With an estimated 17,000 retail gasoline and oil outlets, Vietnam’s fuel retailers provide tens of millions of tons of products to consumers annually. The duo of Petrolimex and PV Oil currently controls nearly 70% of the domestic market share in terms of revenue. It’s no surprise, then, that these two fuel retailers are among the top performers on the stock exchange in terms of revenue.

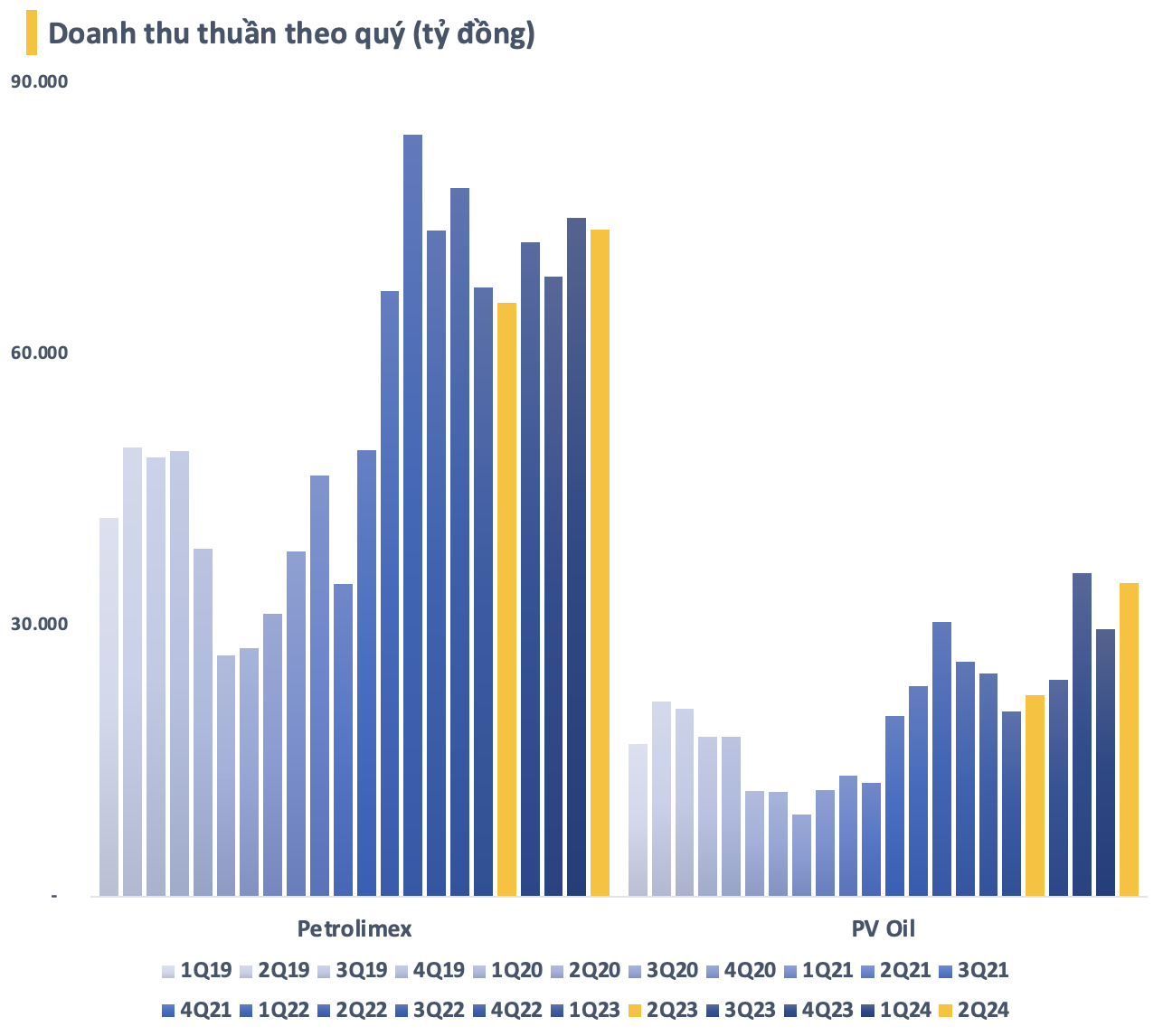

In the second quarter of this year, the combined revenue of Petrolimex and PV Oil reached nearly VND 109,000 billion, a remarkable 23% increase compared to the same period in 2023, and the highest in the last two years. On average, these two fuel retailers bring in nearly VND 1,200 billion per day. This figure is only slightly lower than the record high achieved in the second quarter of 2022.

