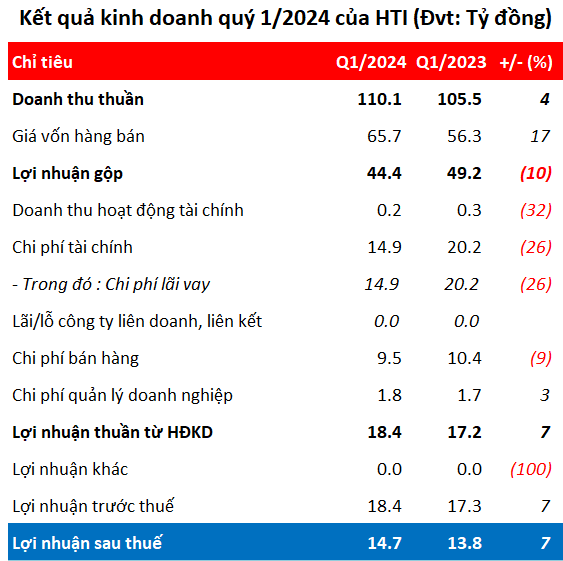

Novaland, a leading real estate company in Vietnam, has announced its financial results for the second quarter of 2024, reporting a net profit of 941 billion VND, a significant improvement from the 634 billion VND loss in the previous year. This marks the highest profit for the company in the last nine quarters, despite a modest revenue of over 1,549 billion VND.

The primary reason for Novaland’s impressive profit this quarter is attributed to its financial investment activities. Specifically, the company’s financial revenue reached 3,951 billion VND, more than five times higher than the same period last year. This increase is mainly due to profits from investment cooperation contracts, amounting to 2,885 billion VND.

During this quarter, many real estate businesses reported profits from project transfers and divestments from subsidiary companies. However, Novaland’s situation differs as the company unexpectedly reported a loss from one such divestment. Without this loss, Novaland’s profits could have been even higher.

According to Novaland’s Q2 2024 financial statements, the company completed the transfer of its investment in Huynh Gia Huy Joint Stock Company at a transfer price of only 1.9 billion VND. This transfer price excludes the value of utility assets and existing debt obligations.

Novaland recorded a loss of 797 billion VND due to the difference between the total transfer value and the book value of net assets. This amount has been included in the consolidated statement of comprehensive income.

According to our research, in Novaland’s 2023 annual report, Huynh Gia Huy Joint Stock Company had a charter capital of 725 billion VND, with Novaland holding 99.8% of the charter capital before the divestment. The company is known as the investor of NovaHills Mui Ne in Phan Thiet and mainly operates in the tourism real estate sector.

NovaHills Mui Ne Resort & Villas

Huynh Gia Huy was established in 2005, with a charter capital of 6 billion VND as recorded in its business registration in 2017. Thus, after 7 years, the company’s charter capital has increased by 121 times.

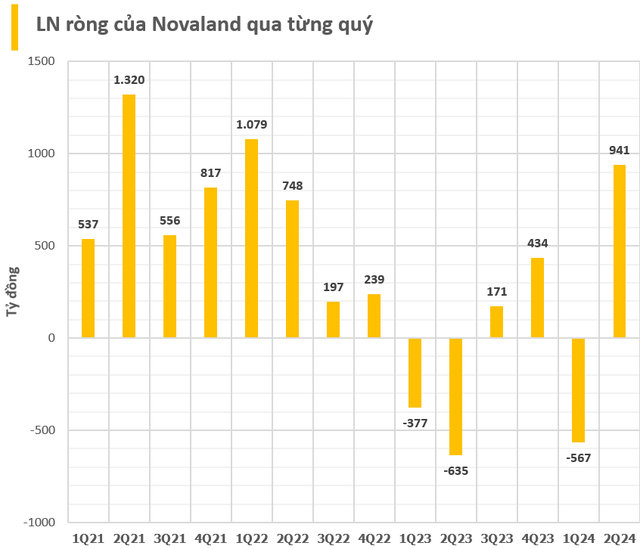

Huynh Gia Huy became a subsidiary of Novaland in 2019, as a result of Novaland’s billion-dollar negotiations in 2018. At that time, Novaland spent 383.5 billion VND to acquire 99.98% of Huynh Gia Huy’s charter capital, including benefits from owner’s equity.

