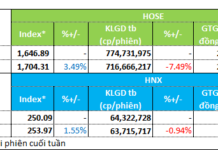

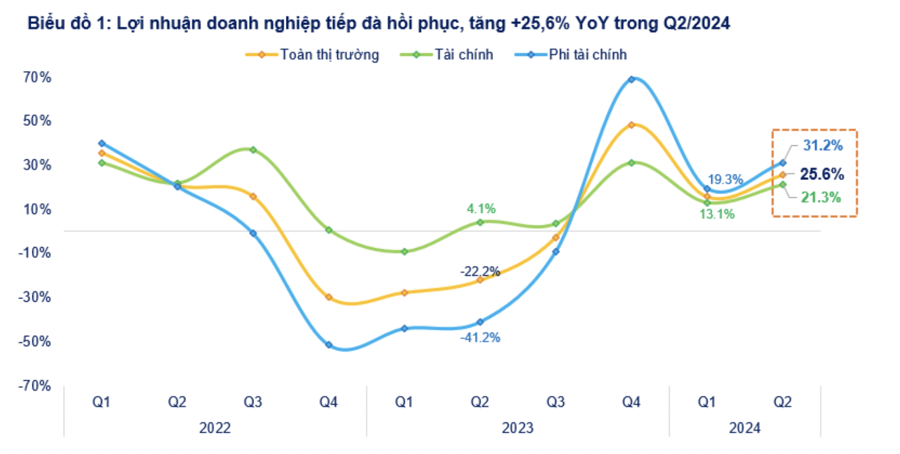

As of July 31, 2024, 986 enterprises representing 96% of the total market capitalization on HOSE, HNX, and UPCoM have announced their financial reports for Q2 2024.

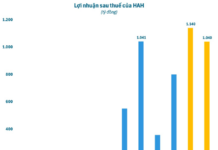

The Q2 2024 after-tax profit of the whole market increased by 25.6% compared to the same period in 2023 and increased by 12.8% compared to Q1 2024, higher than the growth rate achieved in the previous Q1 (+15.7% year-on-year and +0.04% quarter-on-quarter). This indicates that corporate profits are recovering from the low base established in Q3 2023.

The Finance group achieved a profit increase of 21.3%, with Banking up by 21.9%, Insurance by 12.5%, and Securities by 10.9%.

For the Banking sector, industry-wide growth was driven by top private banks in terms of charter capital (MBB, VPB, TCB), while state-owned joint-stock commercial banks (VCB, CTG, BID) recorded lower growth than the overall industry average.

Specifically, MBB reported pre-tax profits of 7,633 billion VND, up 23% year-on-year. In the first six months, the bank’s profit reached 13,428 billion VND, a 5% increase.

VPB reported post-tax consolidated profits of 3,632 billion VND in Q2, a 48% increase year-on-year. The bank’s standalone post-tax profit was 2,885 billion VND, a decrease of 4.60%.

Techcombank (TCB) recorded a Q2 2024 pre-tax profit of 8,122 billion VND, a 59% increase year-on-year. Meanwhile, the Q2 2024 consolidated pre-tax profit was 7,827 billion VND, a 38.5% increase year-on-year. This was also Techcombank’s highest-ever quarterly profit.

Meanwhile, Vietcombank’s Q2 2024 consolidated financial report showed a decline in all business activities. However, thanks to a 40% reduction in provision expenses, the bank recorded a pre-tax profit of 10,116 billion VND, a 9% increase year-on-year.

In the first six months of the year, VCB’s pre-tax profit was nearly 20,835 billion VND, a slight increase of 2% year-on-year, thanks to a 34% reduction in provision expenses (amounting to 3,021 billion VND)

CTG’s pre-tax profit was nearly 6,750 billion VND, a modest 3% increase year-on-year due to higher credit risk provision expenses. For the first six months, the bank’s pre-tax profit exceeded 12,960 billion VND, a 3% increase compared to the same period last year.

BIDV reported a pre-tax profit of nearly 8,159 billion VND, a 17% increase year-on-year, thanks to significant growth in non-interest income. For the first six months, BIDV’s pre-tax profit was nearly 15,549 billion VND, a 12% increase.

The Non-Financial group contributed significantly to the overall market’s profit growth in the last quarter. One of the main reasons for this surge was a low comparative base in the same period last year, as seen in the Steel, Construction, Telecommunications, Gas, Fertilizer, Garment, and consumer-dependent industries (including Retail, Dairy, and Beer).

In the Steel group, HPG reported net revenue of 39,556 billion VND, a 34% increase year-on-year. Net profit reached nearly 3,320 billion VND, a 127% increase year-on-year. In the first six months, Hoa Phat recorded 71,029 billion VND in revenue and 6,189 billion VND in post-tax profit.

Hoa Sen reported net revenue of 10,840 billion VND, a 25% increase year-on-year. Post-tax profit for Q2 2024 was 273 billion VND, 19 times higher than the same period last year. This significant growth was largely due to the low comparative base in the same period last year when the steel industry was in decline.

In the Retail group, according to the Q2 2024 consolidated financial report, VNM’s net revenue reached 16,655 billion VND, surpassing the previous peak of 16,194 billion VND in Q3 2021 to become the highest-revenue quarter. VNM reported a post-tax profit of 2,671 billion VND, a 20% increase year-on-year.

MWG also reported a 67-fold increase in profit in Q2, with a net profit of 1,200 billion VND.

In the jewelry sector, Phu Nhuan Jewelry Joint Stock Company (PNJ) reported Q2 2024 net revenue and post-tax profit of 9,518 billion VND and 428 billion VND, respectively, increases of 43% and 27% year-on-year.

Similarly, according to the recently published Q2 2024 financial report, MSN recorded net revenue of 20,134 billion VND, an increase of over 8% compared to 18,609 billion VND in Q2 2023, thanks to positive performance in its core retail consumer business segments. Post-tax profit after allocation to minority shareholders was 503 billion VND, a nearly 379% increase and higher than the 2023 full-year result of 419 billion VND.

In the Construction group, Coteccons (CTD) achieved net revenue of 21,045 billion VND, a 31% increase, and net profit of over 299 billion VND, 4.4 times higher than the same period last year. With these results, CTD has exceeded its full-year plan.

In the Telecommunications group, VGI reported a post-tax profit of 1,214 billion VND in Q2, an increase of 2,433 billion VND year-on-year.

Additionally, significant financial income from project or subsidiary sales in many residential real estate businesses (NVL, DXG, DIG) also supported the overall growth of the Non-Financial group.

NVL’s net revenue in Q2 reached 1,549 billion VND, and financial income increased significantly to nearly 4,000 billion VND. As a result, the company reported a pre-tax profit of 1,573 billion VND, while in the same period last year, it recorded a loss of 289 billion VND.

DIG reported a net revenue of 821 billion VND in the period, a 407-fold increase, and a post-tax profit of 125 billion VND, a 1,281-fold increase, thanks to the transfer of CSSI project apartments, transfer of unfinished houses in the Dai Phuoc project, and transfer of unfinished houses in the Hau Giang project.

In contrast, profits in some sectors continued to decline year-on-year, including Electricity, Oil and Gas Production, and Chemicals, while Oil and Gas Equipment and Services, Water, Industrial Real Estate, and Livestock unexpectedly saw profits reverse from growth in Q1 to decline in Q2.