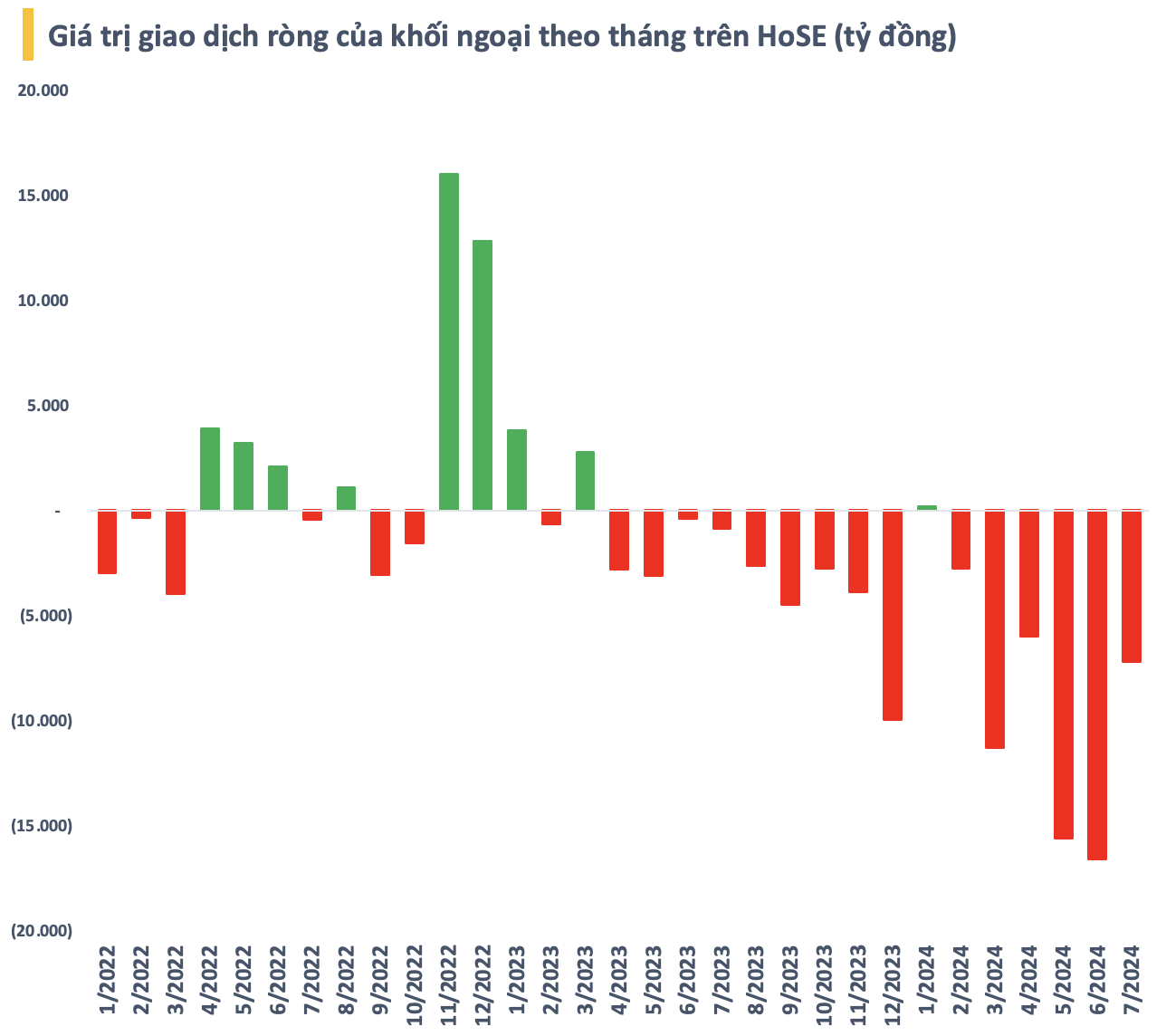

Foreign investors have sold over 59 trillion VND on the HoSE since the beginning of 2024, with a significant increase in selling pressure in the second quarter. In May and June alone, the value of net selling exceeded 15 trillion VND each month, a record high. The sell-off by foreign investors in the Vietnamese stock market is part of a broader trend of capital outflows from frontier and emerging markets.

