According to Clause 5, Article 49 of the Law on Credit Institutions of 2024 and the information provided by the shareholder, on July 30, 2024, ACB announced information about shareholders owning 1% or more of the bank’s charter capital.

|

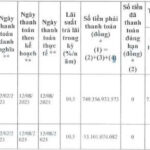

List of shareholders owning 1% or more of the bank’s charter capital

Source: ACB

|

The list of shareholders shows that ACB has 2 individual shareholders who are also insiders of the bank. They are Mr. Tran Hung Huy – Chairman of the Board of Directors of ACB and Mrs. Dang Thu Thuy – Member of the Board of Directors of ACB. Mrs. Thuy is also the mother of Chairman Tran Hung Huy.

Mr. Huy currently owns more than 153 million ACB shares, holding more than 3.4% of the capital here. Meanwhile, Mr. Huy’s mother owns more than 53 million shares, equivalent to a nearly 1.2% ownership stake in the bank.

In addition, a person related to Mr. Huy holds more than 367 million shares, equivalent to 8.22% of the charter capital.

According to the semi-annual management report for 2024, parties related to Chairman Tran Hung Huy‘s family include 3 companies and 6 individuals.

Specifically, Giang Sen Commercial Investment Joint Stock Company (holding 2.07% capital), Van Mon Commercial Investment Joint Stock Company (owning 1.14% capital), Bach Thanh Commercial Investment Joint Stock Company (holding 1.44%), Ms. Dang Thu Ha – Deputy Director of ACB Ho Chi Minh City Branch (owning 1.19%), Mr. Dang Phu Vinh – Director of ACB Block (holding 0.42%), Ms. Dang Thi Thu Van – Director of PGD Go Vap (holding 0.03%), Mr. Dang Van Phu (holding 0.01%), Ms. Pham Thi Huong (holding 0.02%) and Ms. Nguyen Thi Huynh Mai owns 320 ACB shares.

Thus, Chairman Tran Hung Huy and related parties hold a total of nearly 12% of the capital at the bank, while the ownership ratio of shareholders and related parties according to the new regulations is a maximum of 15%.

In terms of organizational groups, SMALLCAP World Fund, Inc. (a US investment fund) holds 2.51% of the bank’s shares. Boardwalk South Limited holds more than 1.84% and VOF PE Holding 5 Limted (under VinaCapital) holds nearly 1.72%. Prudential Vietnam Assurance Private Limited holds nearly 1.56% and a related party of this insurance company holds 0.008%.

Previously, Boardwalk South Limited was one of the four foreign investors (Estes Investments Limited, Sather Gate Investments Limited, Whistler Investments Limited, and Boardwalk South Limited) who received a transfer of more than 154 million ACB shares from the UK bank Standard Chartered in late January 2018.

Standard Chartered Bank was once a strategic shareholder of ACB from July 2005. The above transfer concluded the 12-year relationship between Standard Chartered and ACB.

The year 2024 also marked a change in the ownership of ACB‘s foreign shareholders when Whistler Investments Limited sold 145 million ACB shares in a matched transaction on March 22, with a value of more than VND 4,000 billion, reducing its ownership in the bank from 194 million shares (a rate of 4.99%) to 49 million shares (a rate of 1.26%).

After the transaction of Whistler Investments, the ownership of the group of foreign investors decreased to nearly 243 million ACB shares, accounting for 6.25% of the bank’s capital. It is known that this investment fund is related to the CVC Asia Pacific fund (Singapore), where Mr. Vo Van Hiep – Member of the Board of Directors of ACB is the Executive Director.

In addition to Whistler Investments Limited’s divestment, Dragon Capital also reported that it was no longer a major shareholder of ACB after selling more than 2 million ACB shares on April 2, reducing the ownership ratio of the whole group to 4.96%, equivalent to 192.8 million shares.

Bank introduces a series of incentives to boost export-import businesses from the beginning of the year

ACB is rolling out attractive service packages to help businesses optimize costs and enhance operational efficiency in international trade from the beginning of 2024.