The VN-Index started the week on a positive note, opening with a gap up. However, the buying momentum failed to sustain, leading to a subdued upward move. Selling pressure increased but was not strong enough to turn the market around, resulting in a narrow range-bound session.

The VN-Index closed higher on July 29, gaining 4.49 points (+0.36%) to reach 1,246 points. The trading volume was low, with a turnover of nearly VND11,400 billion on the HoSE. Foreign investors’ net selling of VND316 billion across the market was a downside factor.

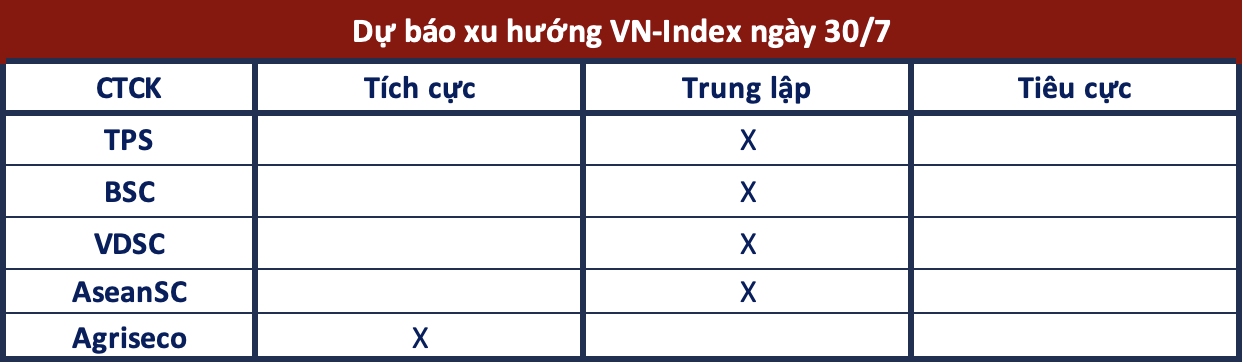

Looking ahead, brokerage houses have offered mixed predictions for the market:

More Positive Signals

TPS Securities: The VN-Index witnessed a strong surge at the beginning of the session, but weak trading volume remains a concern, and investor sentiment is still cautious. The market showed positive signs by trading around the 1,240-point level. To ensure a better scenario, a return to higher liquidity is necessary. TPS recommends a moderate to small investment ratio for short-term trading.

Continued Volatility

BSC Securities: The market breadth was positive, with 12 out of 18 sectors advancing, led by the Tourism and Entertainment sector, followed by Basic Materials, Chemicals, and Retail. Foreign investors net sold on both the HSX and HNX exchanges. Currently, the VN-Index is witnessing a tug-of-war at the 1,245-point level. In the upcoming sessions, the index may continue to experience volatility while trading at this resistance level.

Testing the 1,250-point Resistance

VDSC Securities: Trading volume increased from the previous session but remained low, suggesting that supply pressure is not significant despite some selling interest at higher price levels. Overall, market liquidity is low following the recent sharp decline. The VN-Index is likely to continue its range-bound movement and test the 1,250-point resistance in the next session, but the current low demand may pose a risk of weakness for the index in the near term.

Avoid Chasing Green Candles

AseanSC Securities: The market recovered amid doubts and slightly increased selling pressure, mainly in mid- and small-cap stocks, which do not represent the overall market. On the other hand, large-cap stocks showed more consensus in short-term positions as most of these stocks had a positive session. AseanSC advises investors to avoid chasing green candles in the current context, temporarily holding a moderate stock ratio, and observing market movements.

Expecting Continued Uptrend

Agriseco Securities: The market showed positive signs as the VN-Index maintained a small price gap after the gap-filling and withdrawal within the session. Additionally, selling pressure during the index’s advance towards the 1,250-point level did not increase significantly, raising hopes for a continued uptrend in the coming sessions. With large enterprises gradually releasing their Q2/2024 financial reports at the end of July, Agriseco Research believes that liquidity will quickly recover, and the VN-Index may soon determine its trend after retesting the 1,250-point region.