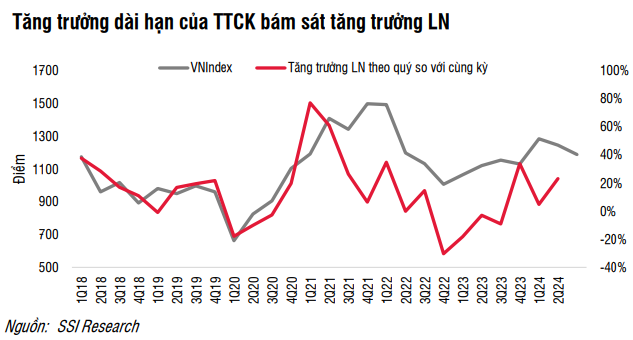

SSI Research notes that the market experienced heightened volatility during the early August sessions as new risk variables emerged. However, several positive factors may have been overlooked due to prevailing psychological factors, such as easing forex risks, a positive quarterly profit recovery trend, and more attractive market valuations as prices continue to adjust.

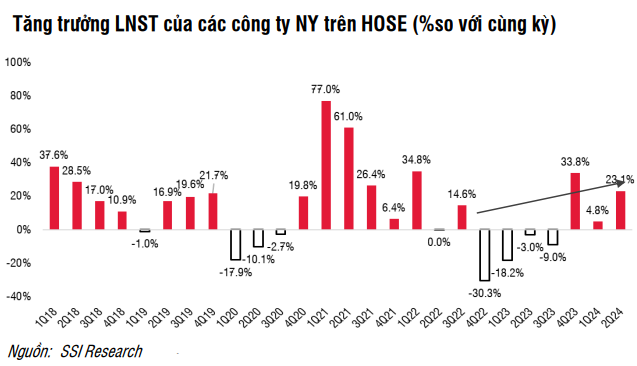

Market profit growth in Q2 2024 continued to improve, with total profits on HOSE rising over 23% year-on-year and 17.5% quarter-on-quarter. The analyst team assesses that the expansion of profit growth compared to Q1 is a supportive factor for the stock market in two aspects: cash flow rotation among industries and an increase in the number of leading stocks driving the market.

According to SSI Research, if economic growth remains positive in the latter part of the year, it will support the continued growth of listed companies, which is a positive factor for the stock market in the long term. However, recession signals in major economies will be a risk factor to monitor closely as it could also affect Vietnam’s recovery process.

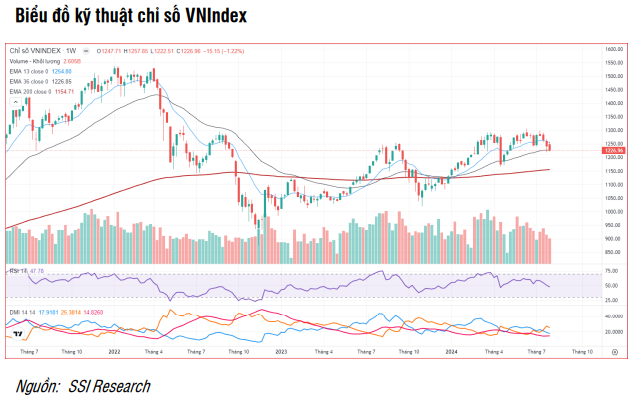

Based on technical analysis, SSI Research believes that technical indicators such as RSI and ADX are in a weak neutral zone on the medium-term chart. However, the technical strength of ADX is weak, indicating that the corrective decline in August, while exerting significant pressure, quickly regained balance.

“VN-Index may find balance in the medium-term support zone of 1,145-1,155 points and recover. Nevertheless, a strong recovery momentum is not highly regarded, and the 1,260-point zone could act as a resistance level in the VN-Index‘s recovery process,” quoted from the SSI report.

With supportive factors for the stock market, including profit recovery momentum and solid valuation foundations, investors are advised to seek opportunities in industries/stocks with room for valuation expansion and factors benefiting from the economic recovery in the second half of the year. The focus may be on consumer goods (food, retail) and industrial goods & services (seaport transportation stocks).

SSI Research also believes that excessive volatility due to psychological factors will create favorable opportunities for stocks with a history of stable cash dividend payments and those with robust balance sheets. Given the new risk variable with unpredictable fluctuations, the analyst team recommends a strategy of “Accumulating in Parts on Deep Price Corrections” for the current phase.