Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, provided an insightful analysis of the resilience of the Vietnamese stock market.

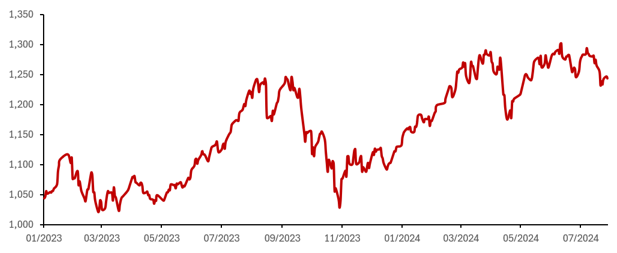

The VN-Index has risen by approximately 10% year-to-date, driven by expectations of nearly 19% earnings growth in 2024 and strong domestic investor buying, contrasting with heavy foreign selling. The recovery in corporate profits, rebounding from a 5% decline last year to an expected 19% growth this year, is supported by Vietnam’s GDP growth accelerating from 5.1% in 2023 to an anticipated 6.5% this year.

Domestic investors’ enthusiasm for stocks stems from deposit rates in Vietnam remaining below 5% – even for 12-month term deposits – and the real estate market remaining somewhat frozen, making the stock market and gold attractive investment avenues for domestic investors.

|

VN-Index Performance

|

Individual investors, who account for the majority of trading volume in Vietnam, averaging 90% of daily value traded this year, have offset the $2.4 billion worth of stocks sold by foreign investors year-to-date (following $1 billion of net selling last year). Foreign selling has been driven primarily by profit-taking and concerns about the Vietnamese dong’s (VND) depreciation of around 4% year-to-date, with some foreign investors adopting a “wait-and-see” approach.

A quarter of the foreign investor sell-off occurred through ETF outflows, including the liquidation of Blackrock iShares’ Frontier ETF in June (foreign investor net selling hit a record high in June partly due to this ETF liquidation). Following the foreign sell-off, foreign ownership ratios in the Vietnamese stock market have dropped to their lowest levels in a decade.

However, the selling streak related to the liquidation of Blackrock iShares’ Frontier ETF has ended. According to VinaCapital, some foreign investors have taken advantage of this to increase their long-term strategic investments in Vietnam.

Positive Outlook for the Second Half of 2024 and 2025

VinaCapital expects earnings growth to accelerate from 9% year-on-year in the first half of 2024 to 33% year-on-year in the second half, partly due to the recovery in the domestic real estate market. VinaCapital has reported that the Vietnamese real estate market started to recover in December 2023, and this process has gained significant momentum since then. Real estate transactions are estimated to have increased by around 40% year-on-year in the first half of 2024 (up from 25% year-on-year in the first quarter) due to pent-up demand and recent government policies to revive the market.

As a result, VinaCapital anticipates an 80% increase in profits for real estate developers, excluding Vinhomes (which will be discussed below), this year. Moreover, a healthy real estate market will support bank profit growth by boosting credit growth and easing concerns about asset quality/credit costs. Finally, the recovery of Vietnam’s real estate sector is likely to further accelerate next year, contributing to VinaCapital’s expectation of a further 17% increase in VN-Index earnings in 2025.

|

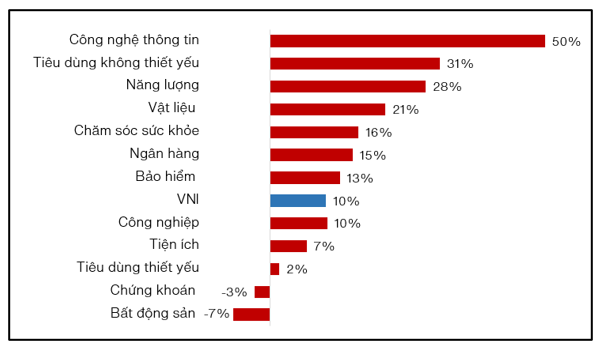

Stock Price Performance by Sector (Year-to-Date)

|

The performance divergence across sectors is a hallmark of the Vietnamese stock market, presenting ample opportunities for active fund managers to outperform the broader market. For instance, funds with a higher allocation to the Information Technology sector have benefited from the global allure of AI-related stocks.

Stock prices in the Non-Essential Consumer sector have also risen this year, with profits expected to surge by 55% in 2024, following a 42% decline last year. This recovery stems from extremely weak domestic consumption (excluding foreign tourists) in 2023 (due to a sluggish real estate market and FDI factory layoffs impacting Vietnamese consumer spending). Domestic consumption has rebounded this year.

Similar dynamics explain the performance divergence in other sectors.

Risks and Non-Risks

The Vietnamese dong (VND) has depreciated by around 4% year-to-date, leading the State Bank of Vietnam (SBV) to sell an estimated over $6 billion in foreign exchange reserves this year to stabilize the exchange rate. While a strong US dollar has been a key factor influencing the value of the VND, a stronger dollar is currently not advantageous for the US government for various reasons. Therefore, the US Treasury has employed “Active Treasury Management” and other tools to prevent the dollar from strengthening further. As a result, the likelihood of further VND depreciation has diminished, even though Vietnam’s foreign exchange reserves are now lower than the typical minimum reasonable level of three months of imports.

Moreover, the Vietnamese government’s policies will remain focused on attracting FDI and boosting economic growth. These policies have been consistent over the past 25 years, and VinaCapital believes this will continue for many years to come.