the company urge Mr. Le to contact the number provided to resolve the issue and avoid further consequences.

Mr. Le confirmed that while his name, date of birth, and place of employment were accurate, the message contained an incorrect citizen identification number. Furthermore, he asserted that he had never engaged in any online or credit borrowing and that two years ago, he was still using his identification card and had not yet obtained a citizen ID card.

Mr. Le also shared that he had received a similar phone call from an unknown number over a week ago, demanding repayment for an alleged loan from two years ago. He had denied the claim and requested a copy of the online credit contract, which he never received. Now, the unknown number has sent a text message to his workplace, specifically mentioning his job position, causing him significant concern.

Attempts to call the number provided in the text message have been unsuccessful, with the number either being unreachable or the caller refusing to answer.

Text message received by the administrative department’s phone number

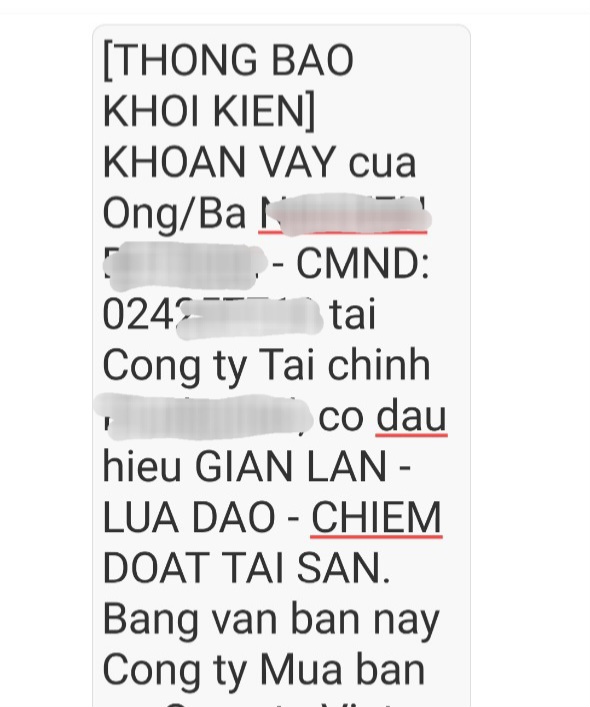

Other readers have shared similar experiences of unexpected debt collection calls and messages, despite having no outstanding loans. Mr. Ngoc, a security guard at a government agency in District 3, Ho Chi Minh City, recounted how he has been receiving frequent debt collection messages and threats for several months, with his personal information, including photos, being posted on social media platforms.

Mr. Ngoc asserted that he has never borrowed money from any online lending apps or financial institutions. He shared that a few months ago, when he inquired about a microfinance loan from a financial organization, he was informed that he had a bad debt record with the National Credit Information Center (CIC), which prevented him from obtaining the loan.

Frustrated, Mr. Ngoc expressed his confusion about how he could have a bad debt record when he has never borrowed money. He has since contacted the financial company, denying any credit relationship with them and requesting the correction of his information in their system.

Mr. Ngoc’s complaint about frequent debt collection messages received in the past few months

Financial experts attributed these incidents to the rampant theft and sale of personal information, which has led to the creation of fake documents for online borrowing. They explained that while the names and phone numbers might be accurate, other details like citizen identification numbers could be incorrect, or the information could be a mix of different individuals, creating a fake profile for borrowing purposes.

To prevent being harassed for debt repayment when no loan has been taken, customers must contact the lender (online lending app, financial company, or credit institution) directly and request the correction and removal of their information from the lender’s system.

In an effort to combat fake and fraudulent accounts, the State Bank of Vietnam has issued Decision No. 2345/QD-NHNN, which came into effect on July 1, 2024. This decision mandates the use of biometric authentication for electronic money transfers exceeding VND 10 million or a total daily transaction value of VND 20 million.

According to the State Bank of Vietnam, the primary goal of Decision 2345 is to ensure that online banking users are the actual account holders, thereby protecting customers and reducing instances of fraud and illegal activities. This decision also contributes to safeguarding customers who utilize banking services.

The State Bank of Vietnam is collaborating with the Ministry of Public Security to clean up customer accounts. Once this process is complete, it will be impossible to open accounts using fake documents. As of early July, approximately 19 million accounts have been verified using the new citizen identification cards with chips issued by the Ministry of Public Security.