IFRS Financial Reporting Standards: An Inevitable Shift

Financial statements are designed to monitor, support analysis, and report on a company’s business performance. The purpose of this report is to examine the use of resources, cash flow, business efficiency, and the current financial status of the enterprise. This helps leaders and investors make sound decisions regarding enterprise management.

Adopting the International Financial Reporting Standards (IFRS) is an inevitable trend, especially for large-scale Vietnamese enterprises. IFRS is becoming a universal accounting “language” widely applied globally, bringing numerous benefits to businesses, investors, and regulatory authorities.

IFRS also opens up opportunities to access international capital markets. For instance, to be listed on foreign stock exchanges, a minimum requirement is for enterprises to have financial statements prepared and presented according to international standards, including IFRS.

Moreover, IFRS-compliant financial statements demonstrate transparency and integrity, enhancing investors’ and lenders’ confidence and reducing their risks. This contributes to establishing an effective monitoring tool that meets the economic management requirements of government agencies, promoting economic development, and global integration.

International Financial Reporting Standards IFRS: The Time is Now

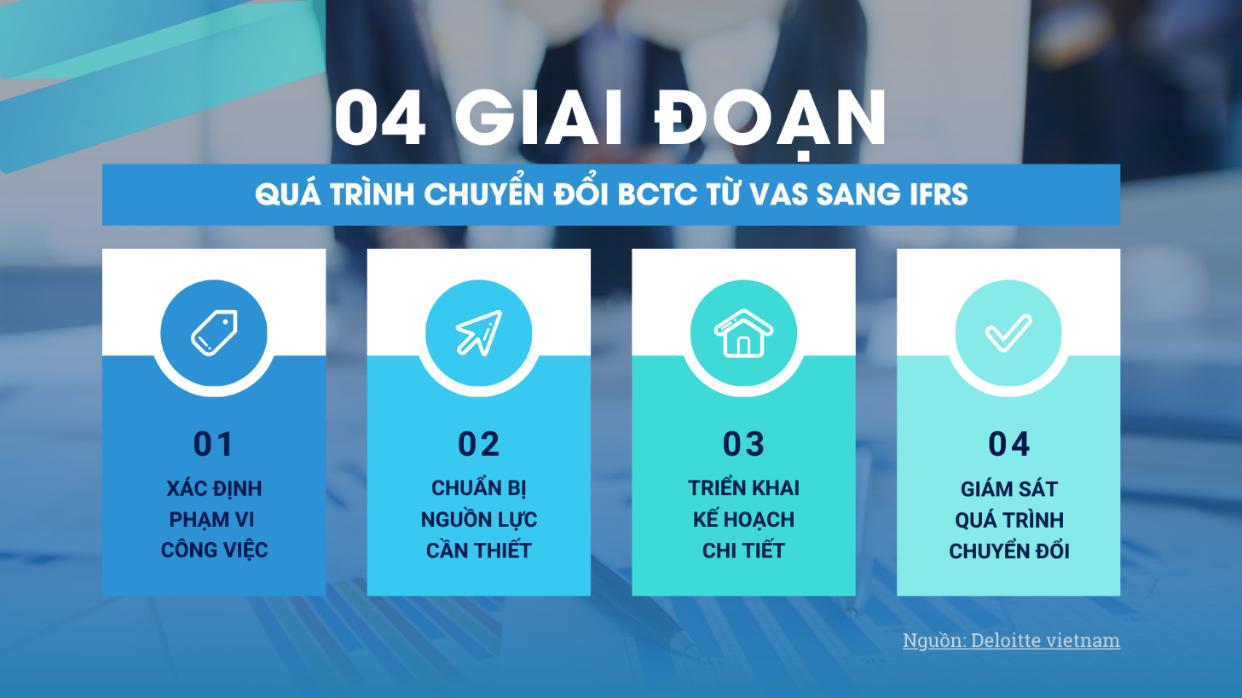

According to Deloitte Vietnam’s publication on converting VAS standards to IFRS, enterprises need to go through four stages to complete the IFRS transition: defining the scope of work, preparing necessary resources, implementing the plan, and monitoring the conversion process.

The four stages of the IFRS conversion process

Currently, most enterprises have been preparing the necessary resources for this transition. This involves not only training financial accounting personnel but also requiring careful preparation from the leadership and coordination from related departments.

