The Legendary Venture Fund 1 (Legendary), a foreign investment fund based in Singapore, has reported to the Ho Chi Minh City Stock Exchange (HOSE) that it has purchased a total of 60.8 million SBT shares of Thanh Thanh Cong – Bien Hoa Joint Stock Company (TTC AgriS).

On July 19, the fund acquired 32.45 million SBT shares, and on July 22, it purchased an additional 28.35 million shares. Following this transaction, Legendary now holds a total of 116.3 million SBT shares, equivalent to 15.71% of TTC AgriS’s charter capital.

Legendary’s purchase of SBT shares took place during the same time as Ms. Dang Huynh Uc My, the new Chairman of TTC AgriS’s Board of Directors, registered to sell 70 million SBT shares from July 12.

Ms. Doan Vu Uyen Duyen, Deputy General Director of the company, also registered to sell 8.1 million shares from July 25.

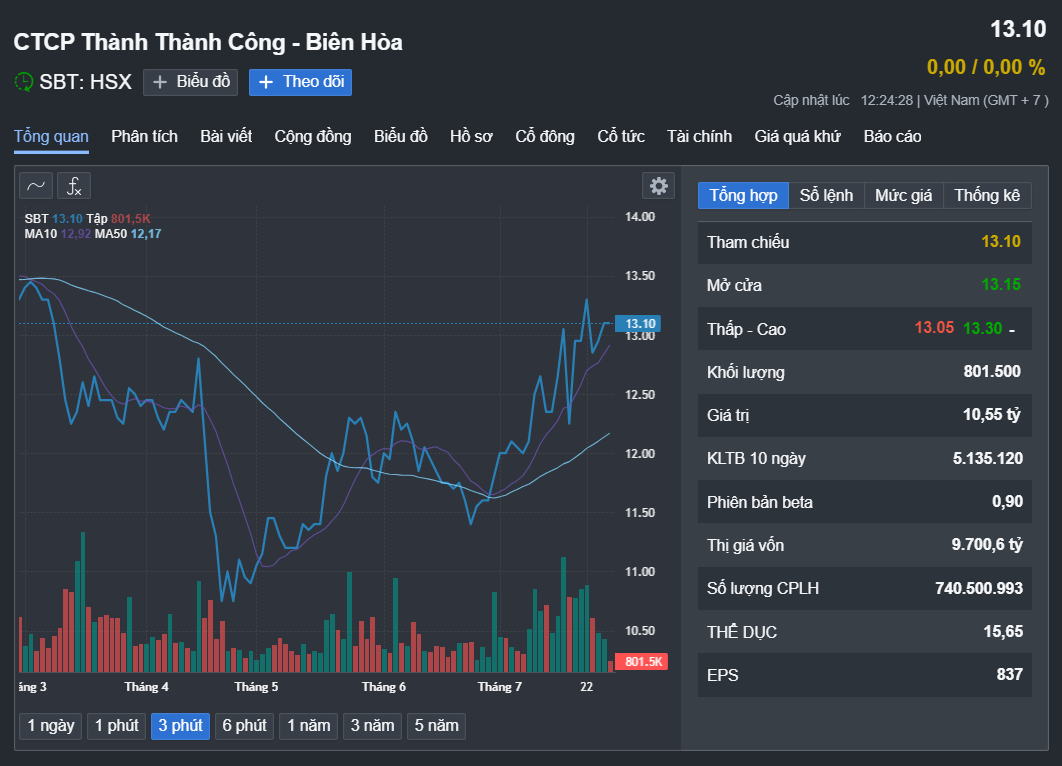

SBT shares rebound after a plunge in April Source: Fireant

TTC AgriS explained that the decision of its leaders to sell shares aims to expand production and business activities and consolidate its position in the international market, as well as to become one of the leading multinational agricultural enterprises in Vietnam.

The buyer, Legendary, is a foreign investment fund headquartered in Singapore. The two parties had a long negotiation and cooperation process before making the investment decision.

Based on the closing prices on July 19 of VND 12,950 per share and on July 22 of VND 13,300 per share, it is estimated that Legendary Venture Fund 1 invested nearly VND 800 billion to acquire these shares.

Legendary is known for investing in companies with potential in Asia. They identify investment opportunities based on attractive intrinsic value and sustainable development strategies, along with predictive data that can unlock value for investors.

Since 2018, Legendary has continuously invested in SBT shares, recognizing the positive prospects of the global sugar industry in the medium and long term.

In the market, SBT shares are gradually recovering after a plunge in mid-April 2024, which was the lowest point since the beginning of the year.

At the closing of the trading session on July 26, SBT shares were priced at VND 13,100 per share, maintaining the reference price.

Regarding TTC AgriS’s business results, the consolidated financial statements for the third quarter of the 2023-2024 fiscal year (from January 1, 2024, to March 31, 2024) showed a revenue of VND 6,159 billion and an after-tax profit of VND 187.5 billion, an increase of 8% and 23%, respectively, compared to the same period.

Meanwhile, the company’s payables at the end of the first quarter increased by more than VND 3,400 billion, reaching VND 22,875 billion.