In addition to the wave of outflows through ETF channels, notably BlackRock’s liquidation of iShares MSCI Frontier and Select EM ETF, open-end funds have also contributed to the storm of sell-offs in the Vietnamese stock market. One of the foreign funds that has been net selling Vietnamese stocks heavily in recent times is the Tianhong Vietnam Market Stock Initiated Securities Investment Fund (QDII).

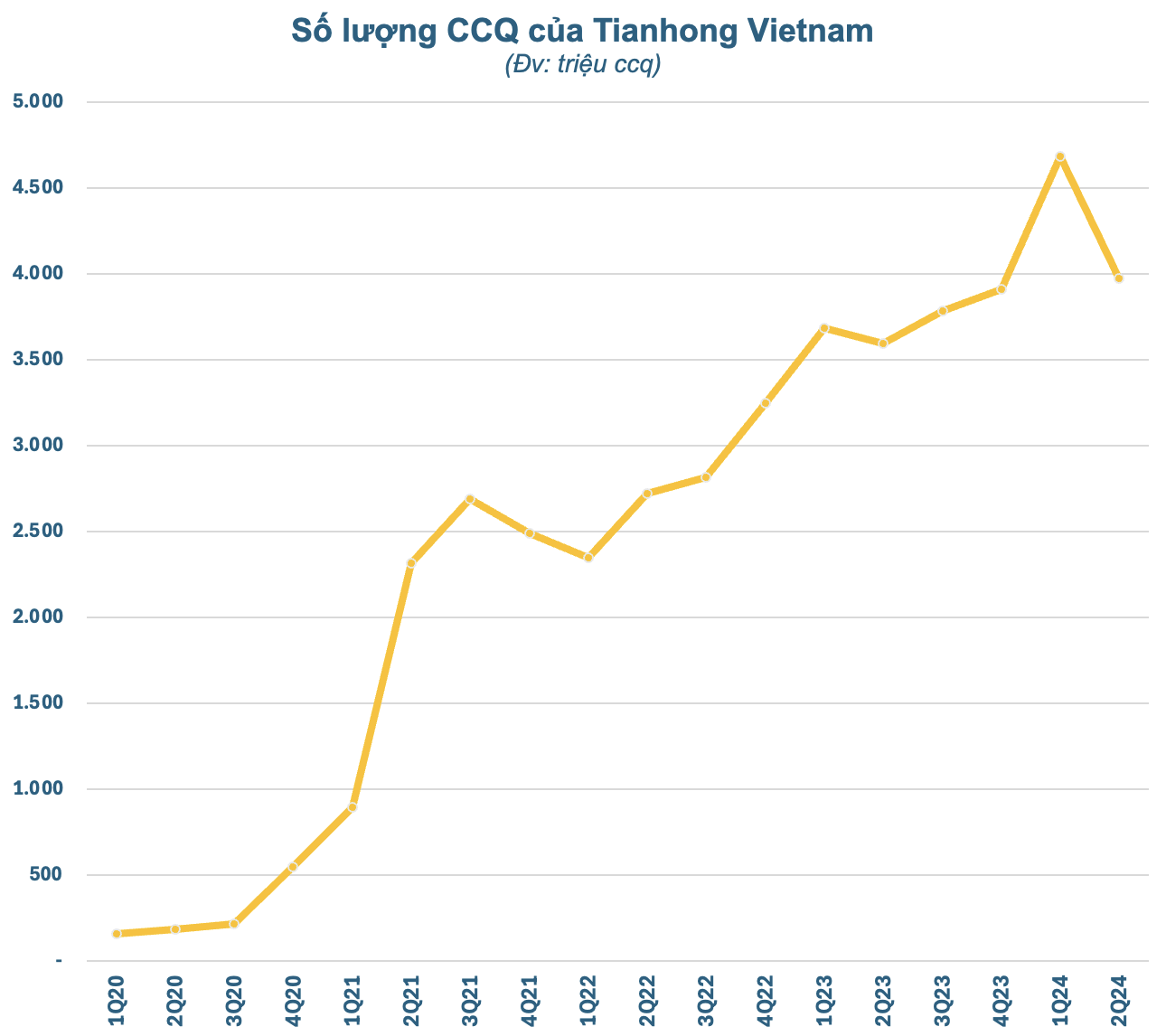

As of June 30, 2024, Tianhong Vietnam had 3.97 billion fund units, a decrease of 720 million units compared to the previous quarter. It is estimated that this foreign fund experienced outflows of about 1 billion RMB (3,500 billion VND) in the second quarter of 2024. This was the quarter with the most significant outflows for Tianhong Vietnam since its launch in 2020.

Tianhong Vietnam is managed by Tianhong Asset Management (Tianhong AM), a fund management company headquartered in Tianjin, China. Established on January 8, 2004, with registered capital of 514.3 million RMB, Tianhong AM operates as a mutual fund. In 2013, the fund management company, together with Alipay, launched the money market fund Yu’ebao.

