According to information from the Ministry of Industry and Trade, on August 2, 2024, the US Department of Commerce issued a conclusion that, despite recognizing positive changes in Vietnam’s economy in recent times, it still does not acknowledge Vietnam as a market economy country.

This means that Vietnamese exporters to the US market will continue to face discrimination in anti-dumping and countervailing duty investigations, and their actual production costs will not be recognized. Instead, a “surrogate value” from a third country will be used to calculate the dumping margin.

The Ministry of Industry and Trade stated that in the future, it will study and analyze the arguments in the US Department of Commerce’s report on Vietnam’s economy. It will then supplement and improve its arguments before submitting a request for the US to reconsider Vietnam’s market economy status. This is to concretize the Vietnam-US Comprehensive Strategic Partnership and promote bilateral economic, trade, and investment cooperation, bringing practical benefits to businesses and people of both countries.

Previously, in its July 2024 report on export industries, PetroVietnam Securities (PSI) expressed its opinion on the upgrade to a “market economy” status. PSI assessed that the upgrade would bring significant advantages to Vietnamese exporting businesses by opening up opportunities for them to enhance trade activities with the US market and benefit from improved tax mechanisms.

However, PSI also stated that even without this upgrade decision, the securities firm maintains a positive outlook for Vietnamese exporters this year. This is because, under normal conditions, the US is still Vietnam’s largest export market.

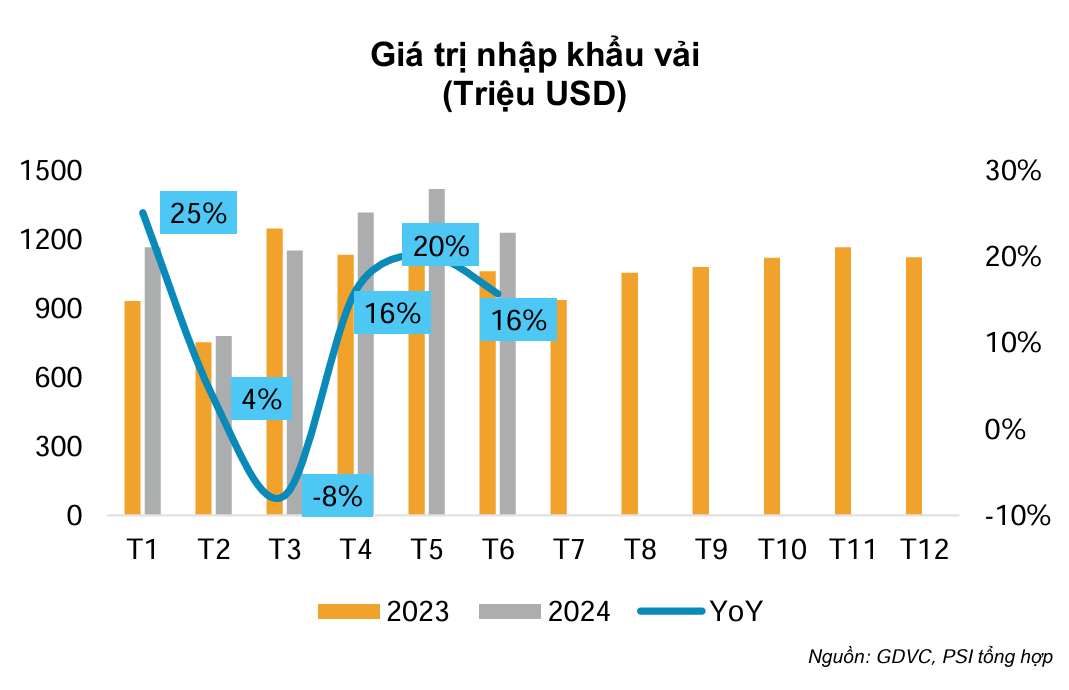

Assessing some export industries, PSI found that in the first six months of 2024, the export turnover of textile and garment products reached $16.2 billion, a 4.4% increase year-on-year. The US remained the main partner, with a turnover of $7.1 billion, a 2.5% increase year-on-year, accounting for 44.2% of the export structure. This recovery in textile and garment exports reflects easing inflation and a rebound in consumer spending. Orders for textile businesses in the first six months of 2024 were also more promising.

According to textile and garment enterprises, the industry is still recovering, despite weak demand. Some enterprises with diverse customer portfolios and strong ESG factors, such as TNG and Eclat Textile (a Taiwanese FDI enterprise), have orders secured until the beginning of the fourth quarter of 2024. Meanwhile, MSH plans to put the new Xuan Truong 2 factory into operation by the end of 2024, reflecting the enterprise’s confidence in the return of orders.

