The 2023 potato harvest fell short of expectations due to unfavorable weather conditions. Heavy rains caused waterlogging, making it difficult to harvest and reducing yield.

The situation was further exacerbated by the prolonged rainy season into early 2024, delaying potato planting. This is expected to result in a late and lower-than-average 2024 crop.

In Belgium, potatoes are a popular staple crop, cultivated on 100,000 hectares, equivalent to 150,000 football fields. This far exceeds domestic consumption needs. In recent years, Belgium has even become a world-leading exporter of processed products like potato crisps and frozen fries.

Jean-Pierre Van Puymbrouck, a potato producer in Tourinnes-Saint-Lambert, described the 2023 harvest as disastrous, with machinery unable to be used and farmers losing 10% of the crop. As a result, potato reserves have been depleted faster than usual.

This explains the surge in potato prices in June, reaching 600 euros/ton, triple the usual price. This price hike created a frenzy in the wholesale market for stored potatoes but did not immediately affect end consumers.

The rainy spring has delayed planting for the 2024 harvest. Mr. Jean-Pierre Van Puymbrouck shared that he was planting until the end of June, much later than usual. Consequently, the harvest season will be pushed back, and unless the summer brings perfect weather, the yield is likely to be lower than average.

Of course, Belgium is not the only potato-producing country. Traders can source from Germany, the Netherlands, or Northern France, but the weather conditions there are not any better than in Belgium.

The fresh potato market is expected to become increasingly tense in the coming weeks, affecting the price of potato packages in stores. “There could be an increase of 10 to 20%,” calculated Jean-Pierre Van Puymbrouck.

The rising price of fresh potatoes will also impact Belgium’s 4,500 fry shops. Mr. Bernard Lefèvre, President of the Fryers’ Federation (UNAFRI), stated that the impact would be less than that of packaged potatoes in stores because potatoes account for only about 10% of the cost of a bag of fries.

In the past two years, due to the conflict in Ukraine and inflation, the price of packaged fries has already increased by approximately 25%.

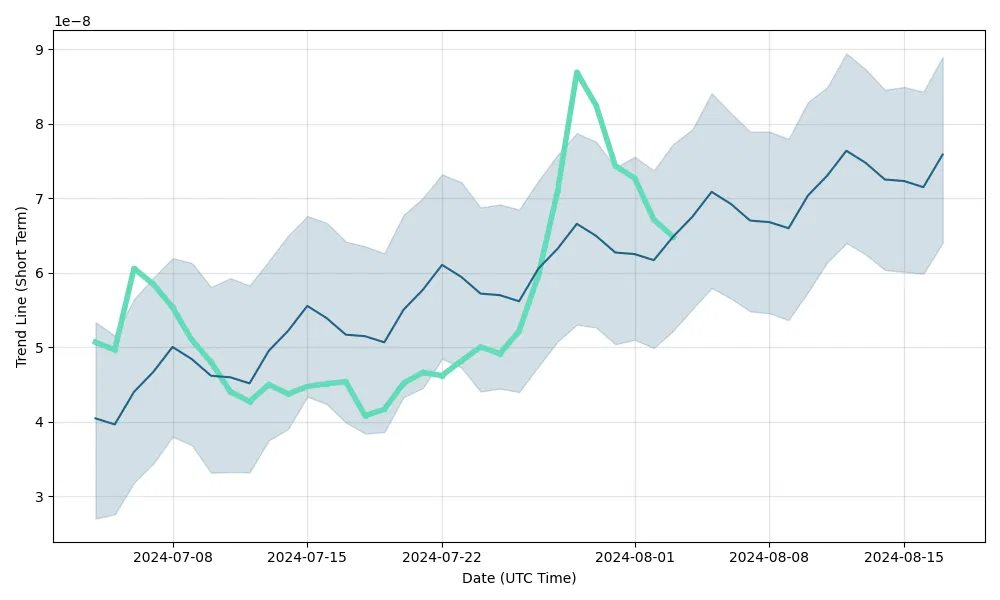

Short-term potato price forecast (Source: Walletinvester)

Europe is not the only continent facing soaring potato prices. Bangladesh, a country in Asia, is also experiencing a sharp rise in potato prices due to reduced production as farmers shift to more profitable crops and unfavorable weather conditions.

According to the Department of Agricultural Extension (DAE), the cultivable land in Bangladesh has decreased to its lowest level in seven years, from 464,000 hectares in the 2021-22 fiscal year to 455,000 hectares in the current fiscal year.

Data from the Bangladesh Trading Corporation (TCB) shows that the average potato price has increased by up to 15 Tk/kg, or 59.57%, in the last month. Notably, potato prices in the capital city of Dhaka have surged by 108.33% year-on-year, from around 16 Tk to 20 Tk/kg in May 2022.

In Egypt, potatoes are also a strategic crop and a staple food that Egyptians rely on, especially amid the country’s inflationary wave and low purchasing power due to the devaluation of the local currency for the fourth time.

According to the Ministry of Agriculture, potato exports, second only to citrus fruits, reached a record high of over one million tons in 2023.

The price increase in Egypt is due to higher demand than supply and may be influenced by the devastating effects of climate change on crops and the dollar shortage the country has experienced for over two years. This has impacted the import of potato seeds for the season ending June 30. The sudden price hike in the local market is expected to subside with the new season starting in November.

The yield per acre has decreased from 14-16 tons in 2023 to 9-12 tons in 2024, while the yield from locally available seeds is around 7-10 tons per acre.

As a result, the quantity of goods brought to the daily market has decreased by 35-40%, causing a supply shortage and driving up prices.

References: rtbf, ahram