The market is currently being heavily impacted by negative external information. Large-scale margin calls are being made domestically. A drastic drop sometimes hurts less.

The VNI breached the 1200 mark today, which was a psychological level and not the sole reason for the intense sell-off. Sentiment is largely influenced by negative news unrelated to the market’s internals, except for forced liquidations.

Today’s decline pushed all last week’s bottom fishers into a losing position. If they used margin to go “all in,” it’s a significant shock. Bottom fishing is inherently risky and must be carefully managed. Safety depends on the price range in which the stock fluctuates and its liquidity. Most importantly, control the allocation ratio during bottom fishing to have resources left for damage control.

Many stocks broke through their accumulation bottoms today, indicating that previous bottom-fishing attempts were wrong. Of course, it also depends on their ability to recover in the next 1-2 sessions, but stocks that show large selling volume at lower levels than their accumulated range are at higher risk of further declines as a new wave of panic selling may occur. Conversely, stocks that withstand today’s pressure, maintain their price floors, and exhibit low liquidity have a better chance of a swift recovery when the market turns around.

Fear is pervasive in the market, and there is no positive news strong enough to hold on to. Therefore, the only opportunity lies in self-stabilization, which may involve intense sell-offs. This is a good opportunity for cash flow preserved during this time. Under technical selling pressure and fear, index levels are no longer reliable; instead, observe the trading activity of potentially volatile stocks regarding margin and panic selling.

In this climate of heightened fear, loosely held stocks will undoubtedly be forced out. Good and bad stocks are now indistinguishable, and profitable businesses are losing value alike. Thus, it is advisable to accumulate stocks from a long-term perspective, using cash investments to improve short-term risk resilience.

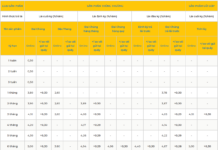

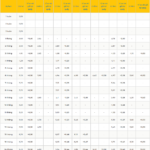

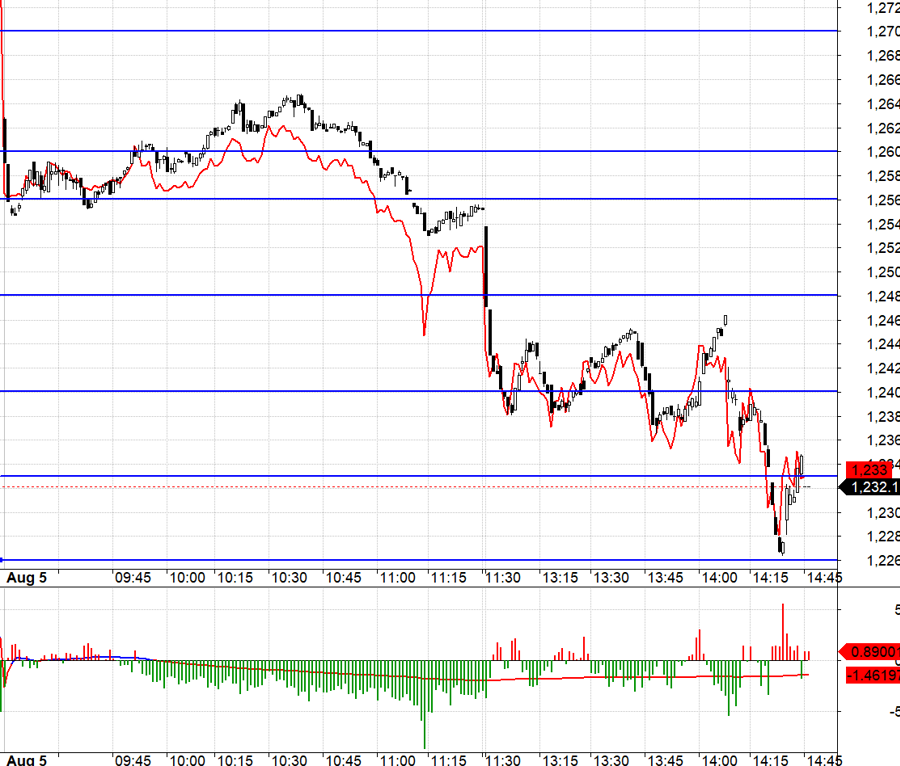

Defending with short positions in derivatives is another way to balance a fundamental portfolio if margin pressure is not an issue. Today, the F1 basis turned negative early, and liquidity increased by 33% from the previous session. VN30 spent most of the day in a “stuck” narrow range from 1256.xx to 1260.xx. Both above and below this range lie areas of wide-open ranges for long and short positions. Midway through the morning session, VN30 briefly surpassed 1260.xx, and F1 had a long setup, but the intraday rise lacked momentum and was ineffective. When the index broke below 1256.xx, the basis widened into a discount, and increased liquidity confirmed the start of strong short-selling pressure. VN30 consecutively broke through 1248.xx and 1240.xx. This range-opening momentum far exceeded expectations.

The intense selling pressure today pushed liquidity up, with a combined matching value of 22,8k billion VND on the two exchanges. The VNI is now approaching the April 2024 low and may find psychological support there, although forced liquidations are likely to break through this level again. The strategy is to look for buying opportunities in stocks and dynamically manage long and short positions in derivatives.

VN30 closed today at 1232.11. Tomorrow’s nearest resistances are 1233; 1241; 1248; 1256; 1260. Supports are at 1226; 1214; 1208; 1200; 1191.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments are solely those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.