In addition to human resources, enterprises have also proactively sought and applied technological solutions. To compile and establish financial statements according to IFRS, enterprises must have a system that can connect information and accounting books and automatically convert data according to current accounting standards.

These are the two most time-consuming aspects of the four-stage IFRS conversion process. However, once enterprises are ready with their resources, the stages of detailed implementation and monitoring of the conversion process will be more time-efficient and cost-effective.

Solution to Increase Efficiency in Consolidating IFRS-compliant Financial Statements

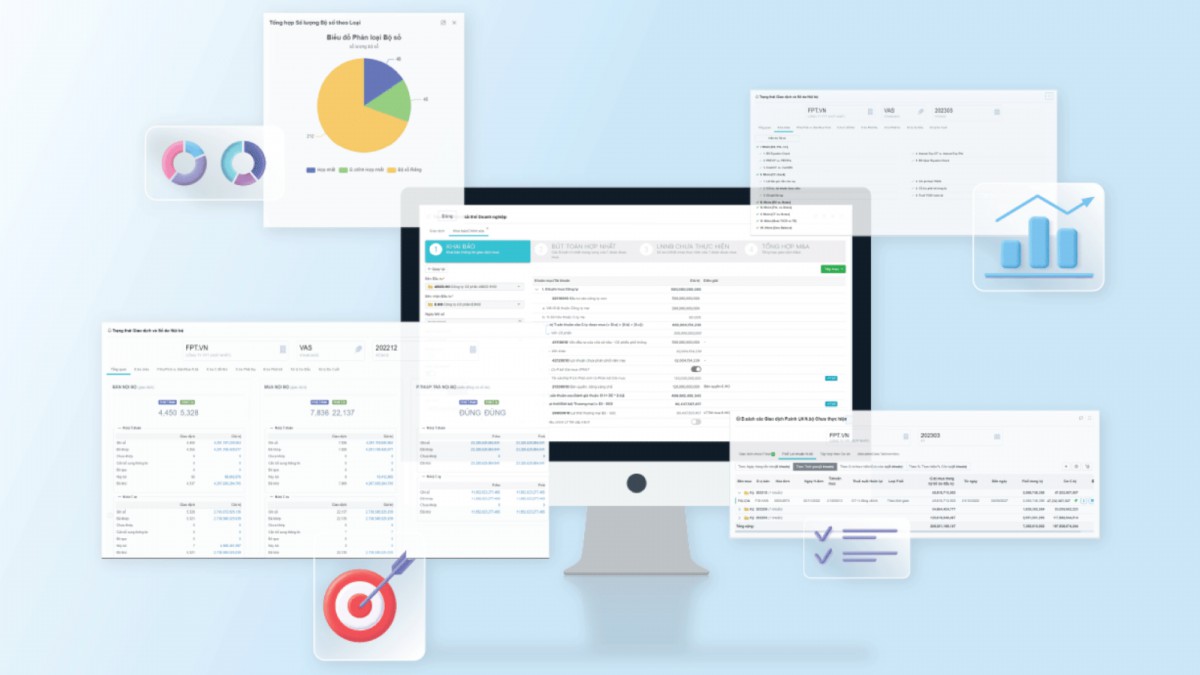

VAS figures and reports are not entirely compatible with IFRS due to differences in accounting principles, recognition methods, and information presentation in financial statements. To address this, enterprises can use tools that automate the adjustment of VAS data and support the transition to IFRS. The comprehensive financial statement consolidation solution, FPT CFS, allows data integration from multiple sources, ensuring accuracy in VAS-compliant financial reporting, managing related information, evaluating and recognizing discrepancies, and tracking and allocating differences according to IFRS standards. Users only need to declare parameters for calculation models, and FPT CFS will take care of the rest.

Additionally, FPT CFS helps enterprises simplify the accounting process, increase automation in preparing and consolidating financial statements by up to 99%, and reduce reporting time by 80%, thereby improving report issuance time by at least 60% compared to the previous average.

With FPT’s technological capabilities, the solution also provides real-time data and reports, enabling leaders to monitor, control, and gain profound insights into the enterprise’s financial health. This leads to better financial management decisions and frees up specialized resources to focus on the enterprise’s strategic financial tasks.

FPT CFS Solution for Consolidated Financial Statement “Revolution”