According to a recent post on Bach Hoa Xanh’s official Facebook page, the company plans to open seven new supermarkets in August and is still recruiting additional staff. These new supermarkets will be located in Ho Chi Minh City, Long An, Binh Duong, and Dong Nai provinces.

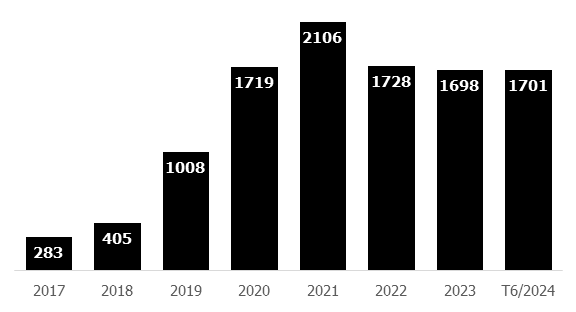

While seven supermarkets may not seem like a significant number for a food retail chain that already has 1,701 stores as of June 2024, the shift in trend is noteworthy. Bach Hoa Xanh reported a profit in the second quarter of this year for the first time, and it appears they are gearing up for expansion. The number of stores in the chain has remained relatively stable since the restructuring and mass closure of stores in 2022.

Stable

No significant change in the number of Bach Hoa Xanh stores

since the mass closure in 2022

|

Stores

Source: Vietstock, MWG

|

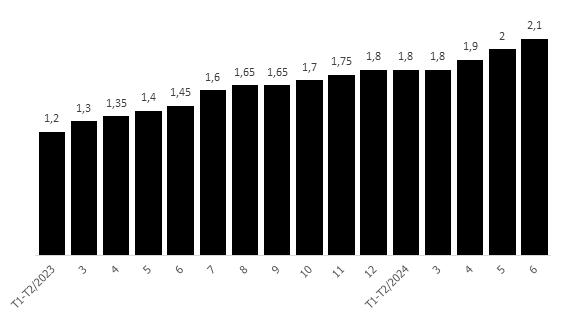

MWG’s investor relations report shows that the average revenue per Bach Hoa Xanh store has been steadily increasing from 2023 to 2024. This growth is driven by the restructuring process led by MWG’s Chairman, Nguyen Duc Tai, and Bach Hoa Xanh’s CEO, Pham Van Trong (appointed in April 2023), along with a shift in consumer behavior towards modern retail channels.

As of June 2024, the average monthly revenue per store in the system reached VND 2.1 billion.

Steady Increase

Nearly 45% rise in average revenue per store across the Bach Hoa Xanh system

in the last year, as of June 2024

|

VND Billion

Source: Vietstock, MWG

|

Bach Hoa Xanh reaching the break-even point and turning a profit in Q2 2024 marks a new chapter for MWG. The retail giant no longer needs to rely on profits from its other chains, The Gioi Di Dong and Dien May Xanh, to fund this supermarket chain.

Although Bach Hoa Xanh’s profit is minimal, with only about VND 7 billion in Q2 (compared to a loss of VND 105 billion in Q1), MWG’s profit picture has changed significantly. While the chain lost VND 657 billion in the first half of 2023, it has reduced its loss to just over VND 94 billion in the same period this year.

Two key factors contributing to this improvement are the end of the price war in the phone and appliance industry and Bach Hoa Xanh’s reduced losses. As a result, MWG recorded a net profit of nearly VND 2,080 billion in the first six months of this year, compared to just VND 17.4 billion in the same period last year.

The restart of new store openings is expected at Bach Hoa Xanh, especially after the chain successfully raised VND 1,770 billion from the Chinese investment fund CDH Investments in Q2 of this year.

However, the process of reopening stores will not be as aggressive as it was from 2019 to 2021. MWG’s leaders, during this year’s annual general meeting and quarterly periodic meetings, have described Bach Hoa Xanh’s new store openings as selective to ensure efficiency.

In a recent report released at the end of June, FPTS Research analysts predicted that the food retail chain under MWG would increase its store count to 1,740 by the end of 2024.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.