Gold prices soar as inflation report solidifies expectations for an early Fed rate cut. Specifically, at the DOJI Group, the price of 9999 gold rings is currently at 75.8-77.15 million VND per tael. At SJC Company, gold ring prices are listed at 75.15-76.65 million VND per tael. PNJ applies a range of 75.15-76.6 million VND per tael. Bao Tin Minh Chau listed prices at 75.68-76.98 million VND per tael.

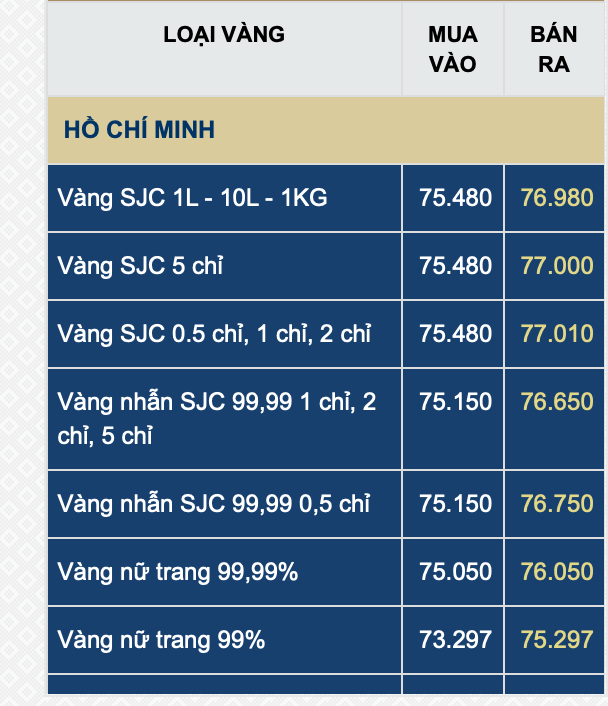

SJC gold prices remain unchanged, still at 77 million VND per tael for selling and around 75.5 million VND per tael for buying, with some places offering 75.9 million VND per tael. Only DOJI maintains its buying price at 75 million VND per tael.

In the international market, gold prices are currently at $2,410 per ounce, the highest level in two months. Converted according to the VND/USD exchange rate, the world gold price is currently equivalent to 74 million VND per tael, excluding taxes and fees.

This week, the precious metal surged as the latest inflation report further solidified expectations for an early rate cut by the Federal Reserve. Core CPI in the US for June decreased by 0.1% from May, to around 3%, marking the first decline in over four years and nearing a three-year low. This is the first time since May 2020 that inflation in the US has shown a downward trend.

Out of 13 Wall Street analysts who participated in Kitco News’ gold survey, all but one agreed that gold prices would climb higher in the coming week. Twelve experts, or 92%, predicted higher prices, while only one analyst, accounting for 8%, forecast a decline. None expected gold to trade sideways in the week ahead.

Meanwhile, 178 votes were cast in the Main Street online survey, with retail investors maintaining their optimistic stance from the previous week. Specifically, 119 retail traders, or 67%, predicted gold prices to rise in the coming week, while 32 others, or 18%, anticipated lower prices. The remaining 27 voters, accounting for 15%, expected prices to move sideways.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)