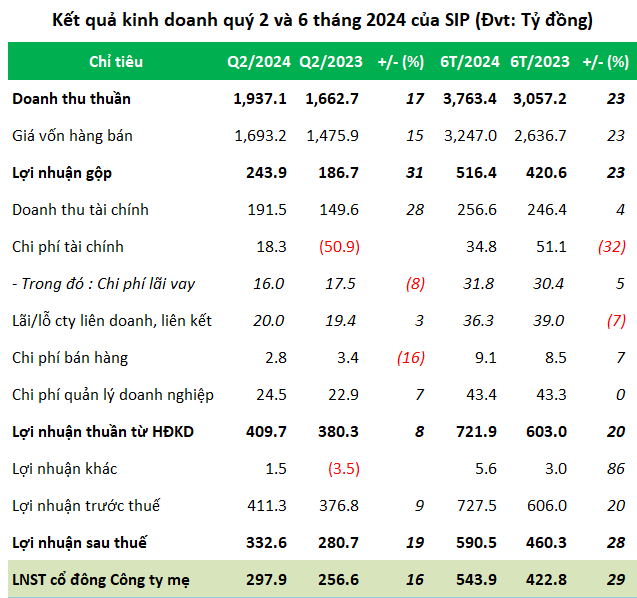

In Q2, SIP recorded net revenue of over VND 1,937 billion and a net profit of nearly VND 298 billion, up 17% and 16% year-on-year, respectively.

Explaining these results, SIP attributed the increase in revenue from industrial park (IP) utility services and gains from the sale of investments as the main drivers of the company’s profit growth.

Source: VietstockFinance

|

For the first six months of the year, SIP reported net revenue of over VND 3,763 billion, a 23% increase, and a net profit of nearly VND 544 billion, up 29% compared to the same period in 2023.

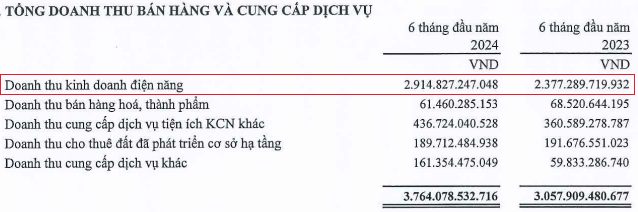

SIP is one of the few IP companies licensed by the Ministry of Industry and Trade to build a 110kV transformer station to directly distribute electricity to tenants in the IP. Thus, the main contributor to its revenue in the first half of the year was the electricity business, which recorded nearly VND 2,915 billion, a 23% increase, and accounted for 77% of total revenue. This was followed by the IP utility services segment, which generated nearly VND 437 billion, a 21% increase, and contributed 12% to total revenue.

Source: SIP

|

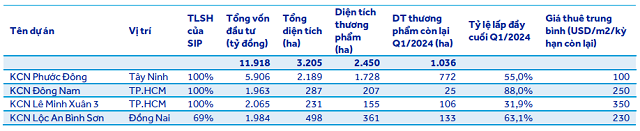

As the owner of Phuoc Dong IP in Tay Ninh, SIP set its 2024 plan with consolidated revenue of nearly VND 5,388 billion and after-tax profit of nearly VND 793 billion, representing decreases of 30% and 21%, respectively, compared to the actual figures in 2023. Thus, SIP has already achieved three-quarters of its annual targets for both revenue and profit in just the first half of the year.

Currently, SIP has over 1,000 hectares of commercial area available for lease across four IPs in Tay Ninh, Ho Chi Minh City, and Dong Nai. The company also plans to lease out 47 hectares of IP land and 4.3 hectares of factory area in 2024, with the majority located in Phuoc Dong IP.

Source: ABCS

|

Nearly one-fifth of its assets are bank deposits

As of Q2 2024, SIP‘s total assets exceeded VND 20,312 billion, an 11% increase from the beginning of the year. Of this, over VND 4,200 billion was in bank deposits, accounting for 18% of total capital sources.

Inventories stood at VND 383 billion, down 18% from the start of the year, with over half comprising production and business costs for ongoing projects such as the Dong Nam residential area at over VND 58 billion, the Ben San resettlement area at VND 83 billion, and the Thuan Loi residential area at over VND 100 billion.

Additionally, SIP‘s construction-in-progress costs increased by 9% from the beginning of the year to over VND 2,470 billion. The majority of this amount was attributed to the Phuoc Dong Boi Loi IP-Urban-Service Area development project with over VND 1,229 billion, the Le Minh Xuan 3 IP project with over VND 677 billion, and the Loc An – Binh Son IP project with over VND 225 billion.

On the liabilities side, SIP had VND 18,928 billion in payables, an 11% increase from the beginning of the year. Financial borrowings increased by 81% to over VND 3,043 billion, accounting for 16% of total debt.

Notably, SIP‘s unearned revenue stood at VND 11,868 billion, representing 63% of total liabilities and 51% of total assets.

SIP to issue over 27 million shares as 2023 dividend payment

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.