Individuals holding more than 1% are all related to Chairman Ho Hung Anh and his wife.

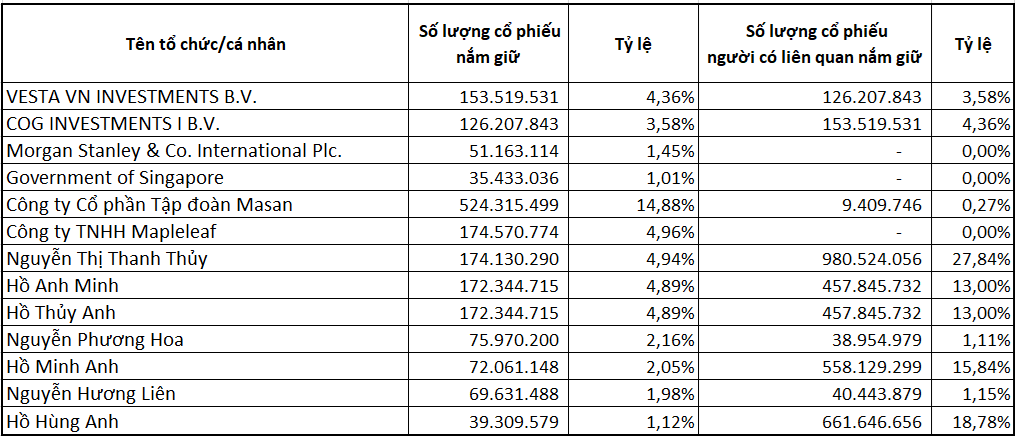

Specifically, Mr. Ho Hung Anh, Chairman of Techcombank, holds 39.31 million shares, equivalent to over 1.1% of the charter capital. Relatives of Mr. Ho Hung Anh own 661.6 million shares, or 18.78%.

Meanwhile, Mrs. Nguyen Thi Thanh Thuy – Mr. Hung Anh’s wife, holds the most shares with 174 million, or 4.943% of the bank’s capital. Mrs. Thuy is currently the Chairman of One Mount Group Joint Stock Company and Viet Thanh – Sai Dong Limited Liability Company.

A group of related individuals of Mrs. Thuy also owns 27.8% of the bank, equivalent to over 980 million TCB shares. In total, nearly 33% of Techcombank’s capital is owned by a group of shareholders related to Mrs. Thuy.

The couple’s two children, Ho Anh Minh and Ho Thuy Anh, each hold nearly 4.9% of the capital, while the other child, Ho Minh Anh, owns over 2%.

Mr. Ho Hung Anh, Chairman of Techcombank.

In addition, the list also discloses 6 organizations holding over 1% of the bank’s capital. Notably, Masan Group Joint Stock Company holds the most shares with over 524 million, equivalent to 14.88% of the bank’s capital. Including related parties, this group’s ownership stands at 15.15% of the charter capital.

Four foreign funds, including the Government of Singapore Investment Fund, own over 1%; Morgan Stanley & Co. International Plc holds 1.45%; COG Investment I B.V and related parties hold 7.9%; and Vesta VN Investments B.V and related parties hold 7.9%.

Furthermore, an organization specializing in education and study abroad consulting, Mapleleaf Company Limited, owns 4.96% of the bank’s capital.

According to the Law on Credit Institutions effective from July 1, banks are required to disclose information about shareholders owning more than 1% of the bank’s charter capital. The amended Law on Credit Institutions also reduces the ownership limit for institutional shareholders (including indirect ownership) from 15% to 10%.

Many businesses pay cash dividends immediately after Tet

After the Lunar New Year in 2024, many companies listed on the stock market will distribute dividends to investors. The banking sector stands out with its generous cash dividend payment.