In Q2 2024’s financial report, JSC Golden Star Rubber (code: SRC) recorded a record-high net profit of nearly VND 114 billion, 18.5 times higher than the same period last year and surpassing the full-year profit plan.

Specifically, revenue in Q2 2024 reached VND 328 billion, a 19% increase year-on-year. After deducting the cost of goods sold, the gross profit of over VND 281 billion also increased by 18%.

While the cost of goods sold, selling expenses, and management expenses all increased, they did not rise proportionally, helping SRC’s profit from business activities double from the previous year to nearly VND 16 billion.

Notably, during this period, Golden Star Rubber recorded an unexpected surge in other income of over VND 306 billion. This income is derived from the transfer of land lease rights with infrastructure and assets attached to the land, resulting in a profit of VND 162 billion.

Although not explained in detail, this income is likely from the lease of 212,000 sq. m of the Chau Son Industrial Park in Phu Ly city, Ha Nam province.

In 2016, Golden Star Rubber leased this real estate from Hanoi VPID JSC for 40 years to carry out the project of relocating and producing Radial tires in Ha Nam. However, in 2020, the company’s leaders decided to halt the project and lease the land to other companies.

Golden Star Rubber Reports Record Profit in Q2 2024

In October 2023, the company signed a contractual agreement with two units: Casablanca Vietnam JSC (leasing 110,000 sq. m) and Casla JSC (leasing 102,538 sq. m) for the transfer of land lease rights with infrastructure and assets attached to the land in Chau Son Industrial Park. The contractual transfer values were VND 157.3 billion and VND 146.6 billion, respectively, totaling approximately VND 303 billion – matching SRC’s recorded amount.

On the other hand, in the long-term asset group, Golden Star Rubber no longer recorded the factory project in Ha Nam. At the same time, SRC collected VND 300 billion in fresh cash from the liquidation and sale of fixed assets and other long-term assets.

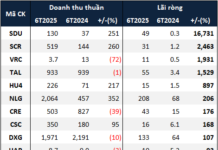

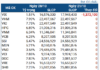

For the first six months, revenue reached VND 503 billion, a 5% increase, achieving only 25% of the revenue target. However, the net profit was VND 117 billion, 11 times higher than the same period last year, surpassing 82% of the annual profit target.

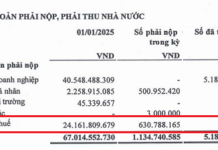

Golden Star Rubber’s total assets as of June 30, 2024, were VND 1,157.3 billion, a 15% decrease from the beginning of the year.

Short-term receivables from customers decreased by 28%, mainly due to a VND 211 billion reduction in short-term receivables from Vietnam Commercial and Import-Export JSC, leaving a debt of VND 45 billion.

Inventories also accounted for a large proportion of the company’s assets, valued at over VND 200 billion at the end of Q2.

In terms of capital structure, total liabilities decreased by 32% to VND 616.7 billion. Short-term borrowings decreased by 51% to VND 165 billion. Long-term borrowings also decreased by VND 130 billion to only VND 2.6 billion as Golden Star Rubber fully settled its loan with Hoanh Son Group JSC (a shareholder holding 50.21% of SRC’s capital).

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.