A large and intense sell-off occurred this afternoon, with pressure on many large-cap stocks pushing the VNI below the 1240 mark at one point before buying interest emerged to lift it back up. While there are still many declining stocks, the recovery effect in many stocks is quite impressive.

Liquidity seems to have improved as the recent gains were quite choppy, and short-term accumulated stocks had to be released by Thursday. The total matched volume of the two exchanges increased by 19% compared to yesterday to nearly VND13,600 billion. This volume is still not large, but at least it helps determine the “firmness” of the bottom-fishers.

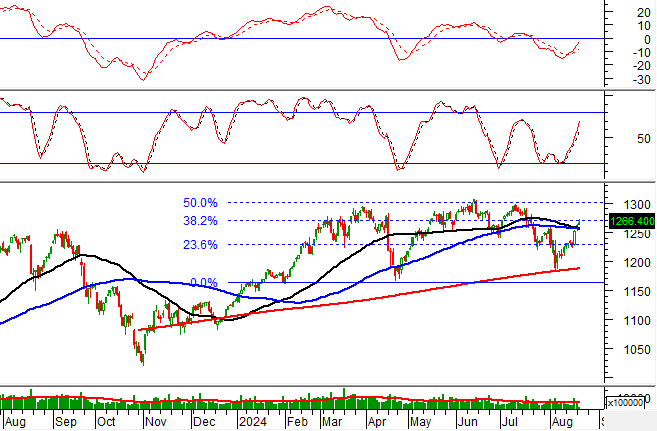

The market has been recovering amid high skepticism in recent days. Is this a technical bounce within a short-term downtrend, or has the market really bottomed out? The crowd always has contrasting opinions, and speculation is often subjective. It’s best to let the market send out signals. The fluctuations, like this afternoon, are a phase for the market to reveal its outlook.

The range of the four recent gains is not large, but it still brings good profits from a T+ surfing perspective. Surfers and lucky ones usually take profits the easiest. The higher the skepticism, the more easily a decline creates psychological pressure. Therefore, the time when the market falls will cause the most psychological polarization, prompting the most decisive action.

In general, this selling has not yet resulted in a large volume of stocks being dumped, but it is also partly because the previous bottom-fishing volume was small. Cash flow into bottom-fishing when prices fall is also limited, but the effect of pushing prices up is good. That’s a positive sign as supply and demand can easily balance.

In fact, whether the VNI breaks below 1240 at this point is not that important. Many stocks have already formed a stable foundation earlier. The strong sell-off this afternoon did not cause the stocks to fall deeply, and some even rose or remained unchanged, which is a signal of strength, regardless of whether it is due to small selling or strong buying. When the market is at its weakest, it is also when it is easiest to observe its strength.

The view remains that the market does not have significant negative factors supporting a deep correction. The index may still be affected by large-caps, but specific stocks are not. Therefore, the deep falls due to large-cap fluctuations are good buying opportunities. If you are more agile, you can trade with reduced capital, or else just hold and continue to accumulate.

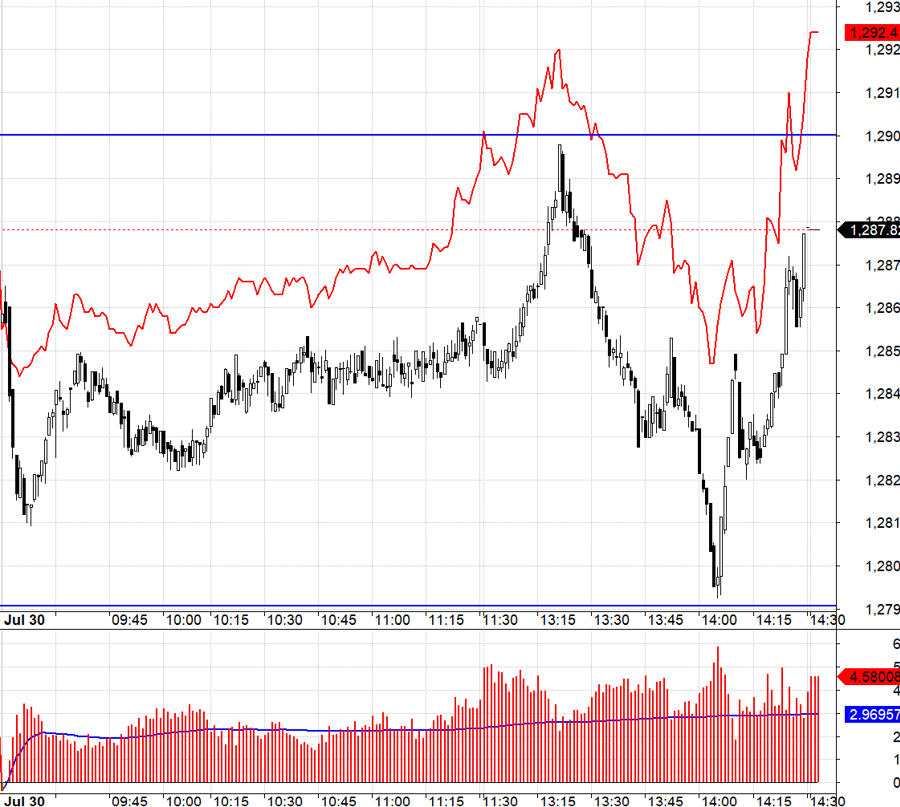

The futures market fluctuated strongly today but was tricky. First, the basis accepted a wide spread, second, VN30 fluctuated widely from 1279.xx to 1290.xx and did not have a standard setup to go Long or Short. Third, the fall from the peak of 1290.xx to the standard of 1279.xx was too fast and unexpected, so it could only be chased downwards, plus the basis remained widely positive, limiting profit margins despite the strong decline in VN30. The bounce from 1279.xx is easier, but the basis is still negative.

The ability to maintain a wide positive basis throughout the session, especially during the rapid decline, indicates that the futures market strongly believes in the “recovery door” of the underlying market. Cash flow into bottom-fishing is also good and pushes prices up. The opportunity to increase continues. The strategy is to wait for a chance to go Long.

VN30 closed today at 1287.82. The nearest resistance levels for tomorrow are 1290; 1298; 1308; 1316; 1319. Supports are at 1279; 1274; 1267; 1260.

“Stock Market Blog” is a personal blog and does not represent the views of VnEconomy. The opinions and assessments are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment opinions.