Techcombank’s Impressive Performance: Half-Year Profit Surpasses VND 15,000 Billion

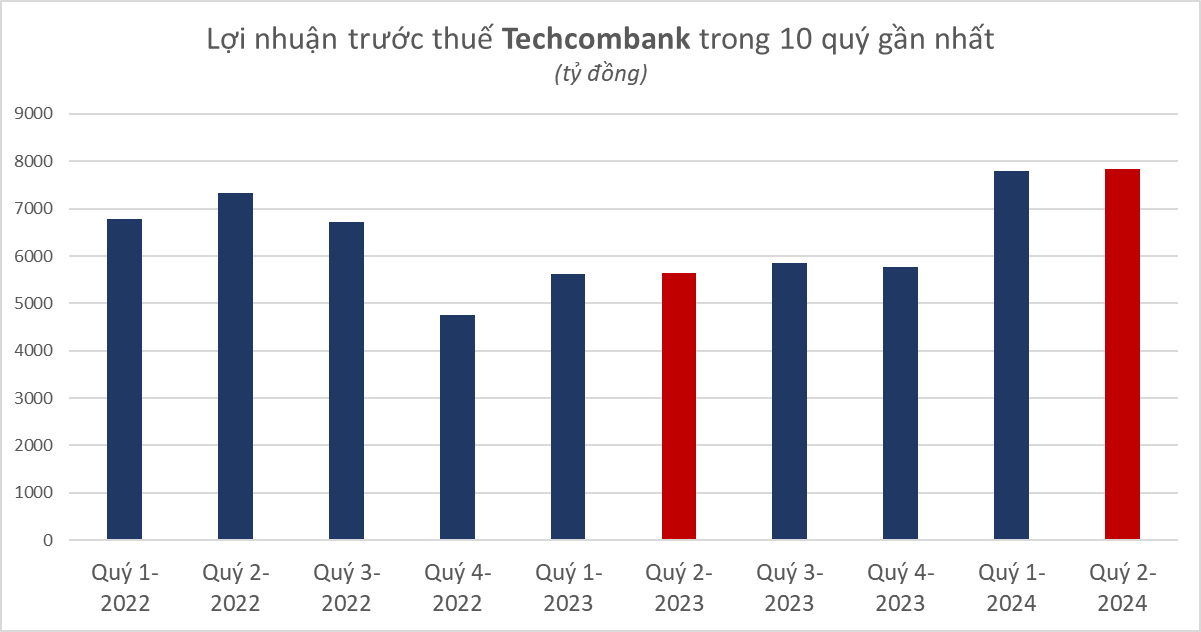

The bank reported a remarkable pre-tax profit of VND 8,122 billion for the second quarter of 2024, marking a 59% increase compared to the same period in 2023. Furthermore, the consolidated pre-tax profit for the same quarter stood at VND 7,827 billion, representing a significant 38.5% year-on-year growth. This quarter’s performance also set a new record for Techcombank’s quarterly profits.

