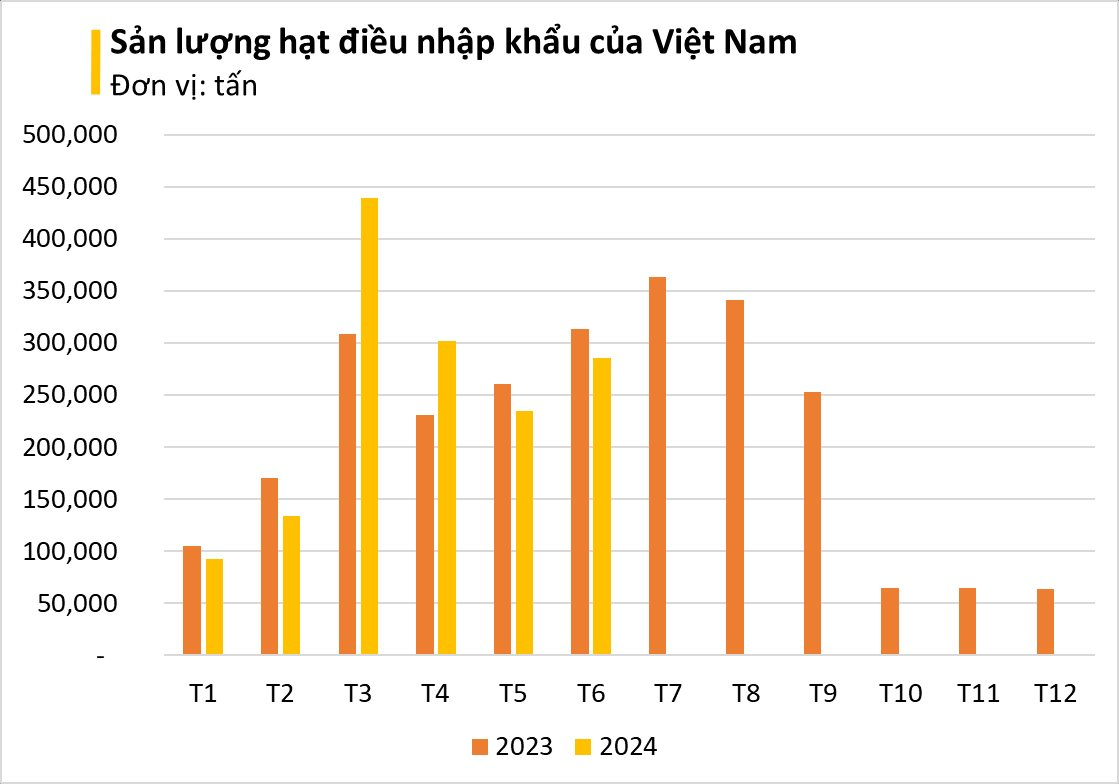

Preliminary statistics from the General Department of Vietnam Customs show that Vietnam imported 285,863 tons of cashew nuts worth over $323 million in June 2024, a surge of 21.8% in volume and 18.4% in value compared to May 2024.

In the first six months of the year, the country imported nearly 1.5 million tons of cashew nuts worth over $1.8 billion, an increase of 8.4% in volume and 3.4% in value year-on-year. The average export price reached $1,208 per ton, a 5% decrease compared to 2023.