Of this, Petrolimex recorded second-quarter revenue of nearly VND 73,800 billion, up 12% from the same period last year but lower than the first quarter. Meanwhile, PV Oil recorded its second-highest quarterly revenue in history at VND 34,800 billion, a 55% increase from the previous year and 17% higher than the first quarter of this year.

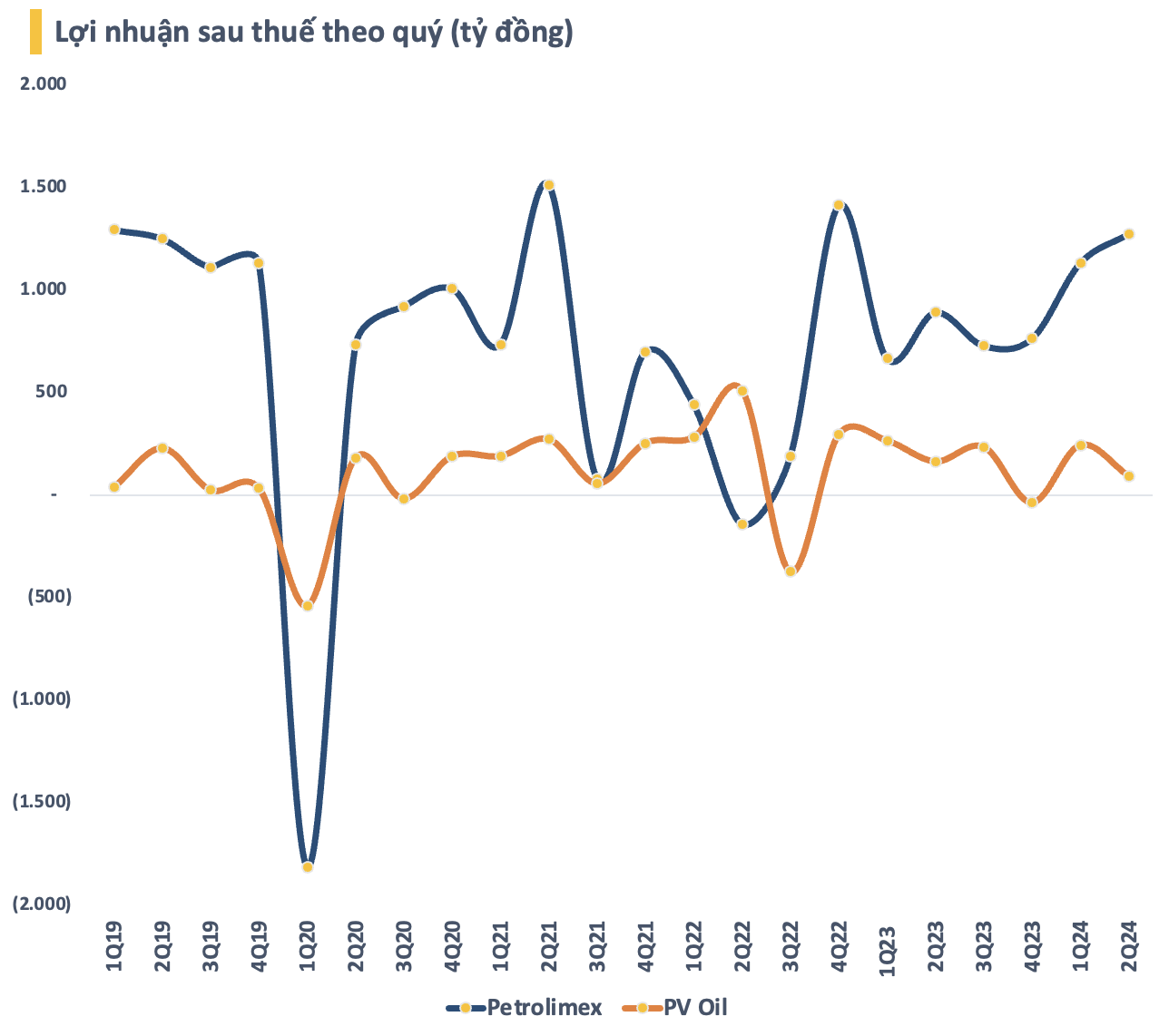

Although both retailers experienced significant increases in revenue compared to the previous year, their profits showed contrasting trends. Petrolimex’s second-quarter after-tax profit increased by nearly 43% year-on-year to over VND 1,275 billion, the highest since the fourth quarter of 2022. On the other hand, PV Oil’s net profit decreased by 43% over the same period to VND 94 billion.

According to PV Oil’s explanation, the frequency of base price adjustments decreased from 10 days/time in the second quarter of 2023 to 7 days/time in the second quarter of 2024. Therefore, despite the downward trend in global fuel prices similar to the previous year, the speed of price reductions during this period was faster, significantly narrowing gross profit. Additionally, the higher USD/VND exchange rate in the second quarter of 2024 compared to the same period last year resulted in increased financial expenses due to foreign exchange losses, impacting the company’s profitability.

In the first six months of the year, Petrolimex recorded net revenue of VND 148,943 billion and after-tax profit of VND 2,407.4 billion, increases of 12% and 54%, respectively, compared to the same period in 2023. Profit before tax reached VND 2,994 billion, 1.6 times higher than the previous year. With these results, Petrolimex has achieved approximately 79% of its revenue plan and exceeded its annual profit target.

On the other hand, PV Oil has accomplished nearly 78% of its revenue plan and 57% of its profit target at the halfway point of 2024. In the first six months, the company recorded revenue of nearly VND 64,400 billion and a pre-tax profit of VND 312 billion, representing increases of 50% and a decrease of 24%, respectively, compared to the same period in 2023.

