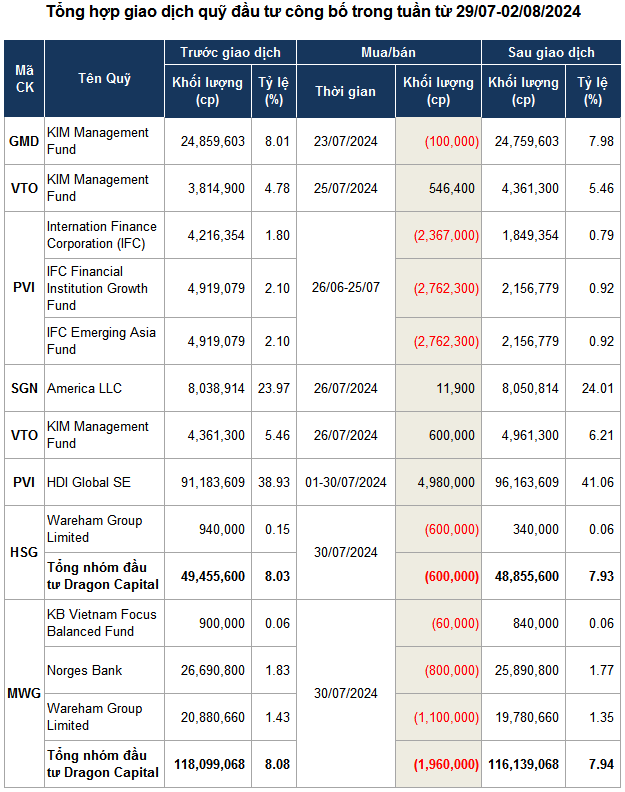

Dragon Capital, a foreign investment fund, has been actively trading shares of Mobile World Investment Corporation (MWG) in recent weeks.

On July 19, the fund sold 1.05 million MWG shares, reducing its holdings to 116.87 million shares (7.99%). However, on July 22, Dragon Capital purchased 182,000 MWG shares, increasing its stake in the company to over 117 million shares, or 8% of MWG.

The fund’s trading activity continued on July 30, as it sold a total of 1.96 million MWG shares, once again lowering its ownership below the 8% threshold to just over 116 million shares.

Between July 19 and July 30, Dragon Capital sold nearly 1.8 million MWG shares, resulting in a net profit of approximately VND 115 billion.

| Price movement of MWG shares from the beginning of 2023 to August 2, 2024 |

Dragon Capital’s frequent changes in trading direction can be interpreted as a strategy to “lock in profits” on MWG shares. This comes as the share price has been on a steady rise since mid-April 2024, reaching a one-year high before facing corrective pressure. As of the market close on August 2, MWG shares traded at VND 62,900 per share, a 6% decrease from its peak of VND 67,000 on July 8. Nevertheless, compared to the beginning of the year, MWG shares are still up by more than 49%.

| Price movement of HSG shares from the beginning of 2023 to August 2, 2024 |

Following a similar selling strategy, Dragon Capital also offloaded 600,000 shares of HSG (Hoa Sen Group Joint Stock Company) on July 30, reducing its ownership in the steel company below the 8% threshold to nearly 49 million shares.

At the close of the trading session, HSG shares were priced at VND 22,900 each. Based on this price, the fund is estimated to have earned nearly VND 14 billion from the sale of its steel industry holdings.

Source: VietstockFinance

|