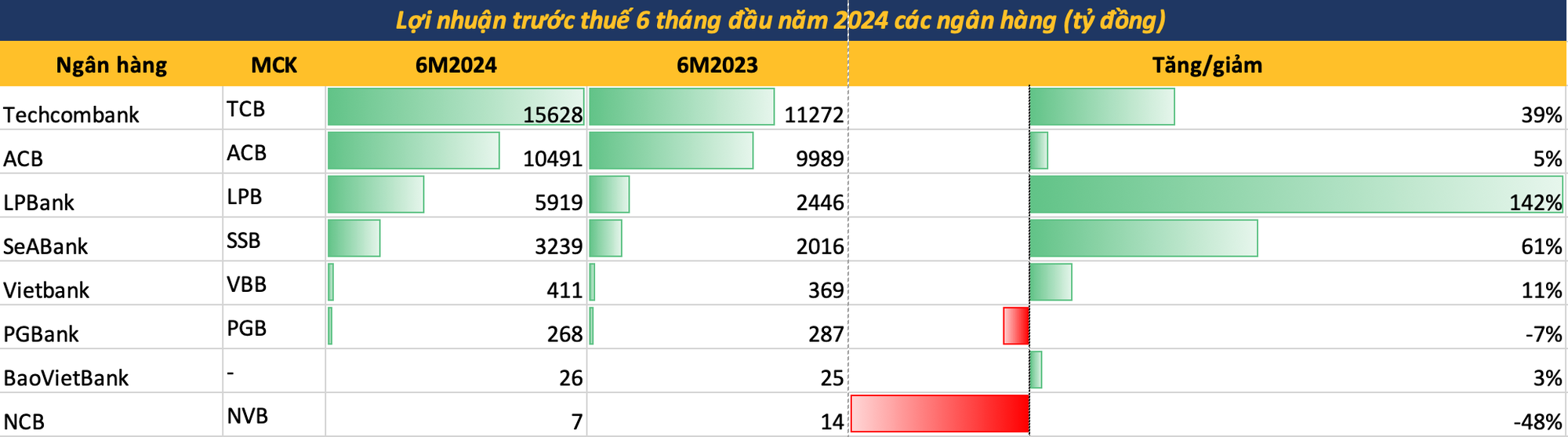

For the first half of 2024, Techcombank’s consolidated pre-tax profit reached an impressive VND 15,628 billion, reflecting a 38.6% increase compared to the previous year.

As of June 30, 2024, Techcombank’s total assets amounted to VND 908,307 billion, a 6.9% increase from the beginning of the year. Customer loan balances witnessed a notable surge, climbing 14.2% to reach VND 592,083 billion. Customer deposits also increased by 6%, totaling VND 481,860 billion.

However, the CASA (non-term deposit) ratio experienced a slight dip from 40% at the start of the year to 37.5% by the end of June 2024. The bank’s non-performing loan ratio stood at 1.23% as of the end of the second quarter, up from 1.16% at the beginning of the year. Techcombank’s bad debt coverage ratio remained healthy at 101%.

ACB’s Strong Showing: Half-Year Profit Approaches VND 10,500 Billion, Credit Growth at 12.4%

ACB announced impressive results, with a pre-tax profit of VND 10,500 billion for the first half of 2024, reflecting a 5% increase compared to the same period last year. Notably, the bank’s second-quarter profit reached VND 5,600 billion, representing a 14% increase from the previous quarter and a remarkable 16% year-on-year growth. This quarterly performance sets a new record for ACB.

ACB’s credit growth stood at 12.4%, outpacing the industry average of 6%. This growth was driven by a 12.3% increase in personal loans, a 7.2% rise in SME loans, and an impressive 37.6% surge in corporate loans.

In terms of deposits, ACB recorded a 6.2% growth, surpassing the industry average of 2%. The bank successfully maintained its CASA ratio at a solid 22.3%. Additionally, ACB’s loan-to-deposit ratio reached 82.2%, outperforming the industry average of 78.7%.

SeABank’s Robust Growth: Half-Year Profit Surges by 61% Year-on-Year

SeABank disclosed its financial results for the first half of 2024, reporting a pre-tax profit of over VND 3,238 billion, marking a significant 61% increase compared to the same period in 2023.

By the end of the first half, SeABank’s total deposits and valuable papers reached VND 160,926 billion, reflecting a net increase of VND 16,139 billion compared to the previous year. Notably, the bank’s non-term deposit (CASA) balance witnessed a substantial increase to VND 20,038 billion, representing a 59% year-on-year growth and accounting for 13.4% of total deposits.

As of June 30, 2024, SeABank’s total assets stood at VND 280,658 billion. The bank’s total customer loan balance reached an impressive VND 185,959 billion.