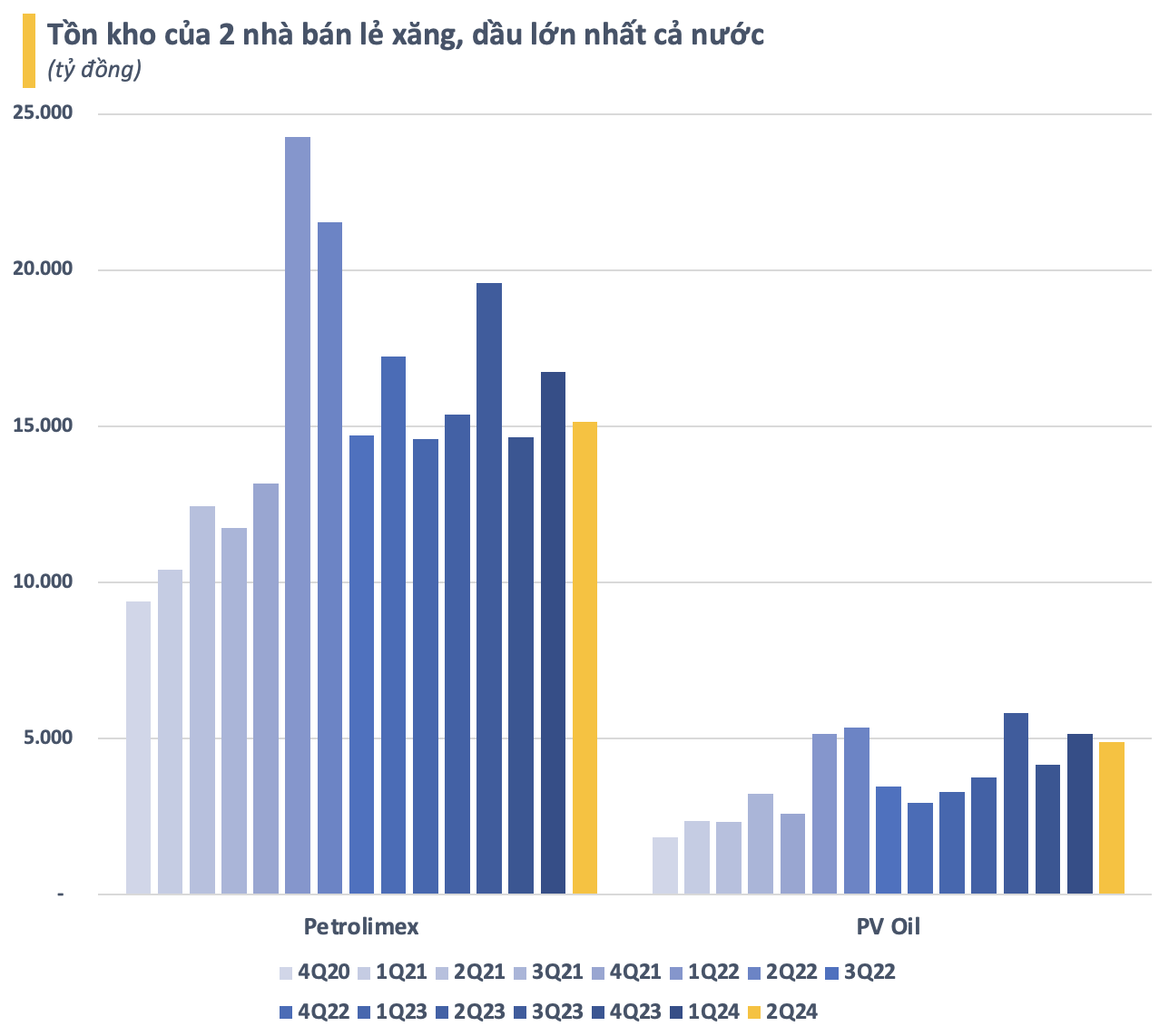

A common trend between these two fuel retailers is the reduction in inventory scale in the last quarter. As of June 30, Petrolimex’s inventory stood at over VND 15,000 billion, a decrease of more than VND 1,600 billion from the previous quarter but slightly higher than the beginning of the year. PV Oil’s inventory also decreased slightly in the second quarter to nearly VND 4,900 billion, still significantly higher than at the start of the year.

Benefiting from the New Decree Proposal

According to a recent report by Maybank Investment Bank, the proposed new decree on gasoline and oil business is expected to positively impact major industry players. The investment bank believes that the new decree will reinforce the advantages of traders, benefiting the dominant players in this group (Petrolimex and PV Oil) the most in terms of potential market share and profit margin growth.

Specifically, the decree maintains the provision that only traders are allowed to purchase gasoline and oil directly from domestic refineries or import from abroad. Meanwhile, the selling prices from these traders to distributors/retailers are not legalized and are entirely based on agreements between the parties involved. In other words, traders retain the power to determine the distribution of profit margins within the value chain.

Distributors will be required to purchase gasoline and oil directly from traders and will no longer be permitted to make cross-purchases from other distributors. Additionally, the decree imposes stricter conditions on retailers, weakening their position within the value chain compared to distributors and traders.

Furthermore, the new decree aims to increase the number of days of fuel reserves from 20 to 30 days, which will increase business costs but will not affect the competitive advantage of traders within the entire value chain.

“Unless there are significant changes from the initial draft, the spirit of the new decree will improve the way retail prices operate, reduce fragmentation, and benefit large-scale traders”, emphasized Maybank Investment Bank in its report.

Following the release of the draft, the stock prices of Petrolimex (PLX) and PV Oil (OIL) quickly accelerated from mid-April. After nearly four months, PLX’s market price has increased by nearly 42%, while OIL’s stock price has also risen by nearly 45%. Both stocks are currently trading at their highest levels in more than two years.

PV OIL reports Q4/2023 loss, doubled debt financing

Due to the decrease in world oil prices, PV OIL incurred a net loss of over 36 billion VND in Q4 2023. What’s more, the company’s total debt at the end of the year increased 2.6 times compared to the beginning of the year, reaching 7,055 billion VND, mainly in the form of short-term loans.