According to IFC’s trading results report, from June 26 to July 25, foreign shareholders sold nearly 2.4 million shares out of the registered 3 million, falling short by 633,000 shares. IFC attributed the reason for not selling all the registered PVI shares to “unfavorable market conditions.”

| PVI Share Price Movement from the Beginning of 2024 to August 01 |

Based on PVI’s closing price on July 25, IFC could have potentially raised approximately VND 122 billion by reducing its ownership in PVI from 1.8% (4.2 million shares) to 0.79% (1.8 million shares).

Previously, IFC and its two member funds, IFC Financial Institutions Growth Fund and IFC Emerging Asia Fund, registered to sell 3 million PVI shares. Thus, the IFC group intended to offload a total of 9 million PVI shares during the period from June 26 to July 25.

Following the IFC group’s registration to divest, on July 23, HDI Global SE purchased 1.98 million PVI shares out of the registered 7 million shares.

On July 23, PVI recorded a matched transaction with a volume equivalent to the fund’s trading volume. The transaction value was nearly VND 96 billion, corresponding to VND 48,400 per share. PVI closed at VND 53,700 per share on that day.

After the transaction, HDI Global SE’s ownership in PVI increased from 40.21% (94.2 million shares) to 41.05% (96.2 million shares), maintaining its position as the largest shareholder of PVI.

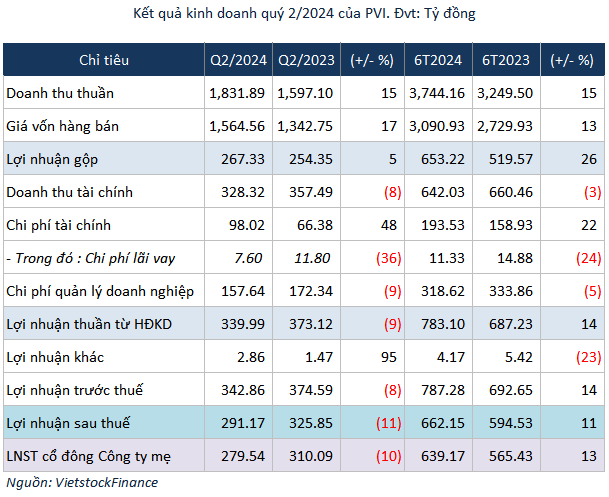

Regarding PVI’s business results, in the second quarter of 2024, the insurance company recorded a net profit of nearly VND 280 billion, a 10% decrease compared to the same period last year.

The main reason for this decline was a twofold increase in reinsurance cession expenses, a 91% rise in insurance compensation costs, and a 21% drop in financial income. The financial revenue mainly comprised interest income from bank deposits.

In the first half of 2024, PVI attained a net profit of over VND 639 billion, a 13% increase compared to the same period last year. This growth was attributed to a 26% surge in profit from insurance operations, surpassing VND 653 billion.

Compared to the target of VND 1,080 billion in pre-tax profit, PVI accomplished 73% of its profit goal in the first half of the year.

As of June 30, 2024, PVI’s total assets exceeded VND 31,545 billion, reflecting a 17% increase from the beginning of the year. The company held over VND 10,800 billion in bank deposits, marking a rise of nearly VND 1,400 billion, or 15%, compared to the start of the year.

PVI’s liabilities grew faster than its total assets, increasing by 21% to nearly VND 22,825 billion and accounting for 72% of the total capital sources. Short-term reinsurance reserves constituted the primary component of these liabilities, amounting to nearly VND 16,175 billion, a 14% increase.

Notably, compared to the beginning of the year, the company incurred new short-term financial debt of nearly VND 935 billion.

Khang Di