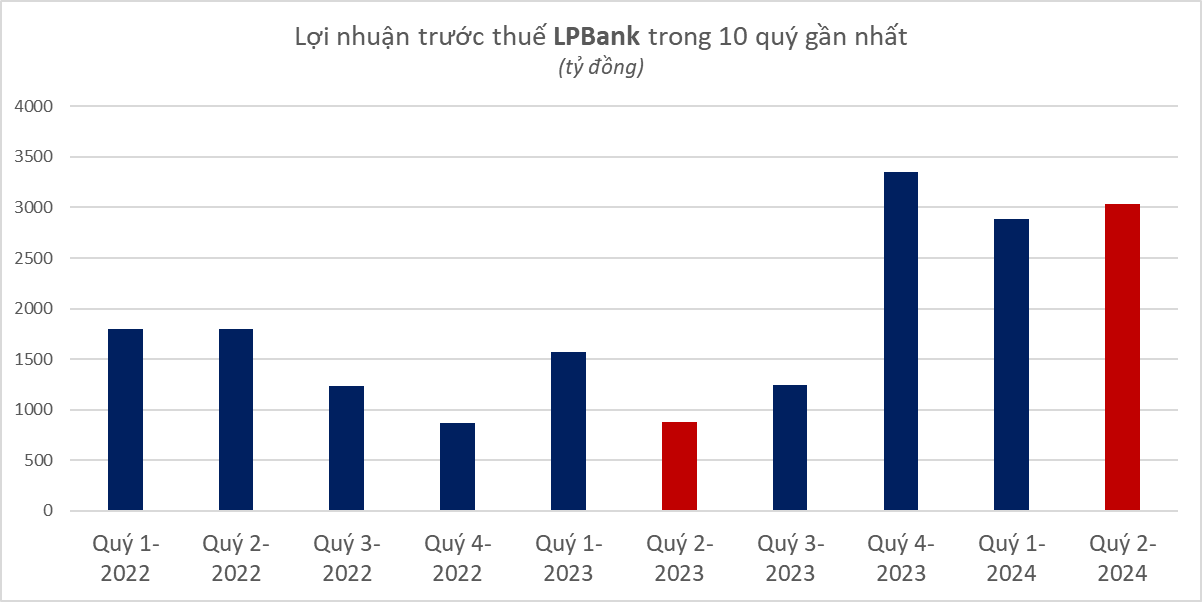

LPBank’s Outstanding Performance: Half-Year Profit Soars by 142% Year-on-Year

LPBank reported impressive results, with a pre-tax profit of VND 5,919 billion for the first half of 2024, reflecting a remarkable 142% increase compared to the same period last year. As of June 30, 2024, the bank’s total assets stood at VND 442,583 billion, a 15.6% increase from the end of 2023. Customer loan balances increased by 15.2% during the first half, reaching VND 317,395 billion. Customer deposits also saw a significant surge, climbing 21.4% to VND 288,098 billion.

However, LPBank’s non-performing loan ratio stood at 1.73% as of the end of June, up from 1.34% at the beginning of the year. The bank’s bad debt increased by 48.6% during the same period.

NCB’s Turnaround: Positive Second-Quarter Results After Three Consecutive Quarters of Losses

NCB returned to profitability after facing losses in the previous three quarters. The bank reported a pre-tax profit of VND 49 billion for the second quarter of 2024, a sixfold increase compared to the same period in 2023. For the first half of the year, NCB’s pre-tax profit surpassed VND 7 billion.

As of June 30, 2024, customer deposits at NCB increased by 11.1% compared to the end of 2023, translating to a rise of nearly VND 8,563 billion. The bank also witnessed a significant increase in customer CASA balances, with a growth of over VND 483 billion compared to the end of last year. Customer loans as of June 30, 2024, reached VND 64,198 billion, reflecting a 16% increase from the previous year. NCB’s total assets stood at VND 103,312 billion, a 7.3% increase from the end of 2023.

Vietbank recorded a pre-tax profit of VND 411 billion for the first half of the year, achieving 43% of its annual plan. The bank experienced an 11.3% growth rate in the past six months, with the second quarter contributing significantly to this semi-annual performance, achieving a remarkable 96.5% year-on-year growth.

Vietbank successfully achieved over 90% of its annual plan for three key metrics: deposit growth, loan growth, and total asset value growth, just halfway through the financial year. Notably, the bank’s loan growth reached 10%, outpacing the industry average of 6% as of June 28, 2024.

PGBank reported a pre-tax profit of VND 151 billion for the second quarter of 2024, a slight increase of 0.6% compared to the same quarter last year. For the first half of 2024, the bank’s pre-tax profit reached nearly VND 268 billion, a 6.6% decrease from the previous year, but still achieving 48% of its annual plan as stated in the 2024 Annual General Meeting of Shareholders (with a planned pre-tax profit of VND 554 billion, a 58% increase from 2023).

BaoVietbank also disclosed its preliminary financial results for the first half of 2024, reporting a pre-tax profit of VND 25.79 billion, a 4.42% increase compared to the same period last year. The second quarter alone contributed VND 17.5 billion to this half-year profit.