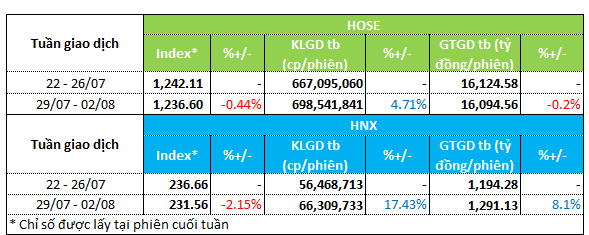

For the week of July 29 to August 2, the stock market witnessed its fourth consecutive weekly decline. The VN-Index fell by 0.4% to 1,236.6, while the HNX-Index dropped by 2.15% to 231.56.

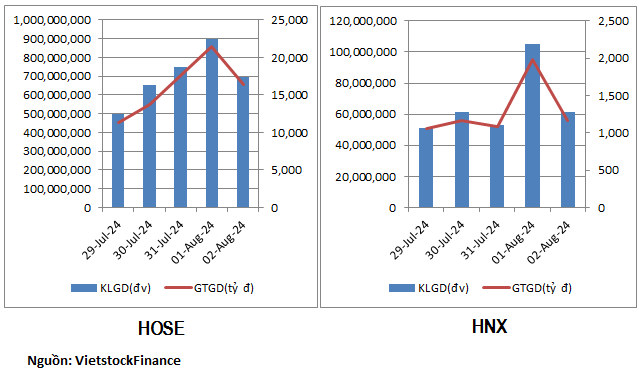

Market liquidity improved during this period. On the HOSE exchange, the average trading volume rose by nearly 5% to 698 million units per session, while the value traded remained relatively unchanged at VND 16.1 trillion per session.

On the Hanoi Stock Exchange, both volume and value traded improved. The average trading volume increased by over 17% to 66.3 million units per session, while the average value traded rose by 8% to nearly VND 1.3 trillion per session.

|

Market Liquidity Overview for the Week of July 29 to August 2

|

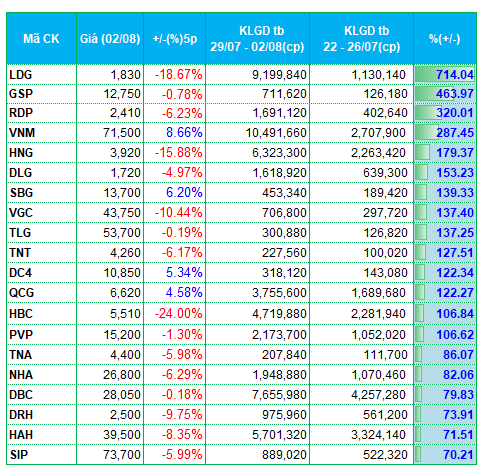

During this week, the HOSE exchange saw a significant surge in liquidity for several individual stocks. LDG topped the list, witnessing a more than 700% increase in trading volume compared to the previous week, reaching 9.2 million units per session. This stock experienced several volatile sessions in terms of liquidity throughout the week.

For instance, on July 30, the trading volume surpassed 25 million units, while on August 2, it stood at 9 million units. However, LDG’s share price plummeted by nearly 20% during this period, closing the week at VND 1,830 per share. Recently, LDG received a decision from the People’s Court of Dong Nai Province regarding the initiation of bankruptcy proceedings related to a disputed debt with Phuc Thuan Phat Construction and Trading JSC. In response, LDG has issued a statement asserting its solvency and ongoing negotiations with its partner.

According to the company’s second-quarter financial report, this real estate business incurred a net loss of nearly VND 300 billion in the first half of 2024. As of June 30, 2024, the accumulated loss amounted to VND 175 billion.

HNG continued to experience an increase in liquidity after receiving a decision for mandatory delisting. Its trading volume surged by nearly 180% to 6.3 million units per session, while the share price declined by approximately 16% during the week.

Within the real estate sector, several stocks attracted strong buying interest. In addition to LDG mentioned above, other stocks within this sector, including QCG, NHA, DRH, SIP, API, AAV, DTD, and IDJ, also witnessed an increase in liquidity during the week.

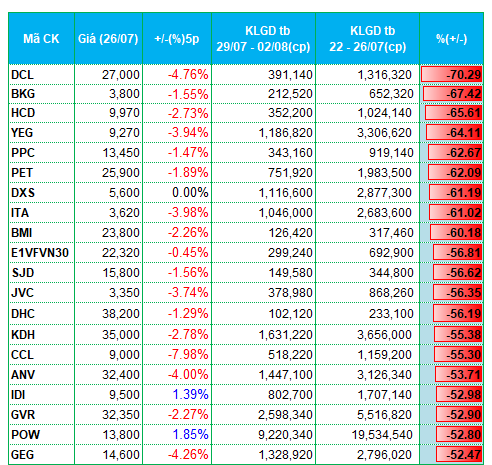

However, some real estate stocks experienced capital outflows, with DXS, ITA, KDH, CCL, PV2, VC3, and NRC witnessing significant declines in liquidity on both exchanges.

On the other hand, electric stocks witnessed substantial capital outflows, with PPC, SJD, POW, and GEG experiencing volume declines ranging from 50% to 65%.

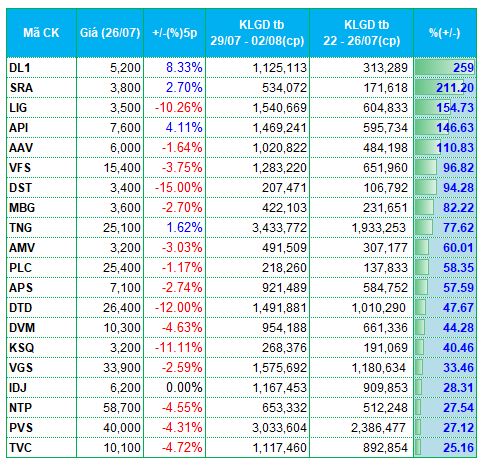

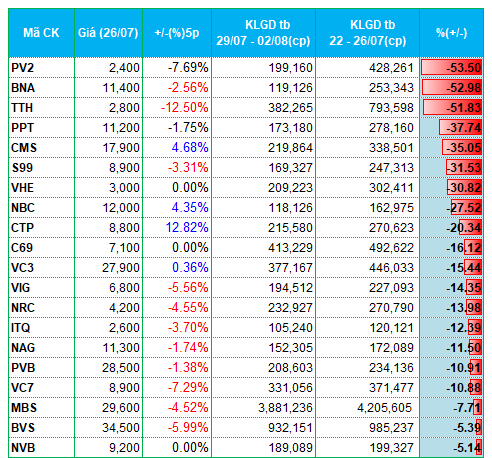

On the HNX exchange, certain construction and securities stocks witnessed weakened liquidity. Specifically, within the construction sector, CMS, S99, C69, and VC7 experienced reduced trading activity. Meanwhile, in the securities sector, VIG, MBS, and BVS saw a decline in liquidity.

|

Top 20 Stocks with the Highest Increase/Decrease in Liquidity on the HOSE Exchange

|

|

Top 20 Stocks with the Highest Increase/Decrease in Liquidity on the HNX Exchange

|

The list of stocks with the highest increase/decrease in liquidity is based on a minimum average trading volume of 100,000 units per session.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.