The stock market witnessed significant volatility during the week’s final trading session, following a deep decline. The VN-Index plummeted more than 16 points at one point before staging a remarkable comeback, surging nearly 10 points (equivalent to 0.79%) to reach 1,236 points. However, liquidity somewhat contracted, with the trading value on HOSE surpassing just over VND16,300 billion. Foreign investors’ net buying was a positive factor, as they net bought nearly VND 800 billion in the entire market.

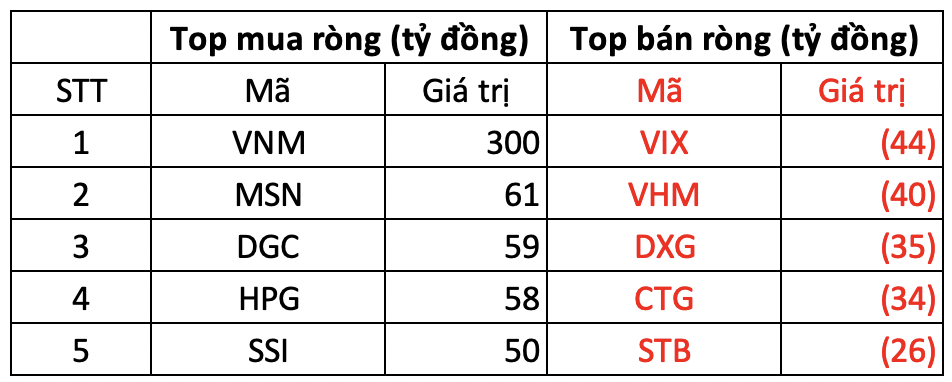

On HOSE, foreign investors net bought VND 743 billion.

In the buying column, VNM shares were the focal point of foreign investors’ net buying, with a value of VND 300 billion. Following closely, MSN and DGC were the next two codes added to their portfolio, with net purchases of VND 61 billion and VND 59 billion, respectively. Additionally, DGC and HPG also witnessed net buying of VND 59 billion and VND 58 billion.

On the opposite end, VIX faced the most intense selling pressure from foreign investors, offloading nearly VND 44 billion worth of shares. VHM and DXG also experienced net selling of VND 40 billion and VND 35 billion, respectively.

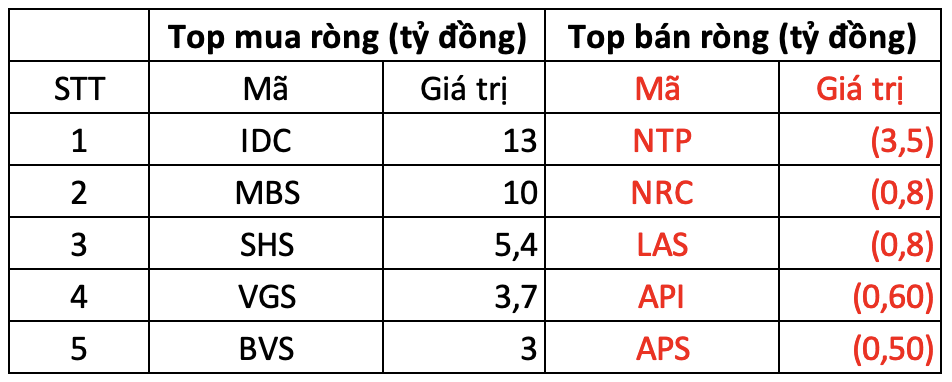

On HNX, foreign investors net bought VND 39 billion

In terms of net buying on the HNX, IDC topped the list with a net purchase value of VND 13 billion. Meanwhile, MBS secured the second spot, with foreign investors net buying VND 10 billion worth of shares. Additionally, they also invested a few billion dong in net buying SHS, VGS, and BVS.

Contrarily, NTP faced net selling pressure from foreign investors, offloading nearly VND 3.5 billion worth of shares. This was followed by NRC, LAS, and API, which witnessed net selling of a few hundred million dong.

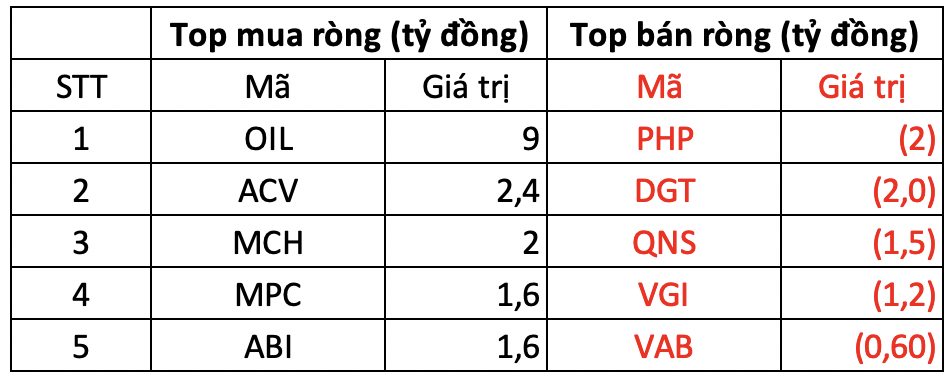

On UPCOM, foreign investors net bought VND 11 billion

On the selling side, PHP was net sold by foreign investors for nearly VND 2 billion. Additionally, they also net sold DGT, QNS, and a few other stocks.