Why NCS’s Profits Soar

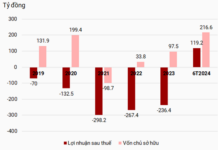

In the first half of this year, Noi Bai Aviation In-Flight Catering Joint Stock Company (stock code: NCS) reported an after-tax profit of over 27 billion VND, a significant increase compared to the same period last year. NCS is one of the largest providers of in-flight catering services in the market. The company also supplies bubble tea to Vietnam Airlines.

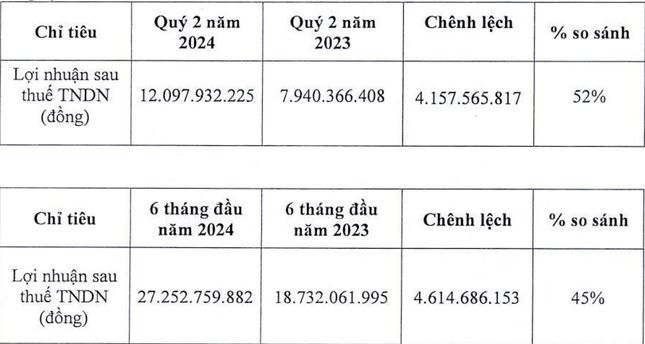

NCS’s second-quarter financial report recorded a revenue of over 162 billion VND. In the six-month cumulative, the company achieved 340 billion VND in revenue, a 20% increase year-on-year. After deducting expenses, NCS’s after-tax profit reached over 27 billion VND in the first six months, a 45% increase compared to 2023.

NCS’s profit growth compared to the same period.

In its explanation to the State Securities Commission and the Hanoi Stock Exchange (HNX), NCS attributed its revenue and profit growth to the full recovery of the international aviation market, even surpassing pre-COVID levels in 2019. The international flight network continues to expand, with airlines increasing flight frequencies and enhancing service standards. Meanwhile, the domestic market remains stable and growing.

“The company continues to provide non-aviation products such as pork pies for Tet, bubble tea, mooncakes, and other bakery products. As a result, revenue and profit in the second quarter and the first six months of the year increased significantly compared to the same period last year,” NCS explained.

As of mid-year, NCS’s equity stood at 154 billion VND, approximately equal to half of the company’s payables (303 billion VND).

Sasco’s Profit Decline

In the southern market, the financial results of Tan Son Nhat Airport Aviation Service Joint Stock Company (Sasco, stock code: SAS) showed a decline. In the second quarter, Sasco recorded a revenue of 654 billion VND (up 8% year-on-year), but its after-tax profit decreased by nearly 9% to 68 billion VND.

Sasco’s profit decline occurred amid a significant increase in cost of sales and administrative expenses, up 11% and 30% to 227 billion VND and 81 billion VND, respectively.

Additionally, financial expenses soared to 16 billion VND due to foreign exchange losses, while financial income plummeted to 35 billion VND, mainly due to a decrease in bank interest income.

Nevertheless, in the first six months of the year, Sasco’s after-tax profit still managed a slight increase of 3% year-on-year, reaching 113.5 billion VND. This result was largely due to improved business performance in the first quarter and the overall recovery of the aviation market.

Sasco’s core business areas include duty-free sales and lounge operations.

Sasco currently has equity of 1,460 billion VND, nearly double its payables (755 billion VND). The company has no short-term financial debt or lease liabilities. Its largest liability is short-term accounts payable, totaling over 401 billion VND, mainly owed to IPP Group, owned by ‘luxury king’ Johnathan Hannah Nguyen (270 billion VND).

Sasco is also a company chaired by Johnathan Hannah Nguyen, specializing in retail, duty-free, and service operations at Tan Son Nhat International Airport.

In central Vietnam, Danang Airport Aviation Service Joint Stock Company (MAS) reported a 240% surge in after-tax profit in the second quarter compared to the same period last year, reaching 3.822 billion VND. Revenue increased by 46% to 50 billion VND.

MAS’s growth reached triple digits.

MAS stated that in the second quarter, passenger volume to and from central Vietnam airports increased significantly. Consequently, all of the company’s business areas experienced growth compared to the previous year. Revenue increased across the board: in-flight catering (51%), driver training for cars and motorcycles (53%), and commerce (25%).

As of the end of the second quarter, MAS’s payables stood at over 48 billion VND, a 20% increase from the beginning of the year.