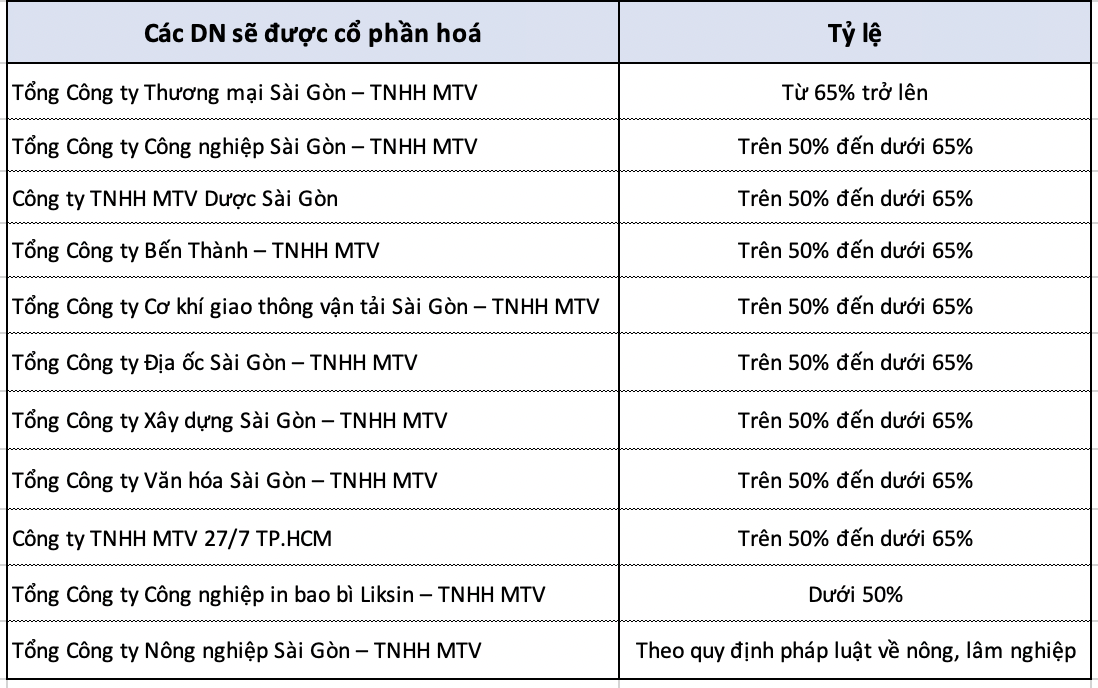

The Ho Chi Minh City People’s Committee has issued a plan for restructuring state-owned enterprises and those with state capital under its management by the end of 2025. This includes the privatization of 10 companies by 2025, with the state typically retaining a 50-65% stake.

Image: List of companies to be privatized.

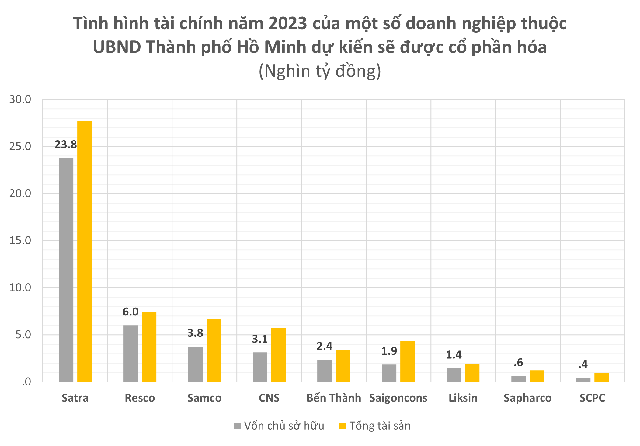

The only company in which Ho Chi Minh City will maintain a stake exceeding 65% is the Saigon Trading Group (Satra). Satra also stands out from the other companies on the list in terms of the scale of its assets and profits.

As of the end of 2023, Satra’s total assets and owner’s equity stood at VND 27,700 billion and VND 23,800 billion, respectively. Satra consistently generates profits of several thousand billion dong each year, largely derived from its 40% stake in two joint ventures that produce and distribute Heineken beer in Vietnam.

In addition to Satra, eight other companies will have state capital exceeding 50% but less than 65% after privatization. The first is Saigon Industry Corporation (CNS), with a charter capital of over VND 3,091 billion and total assets of nearly VND 4,666 billion as of the end of 2023. CNS is one of the largest manufacturers of cigarettes in Vietnam.

Ben Thanh Group, Resco, and Saigoncons are among the companies that own significant real estate and have large joint ventures in the fields of real estate and hospitality. Resco, for instance, holds 30% of the Sheraton Saigon Hotel and 16% of Keppel Land Watco (Saigon Centre). Meanwhile, Saigoncons owns 30% of the Park Hyatt Saigon hotel and 30% of the Metropolitan Tower. Similarly, Ben Thanh Group also has significant stakes in the Sofitel Saigon and Renaissance Riverside Saigon hotels.