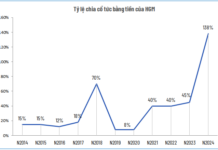

| KSV’s quarterly net profit performance from 2016 to the present |

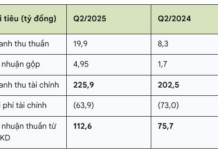

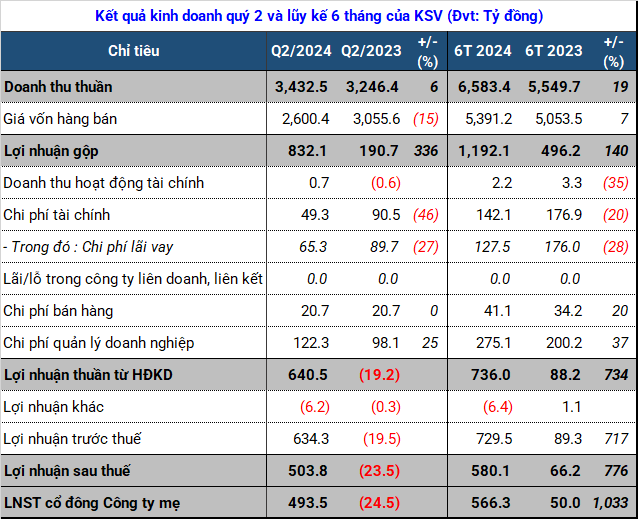

KSV’s second-quarter revenue remained flat year-over-year, reaching over VND 3.4 trillion, but gross profit surged by 336%, earning VND 832 billion. As a result, the gross profit margin soared from 5.9% to 24.2%. This significant improvement was mainly due to the substantial increase in the average selling prices of key products.

For instance, the selling price of gold during this period exceeded VND 1.6 billion per kg, marking a VND 351 million increase, equivalent to a 24% surge. Similarly, the selling price of copper sheets rose by 15% to VND 230 million per ton (an increase of VND 31 million per ton), while the selling price of silver climbed by 21% to VND 16.1 million per kg (a VND 2.8 million increase). Additionally, the selling price of manganese ore witnessed a remarkable 66% jump, reaching VND 1.5 million per ton (an increase of VND 0.6 million).

Another contributing factor to KSV’s performance was the reduction in interest expenses, which fell by 27% to VND 65 billion. Consequently, KSV achieved a record-high net profit of VND 493 billion, in contrast to a loss of VND 25 billion in the same period last year.

For the first six months, the mining enterprise posted a profit of VND 566 billion, a tenfold increase compared to the first half of the previous year. These outstanding results enabled KSV to surpass its full-year pre-tax profit plan by 243%. Revenue for the period reached VND 6.6 trillion, representing a 19% increase and putting the company well on track to achieve its annual target.

Source: VietstockFinance

|

As of June 2024, KSV’s total assets stood at nearly VND 10.5 trillion, reflecting an increase of over VND 1 trillion since the beginning of the year. Short-term assets accounted for half of this total, amounting to approximately VND 5 trillion, signifying a notable 43% rise.

A notable highlight during this period was the addition of VND 1 trillion in short-term receivables from customers, bringing the total to nearly VND 1.5 trillion. However, this amount was not elaborated upon in the disclosures. Inventories also witnessed a substantial increase, climbing by VND 596 billion to reach VND 2.9 trillion.

The company’s total liabilities amounted to VND 7.1 trillion, reflecting a VND 750 billion increase over the past six months. This rise was primarily driven by a significant jump in taxes and other payables to the State, along with short-term expenses, totaling VND 847 billion. Short-term and long-term loan balances at the end of the period remained relatively stable, standing at VND 2.3 trillion and VND 1.5 trillion, respectively.

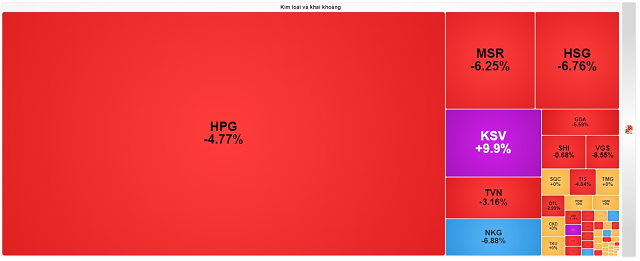

Amid the continuous decline of the VN-Index, KSV’s stock price has bucked the trend, surging by 65% over five consecutive sessions, even amidst the sell-off on August 5. Currently, the market price stands at VND 57,700 per share, the highest level since 2021-2022. Trading volumes during these sessions have also witnessed a remarkable surge, averaging around 321,000 shares per session, in contrast to the average of 14,000 shares from the beginning of the year until the period before this rally.

| KSV’s stock price movement since the beginning of July 2024 |

KSV’s stock turned purple amidst the sea of red following the close of the August 5 session. Source: VietstockFinance

|

Tu Kinh

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.