The business consolidation of Huynh Gia Huy into Novaland in 2019 resulted in an increase of more than 784 billion VND in total assets for Novaland (including nearly 590 billion VND in inventory and 173 billion VND in short-term receivables…). The consolidation also added over 129 billion VND to Novaland’s debt. Therefore, the net asset value acquired was 655 billion VND.

Subtracting the purchase price, this transaction brought Novaland a profit of 271 billion VND from the bargain purchase. After being a subsidiary of Novaland for 5 years, on the day of its departure, Novaland sold it for 2 billion VND along with a loss of 797 billion VND.

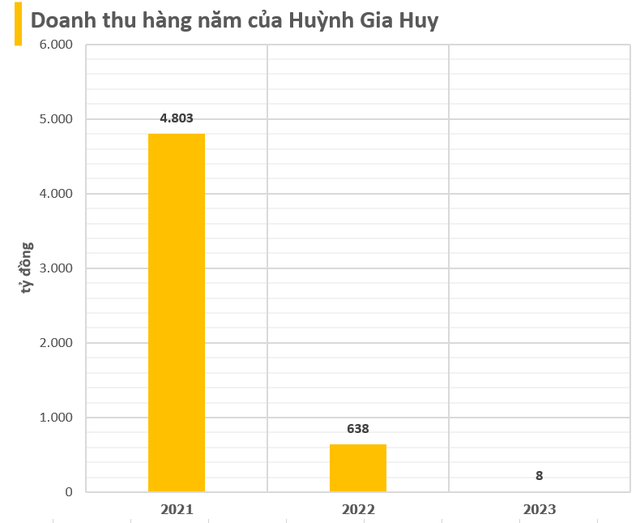

According to Novaland’s annual report, Huynh Gia Huy contributed only 8 billion VND in revenue in 2023. In the past, the company had achieved nearly 5,000 billion VND in revenue.

NEW BOARD OF MEMBERS AT HUYNH GIA HUY JSC

According to the latest business registration of Huynh Gia Huy Joint Stock Company, its legal representatives include Mr. Le Dinh Tuan, Chairman of the Board of Directors, and Ms. Nguyen Nhu Xuan Trang, General Director.

Mr. Le Dinh Tuan is currently known as a member of the Board of Directors and Vice President of Everland Corporation (EVG). He is also the younger brother of Mr. Le Dinh Vinh, the younger brother of the Chairman of the Board of Directors of Everland.

Everland, established in 2009, focuses on three core areas: Real Estate, Construction, and Trade – Services. Real estate is the dominant field with numerous projects and works implemented nationwide. The company is also known for its investment in projects such as Crystal Holidays Harbour Van Don (Quang Ninh), Everland Park Hill Golf & Residences (Thanh Hoa), the Ly Son Cultural Heritage Tourism Complex (Quang Ngai), the Crystal Holidays Marina Phu Yen Tourism and Resort Complex, and the Everland Park Entertainment and Resort Complex in Khanh Hoa…

Crystal Holidays Harbour Van Don by Everland

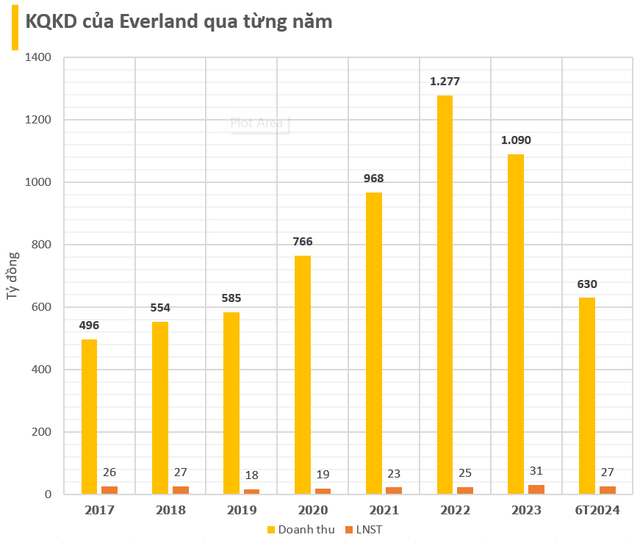

Everland consistently generates hundreds of billions of VND in revenue and tens of billions of VND in profit annually. For example, in the first half of 2024, the company recorded 629 billion VND in revenue and nearly 27 billion VND in net profit.

Regarding NovaHills Mui Ne, the project has a scale of nearly 40,000 m2 and includes approximately 600 detached villas and 17 shophouses, catering to the tourism and resort needs of domestic and international customers. The project was started in 2018 and completed in 2022.