PSI expects orders to continue to be secured and increase in the second half of the year, as the peak shopping season approaches in major markets. Additionally, clothing inventory levels in the US are low, while clothing retail sales are on an upward trend as inflation cools.

However, PSI also noted that gross profit margins for textile and garment enterprises are unlikely to increase significantly due to rising labor costs, with minimum wages increasing by 6% from July 2024.

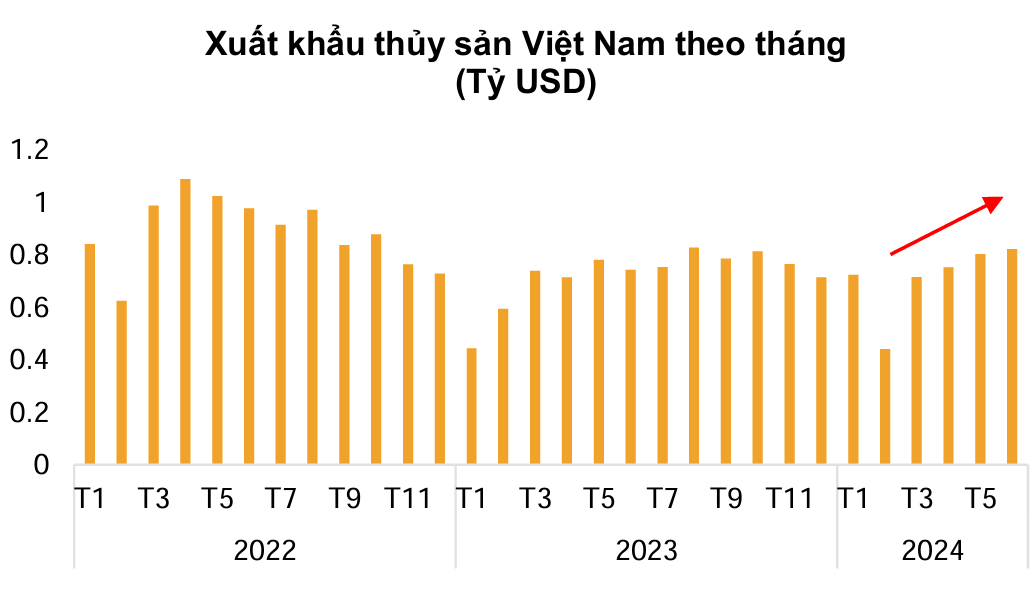

Regarding the seafood industry, in the first six months, seafood exports reached over $4.43 billion, a 6.8% increase compared to the same period last year.

PSI assessed that seafood inventory levels in foreign markets have decreased compared to the same period last year, and retailers will need to replenish their stocks before the year-end shopping season. Additionally, export prices of tra fish in markets such as the US, China, and the EU are expected to continue improving due to increasing demand. The consideration of upgrading Vietnam’s market economy status by the US in the coming time will also help remove tax barriers related to countervailing duties on Vietnamese shrimp exports, supporting the recovery of Vietnam’s shrimp industry.

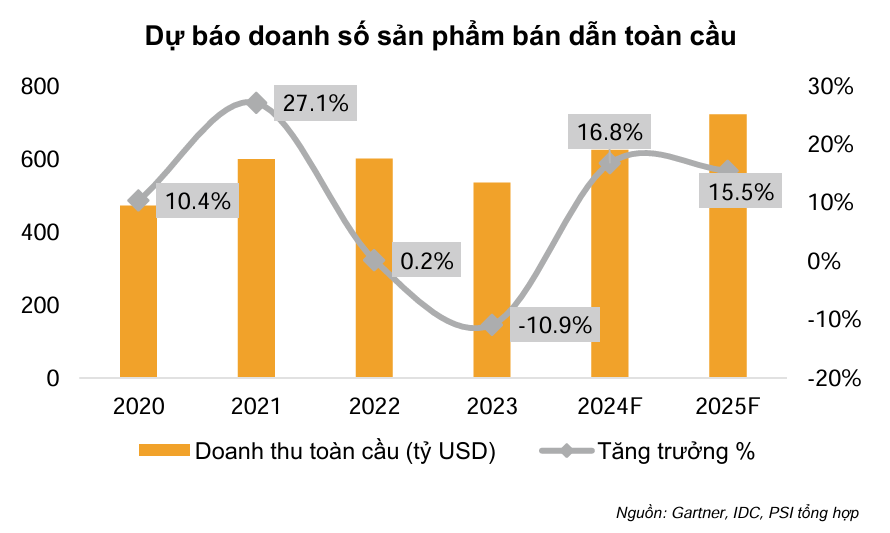

Moreover, PSI also expects the export turnover of Vietnam’s technology products to grow stronger in 2024-2025, with hopes for a reversal in the global technology product cycle.