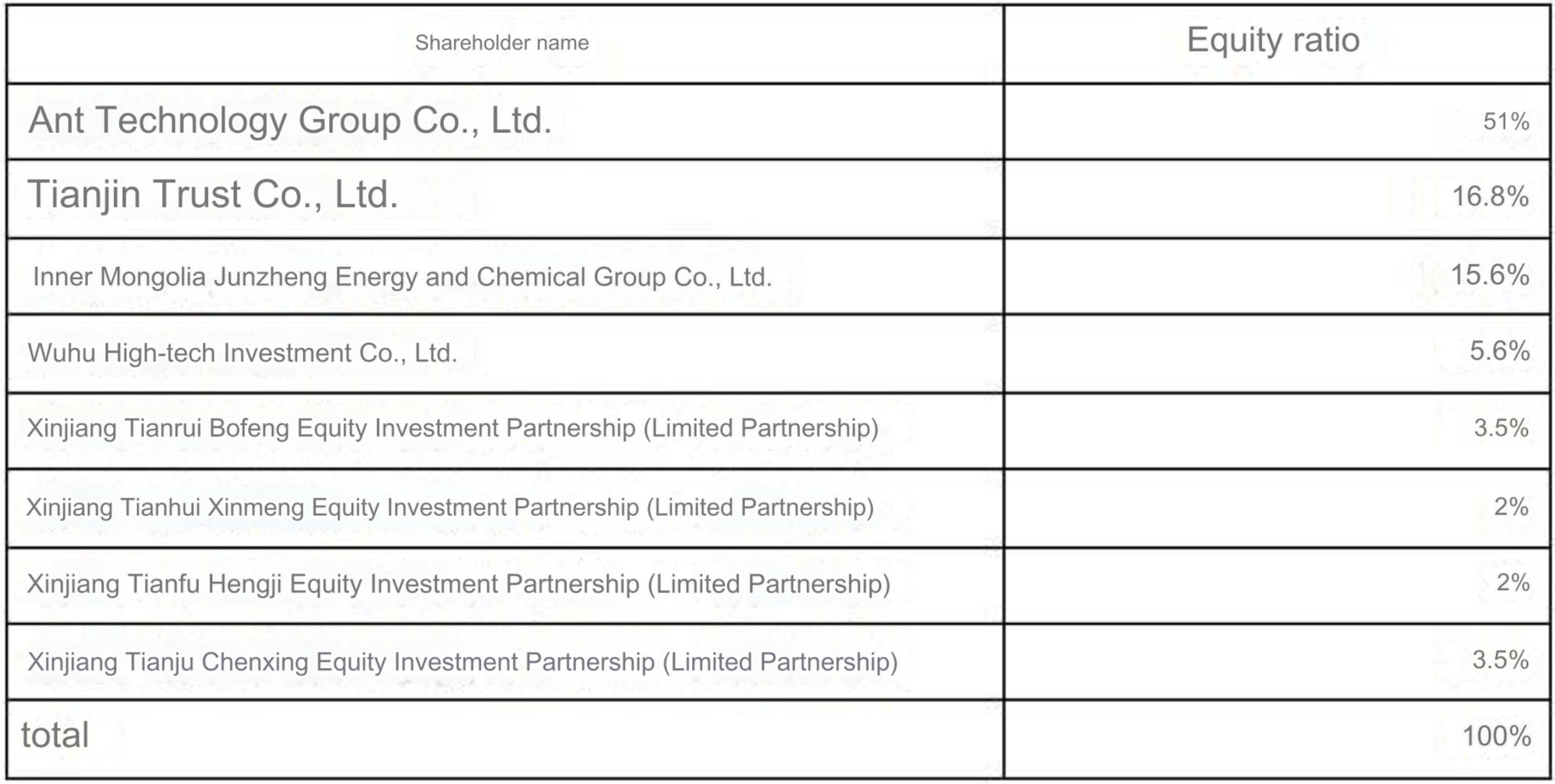

Tianhong AM was the first fund management company in China to have total assets under management exceeding 1,000 billion RMB (142 billion USD). Its main products include capital investment funds, bond investment funds, index funds, money market funds, and MRF (Mutual Recognition of Funds). As of December 31, 2023, Ant Financial, owned by billionaire Jack Ma, was the largest shareholder, holding 51% of Tianhong AM’s capital.

Ant Financial manages 48 member funds that invest in a wide range of products, including big data and intelligent investment. It is a branch of the Alibaba Group, which owns China’s largest payment platform, Alipay. Ant Financial has been expanding its presence in Asian and European markets, with notable acquisitions and investments such as helloPay and Paytm.

Shareholder structure of Tianhong AM at the end of 2023

Tianhong Vietnam was launched after Tianhong AM successfully introduced its first QDII product in the US in September 2019. The fund was designed to track the VN30 index, comprising the 30 largest stocks listed on the HoSE. After its launch, the fund attracted significant capital and expanded rapidly before the trend reversed in the second quarter of 2024.

As of June 30, 2024, the net asset value (NAV) of Tianhong Vietnam stood at over 5.52 billion RMB (19,300 billion VND), significantly lower than the approximate 7 billion RMB (24,000 billion VND) at the end of the first quarter. Despite this, Tianhong Vietnam remains one of the largest open-end funds investing in the Vietnamese stock market.

