Indirect investment (FII) will return in 12-18 months

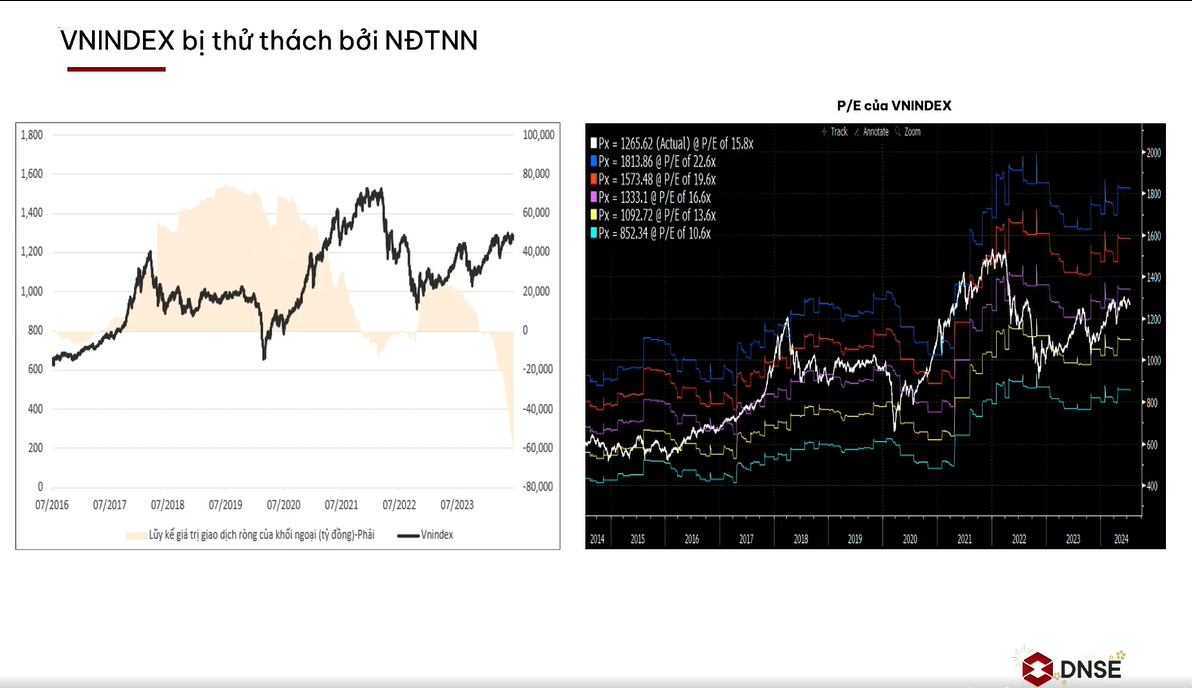

A hot topic discussed by experts is foreign investor capital. In the first six months, foreign investors net sold over VND 60 trillion in the stock market. The question is, when will they come back?

Mr. Cao Minh Hoang – Director of Hanoi High-end Clients, DNSE Securities Joint Stock Company assessed that in the past decade, direct investment (FDI) in Vietnam has been very strong. Samsung entered Vietnam in 2007 and poured more capital in 2013. According to historical data, when FDI increases, indirect investment (FII) will follow two years later. This development is cyclical.

Currently, FDI continues to grow but is cyclical. The long-term FDI growth trend remains robust. Mr. Hoang assessed that the net selling of FII on the secondary trading floor is only temporary.

Looking back at 2017-2019, foreign investors net bought VND 70 trillion and then also sold during the COVID period, the Index surged from 600 to 1,500 points. The recent net selling phase of foreign investors is nothing new.

The market’s internal strength is still very positive. The economy is doing well, growing, and macroeconomic indicators such as GDP and inflation are favorable. Confidence in the government’s management remains high. The VN-Index liquidity is much higher than 2-3 years ago. Investors are more mature, with many algorithmic research companies participating, demonstrating high knowledge and discipline. Unlike 2021, when there were many new individual investors, currently, these investors have become more experienced and disciplined. The current high differentiation reflects the market’s professionalism.

|

VN-Index valuation and foreign investor net selling

Source: DNSE

|

Although foreign investors have been net sellers, the market is still developing. Mr. Hoang assessed that when FDI continues to grow, FII will return. This could happen in the next 12-18 months when the Fed’s interest rate peaks and begins to decline. At that time, indirect investment will flow into markets with appropriate valuations.

Looking back at the past decade, from 2014 to the present, there have been many years when valuations were very high, such as in 2017, when the VN-Index’s PE reached 23 times. Conversely, there were also pessimistic periods, such as during the COVID pandemic and the Van Thinh Phat case, when valuations were low. Currently, valuations are quite attractive.

Which sectors are worth paying attention to?

According to Mr. Hoang, at the current valuation, investors can allocate capital but should choose companies with a growth rate of at least 20% per year. Alternatively, they can wait for lower valuations to buy, but this may require a long wait. Therefore, investors can divide their capital into two parts: one for immediate investment in good companies and the other for investment when valuations are lower. If they wait, it could take 2-4 years.

At the moment, investors can consider the following sectors: First, banks, which are expected to perform well. Second, port and maritime transport companies. When the economies of major countries are on par, there may be geopolitical developments that disrupt supply, causing freight rates to rise. Third, public investment companies. In addition, there is the oil and gas group, which has a large workload in the next 3-4 years. However, investing in this group requires recognizing that this is a challenging period, and results will only show in 1-3 years.

Additionally, Mr. Ho Si Hoa – Director of Investment Consulting and Research, DNSE Securities Joint Stock Company suggested the industrial real estate and insurance sectors. Industrial real estate benefits from the continued inflow of FDI into Vietnam. The insurance sector is currently undervalued, with many companies trading at PB around VND 1, and rising interest rates in the last six months are expected to support this sector.

Vietnam Economy 2024: Reaching New Heights

Vietnam has set a target to achieve an economic growth rate of 6-6.5% in 2024 – the Year of the Dragon. Our goal is within reach when compared to the growth forecasts of reputable global economic organizations such as the International Monetary Fund (IMF), the World Bank (WB), and the Asian Development Bank (ADB). Just like a cable car system, Vietnam’s economy has only one direction – moving forward, aiming for even greater heights.