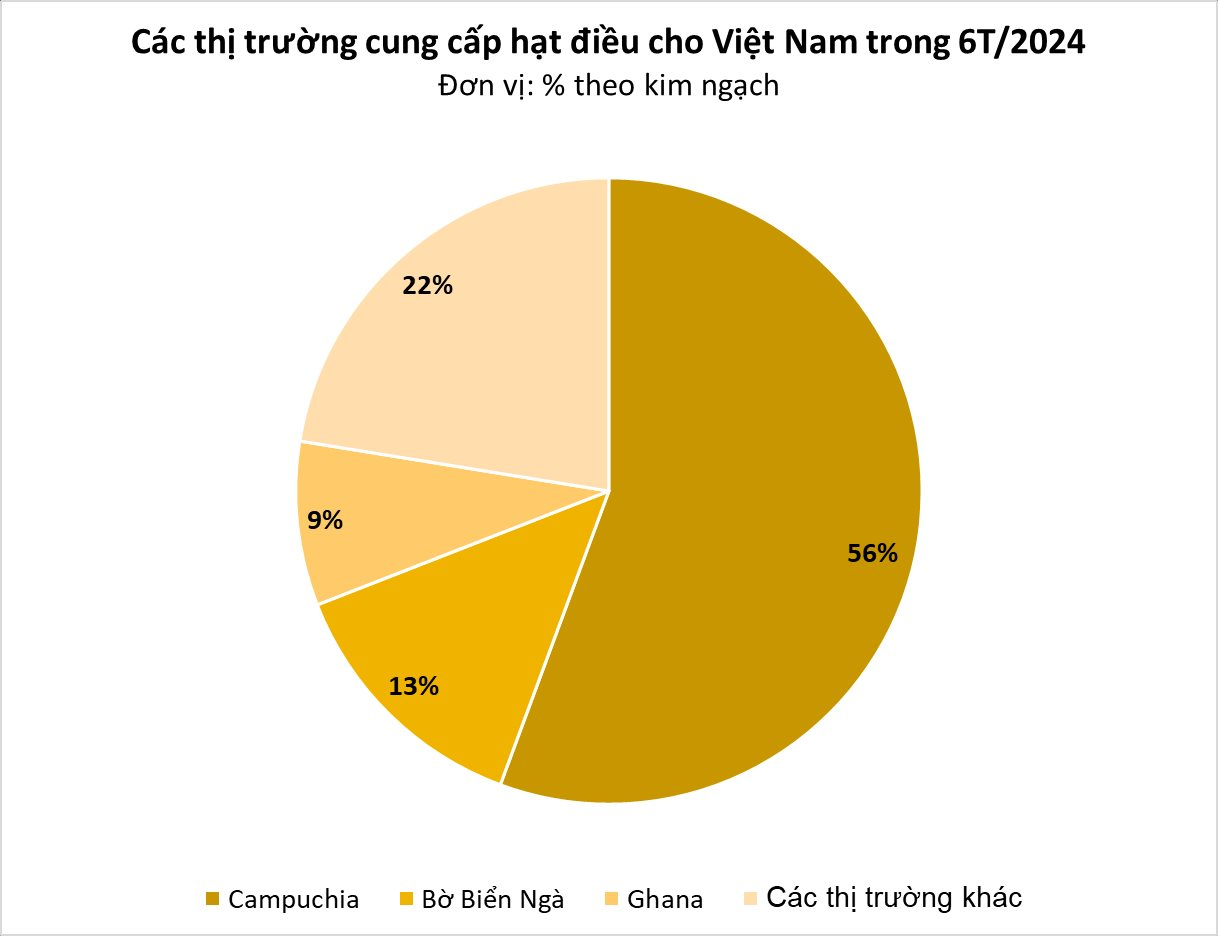

Cambodia remained Vietnam’s largest cashew supplier in the first half of the year, providing 750,000 tons worth over $1 billion, a significant rise of 37% in volume and 28% in value year-on-year. The import price averaged $1,284 per ton, a 6.2% decrease compared to the previous year.

The second-largest market for cashew imports into Vietnam was the African country of Côte d’Ivoire. In the first six months, the country supplied Vietnam with 217,000 tons of cashews, equivalent to more than $242 million, a decrease of 15% in volume and 21% in value compared to the same period last year. The average import price was $1,117 per ton, a 6.5% drop from 2023.

Ghana ranked third, with 142,000 tons of cashew nuts worth $153 million, a rise of 10% in volume and 2.5% in value. The average export price reached $1,075 per ton, a 7% decrease compared to the previous year.

Among the six import markets, Indonesia recorded the highest growth rate, with a surge of 294% in volume and 275% in value compared to the same period last year.

While Vietnam exports cashew nuts worth several billion dollars annually, the situation of raw material shortage is reflected in the increasing import expenditure.

According to the Vietnam Cashew Association (Vinacas), most cashew processing enterprises have not proactively secured raw material sources. Domestic cashew nut supply only meets about 30% of processing capacity, with 70% of raw materials relying on imports. Therefore, Vietnam still needs to increase imports from other countries such as Cambodia, Côte d’Ivoire, Ghana, and Indonesia.

Enterprises in the industry have reported that the price of imported raw cashew nuts from African countries is always higher than that of exported cashew kernels, making it challenging for businesses to coordinate and adjust production capacity effectively.

Vietnam is a center for cashew processing, but it lacks a raw material region, and the domestic cashew-growing area is shrinking, with declining yields. As a result, factories must compete to purchase raw cashews from Africa, and there are times when export prices are lower than import prices.

Recently, several cashew processing enterprises in Vietnam have called for help as the price of raw cashews has soared, and many foreign suppliers have failed to fulfill their previously signed contracts. Domestic businesses face the risk of supply chain disruption.

According to the International Nut and Dried Fruit Council (INC), cashew production in West Africa is expected to decrease by about 7% this year. A group of Ivorian cashew exporters has taken advantage of this opportunity to drive up raw cashew prices. In just one month, the price of raw cashews increased by $400 per ton, an unprecedented fluctuation in the decades they have participated in the cashew industry.

Enterprises reported that foreign partners have many “tricks” to “trouble” domestic enterprises. One tactic is to deliver goods without providing the necessary documents for customs clearance. Moreover, some exporters quietly break their agreements, selling raw cashews contracted to one enterprise to another at a much higher price.

Vinacas stated that it would create a blacklist of unreliable raw cashew suppliers to warn the entire industry. For those West African businesses that fail to deliver goods, legal action will be taken through international courts to resolve the dispute and enforce the delivery of containers to Vietnamese businesses.