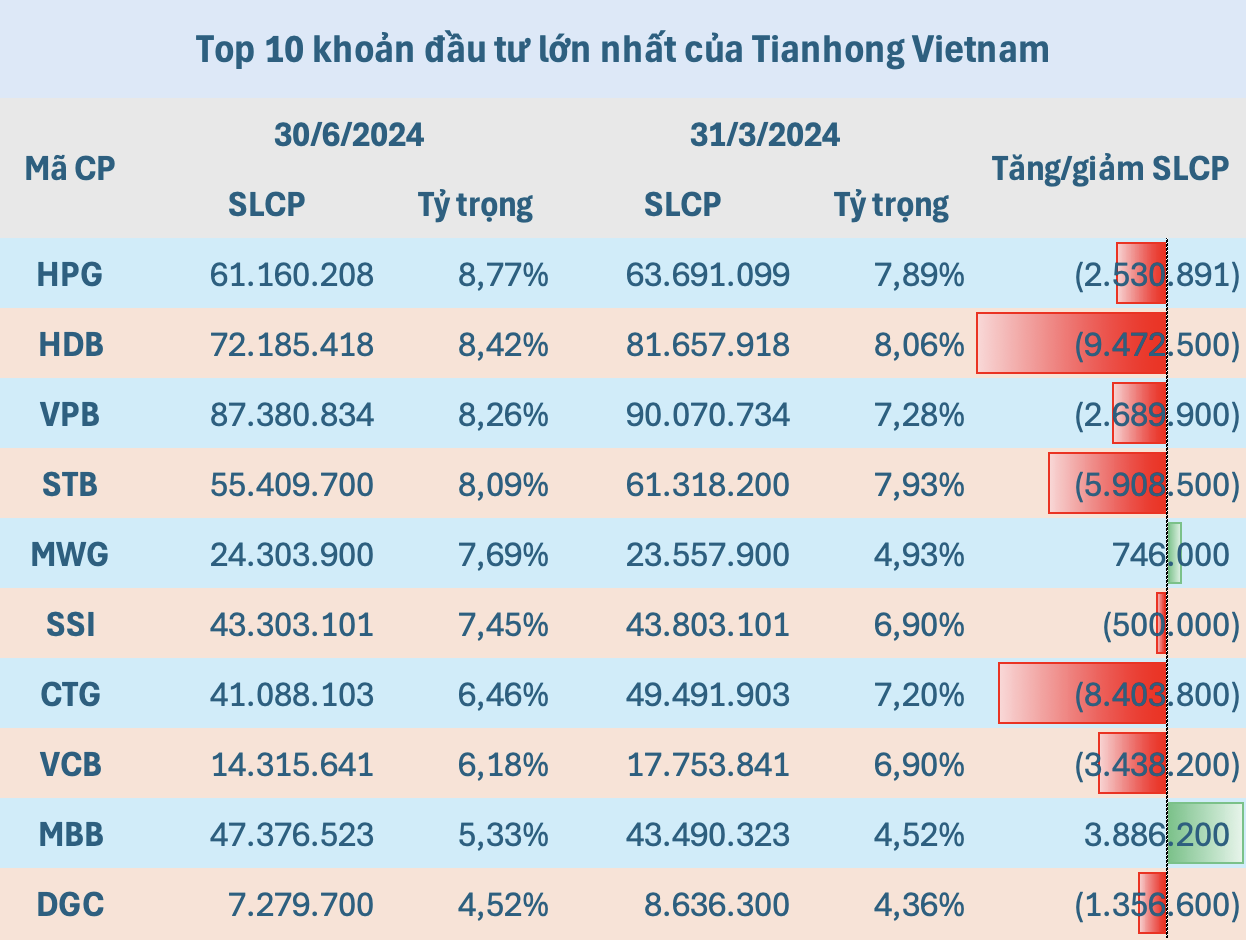

As of the end of the second quarter, equity investments accounted for 90.49% of the fund’s NAV, equivalent to 5.16 billion RMB (18,000 billion VND), a decrease of about 4,000 billion VND compared to the previous quarter. The top 10 investments of the fund include HPG, HDB, VPB, STB, MWG, SSI, CTG, VCB, MBB, and DGC, with a total weight of over 71%. Except for MWG and MBB, the other stocks were sold off heavily.

The actual selling volume may be higher as some stocks underwent stock splits in the second quarter

Aside from Tianhong Vietnam, several large investment funds from China and Taiwan, such as Fubon FTSE Vietnam ETF, CTBC Vietnam Equity Fund, and Jih Sun Vietnam Opportunity Fund, are also investing in the Vietnamese stock market. Among them, Fubon ETF also experienced a phase of significant outflows despite being in the process of raising additional capital in its sixth offering.

The Fed’s approaching decision to cut interest rates is expected to ease capital outflows from frontier and emerging markets and may even reverse capital flows in the short term. With stable macro fundamentals and high profit growth of listed companies, foreign capital is expected to return to the Vietnamese stock market.