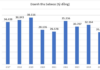

While the broader market has been volatile, PTX shares of Nghe Tinh Petrolimex Transport and Services JSC have made a remarkable breakthrough, becoming the best-performing stock on the exchange last week.

Specifically, PTX marked five consecutive sessions of surging to the daily limit, thereby reaching an all-time high. In just over a month, this stock has skyrocketed by 333% in value, yet the striking fact is that its market price is a mere VND 2,600 per share.

This fuel transport stock’s rally began right after the company distributed large cash dividends. In early July, PTX disbursed nearly VND 10 billion in cash dividends for 2023, with a rate of 15% in cash according to the list locked on June 18.

In fact, in the last five years, this fuel transport company has consistently maintained an 8-10% cash dividend payout. However, this year also marks the highest cash dividend payout in PTX’s history.

In mid-June, Nghe Tinh Petrolimex Transport and Services JSC also approved the plan to register for listing PTX shares on the Hanoi Stock Exchange (HNX). The company stated that specific content would be reported by the Board of Directors at the nearest meeting.

Nghe Tinh Petrolimex Transport and Services JSC is a member of Petrolimex Vietnam and was established through the equitization of state-owned enterprises under Decision No. 1364/2000/QD-BTM dated October 3, 2000, by the Ministry of Industry and Trade.

In 2018, the company officially traded on UPCoM. After several rounds of capital increases, PTX currently has a charter capital of nearly VND 64 billion, of which Petrolimex Service Joint Stock Company, the parent company, holds 3.2 million shares, equivalent to 51%.

The company’s main business activities include fuel transportation, wholesale and retail of petroleum, and motor vehicle training and testing. Among these, fuel transportation is the core business with 81 transport vehicles, including 21 tractor trucks with an average capacity of 40 cubic meters per vehicle, and a total capacity of nearly 2,061 cubic meters for the entire fleet. This meets the transportation and supply needs of gasoline and oil in Nghe An, Ha Tinh, part of Thanh Hoa, Quang Binh, and Laos.

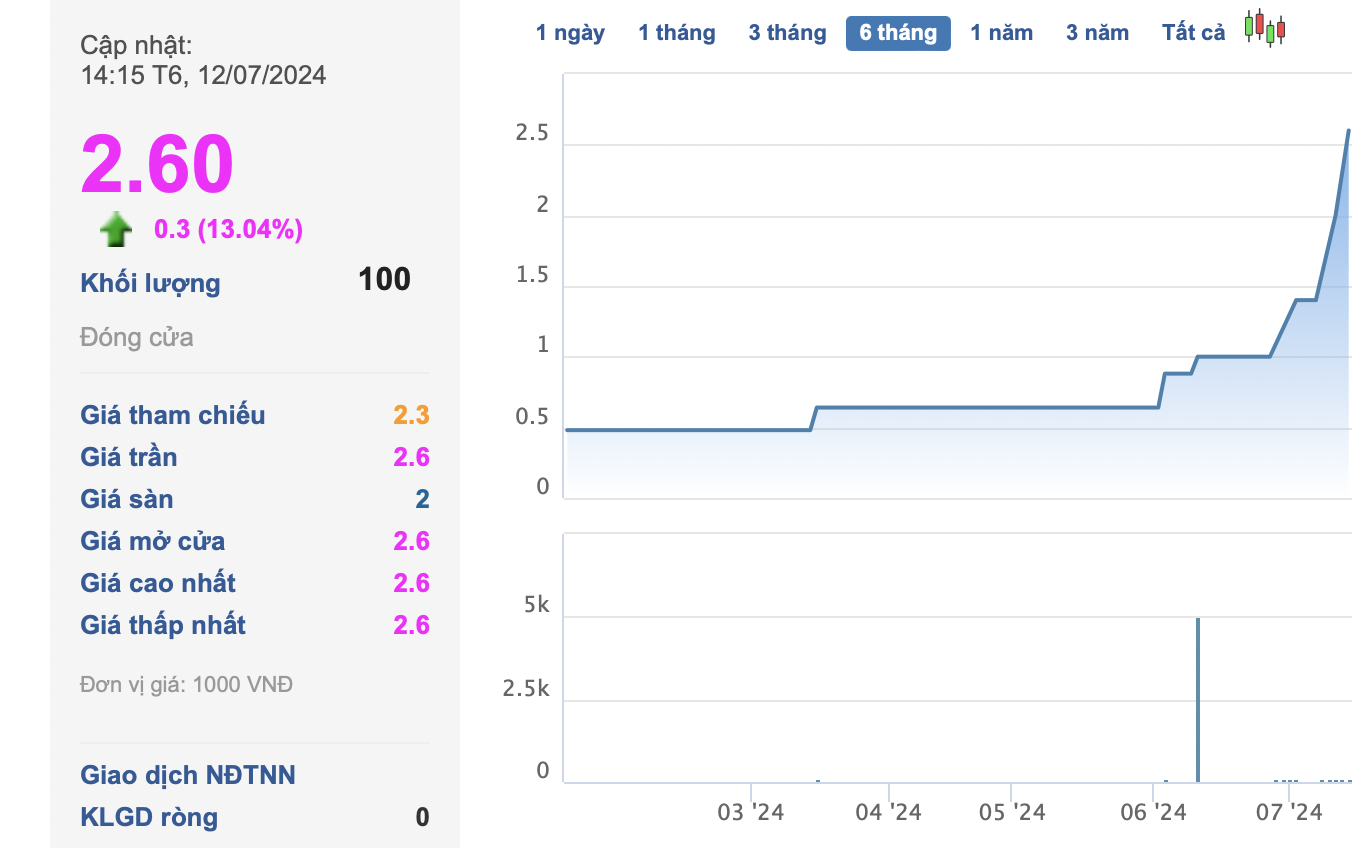

In 2023, the volatile global oil market led to a surge in demand for Petrolimex’s products, resulting in a significant increase in PTX’s sales across all channels, particularly in direct retail and purchases from commercial traders within the Petrolimex distribution system. Revenue and after-tax profit for 2023 reached VND 2,147 billion and VND 12.5 billion, a decrease of 4% and an increase of 22%, respectively, compared to the previous year.

For 2024, the company’s management anticipates that the Russia-Ukraine tension and the Israel-Palestine conflict will continue to impact the global economic landscape, and the oil trading and transportation mechanisms will remain volatile. Additionally, the changing dynamics of goods transportation may lead to localized supply shortages at certain times. These factors are expected to significantly influence the business performance of the company and the broader business community.

Consequently, for the year 2024, the company forecasts a revenue of VND 1,843 billion and a pre-tax profit of VND 10.4 billion, representing a decrease of 12% and 14%, respectively, compared to the previous year. The expected dividend payout ratio is 10%, lower than in 2023.