## Petrolimex’s Business Performance in Q2 2024

|

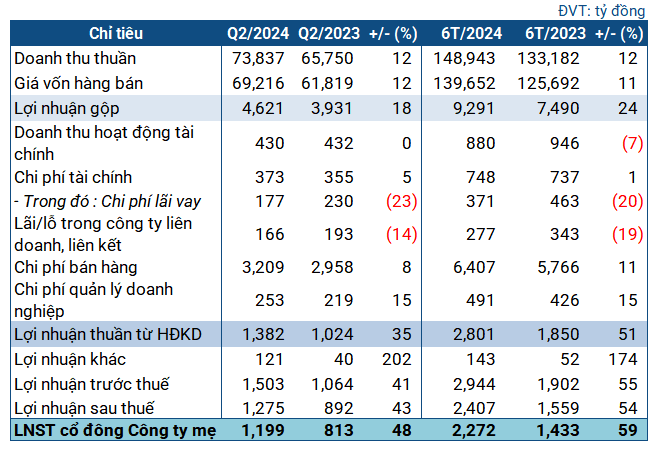

Petrolimex’s Financial Highlights for Q2 2024

Source: VietstockFinance

|

In Q2, PLX witnessed a 12% year-on-year increase in revenue, reaching nearly VND 74,000 billion. After deducting cost of goods sold, the company’s gross profit amounted to over VND 4,600 billion, an 18% increase compared to the same period last year.

Regarding other financial metrics, financial expenses rose by 5% to VND 373 billion, despite a 23% reduction in interest expenses. Selling expenses increased by 8% to more than VND 3,200 billion, and administrative expenses rose by 15% to VND 253 billion. Notably, Petrolimex recorded VND 121 billion in other income, triple the amount from the previous year.

Finally, the company’s net profit amounted to nearly VND 1,200 billion, representing a significant 48% year-on-year increase.

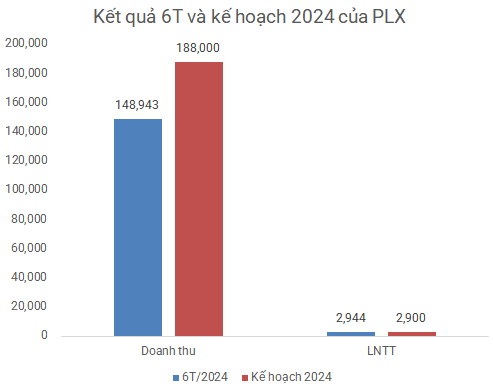

For the first six months of the year, PLX achieved nearly VND 149,000 billion in revenue, a 12% increase compared to the same period last year, with a net profit of nearly VND 2,300 billion, a substantial 59% rise. In relation to the annual plan, the company has accomplished 79% of its revenue target and surpassed the pre-tax profit goal by 1.5%, as approved by the 2024 Annual General Meeting of Shareholders.

Source: VietstockFinance

|

As of the end of June, Petrolimex’s total assets were valued at nearly VND 74,000 billion, a 7% decrease from the beginning of the year, representing a reduction of approximately VND 6,000 billion. Of this, nearly VND 53,400 billion were current assets, a 7% decline. This included over VND 26,700 billion in cash and bank deposits, a decrease of about 12%. Inventories showed a slight increase, reaching over VND 15,000 billion.

At this point, the company held approximately VND 6.7 billion in principal value of trading securities and incurred a loss of roughly VND 2 billion.

On the other side of the balance sheet, short-term borrowings totaled VND 44,700 billion, a 10% reduction compared to the start of the year. The company maintained a relatively strong financial health with a current ratio of approximately 1.19. While the quick ratio stood at 0.86, the nature of inventories in the oil and gas industry makes this less of a concern.

The majority of PLX’s debt comprised short-term borrowings, amounting to VND 17,000 billion, a 10% decrease from the beginning of the year. Long-term borrowings totaled VND 596 billion, an 8% drop.

Looking ahead, according to VietCap, the approval by the Ministry of Industry and Trade to increase the standard cost for each liter of gasoline and diesel on July 4th (from VND 60 to VND 140 and VND 1,140, respectively) could lead to higher fuel prices. This adjustment has the potential to enhance PLX’s ability to cover its actual business expenses. Additionally, the company is expected to benefit in the long term from expanding its distribution of aviation fuel when the Long Thanh International Airport (LTA) commences operations.

At the 2024 Annual General Meeting, PLX shared its plans to supply aviation fuel to airlines at LTA as part of its 2020-2030 business strategy. The aviation fuel distribution segment has contributed, on average, about 10% to PLX’s profits during the 2019-2023 period through its subsidiary, Petrolimex Aviation, which is 59% owned by PLX. Furthermore, during a recent investor meeting, PV OIL acknowledged that entering the aviation fuel business is challenging, as it is dominated by Skypec and Petrolimex Aviation, underscoring PLX’s competitive position in this line of business.

Chau An