On August 8, 2024, HSBC Global Research released a report titled “Vietnam at a Glance – FDI,” highlighting Vietnam’s continued appeal as a preferred destination for foreign-invested enterprises (FIEs).

Numerous Competitive Advantages

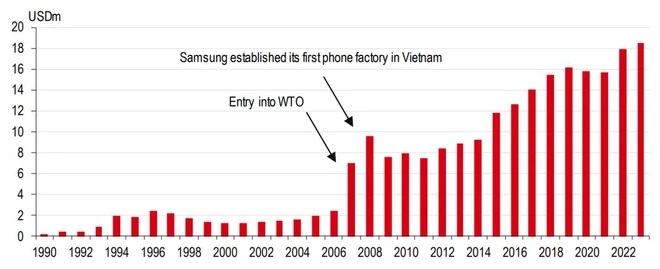

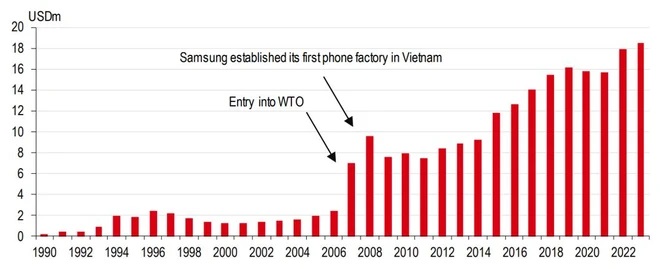

HSBC analysts argue that over the past two decades, Vietnam has transformed itself into a major manufacturing hub, deeply integrated into global supply chains. Exports have grown by over 13% annually since 2007, largely driven by foreign-invested businesses.

Historically, FDI inflows into Vietnam have primarily originated from South Korea, notably Samsung. In 2023, Chinese manufacturing companies also ramped up their investments, accounting for nearly 20% of new registered FDI. Actual FDI in Vietnam during the first six months of the year is estimated at 10.84 billion USD, an increase of over 8% from the same period last year and the highest level in the past five years.

So far this year, registered new manufacturing FIEs have increased by 36% compared to the same period last year and higher than some previous years. Bac Ninh province attracted more than 30% of the total registered capital in June and July, as Amkor Group accelerated its investment in a semiconductor project in the province by an additional 1.07 billion USD.

According to HSBC, the interest of multinational corporations in Vietnam has increased significantly due to various factors, including competitive costs and FDI-supportive policies. When comparing manufacturing labor costs in the Asian region, Vietnam offers lower wages despite its population’s strong basic education levels.

Other costs, such as energy needed for factory operations and widely used diesel fuel, also showcase a competitive pricing advantage.

Additionally, Vietnam has made significant progress in establishing various economic agreements with trading partners, such as the Vietnam-EU Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These moves have supported and facilitated foreign investors.

Explosion of FDI inflows into Vietnam since 2007. Source: HSBC

|

The conducive investment environment can be partly attributed to the government’s active support through its tax system. Vietnam is competitively positioned compared to other countries, thanks to its statutory corporate income tax rate of 20%. Some businesses can further reduce their effective tax rates by taking advantage of extended tax exemption and reduction periods.

Up to the present, attractive factors have played a crucial role in attracting investment and helping Vietnam integrate deeply into the global value chain. In fact, Vietnam’s participation in the global value chain has increased significantly over the years, now comparable to Singapore. However, this increased integration has primarily occurred through more backward linkages. Vietnam is currently positioned as a center for the import of complex intermediate inputs for final assembly, as evidenced by the low localization rate in the electronics industry.

Maintaining Robust Investment Flows

To maintain robust investment flows, HSBC analysts emphasize the importance of Vietnam moving up the manufacturing value chain and increasing the domestic value-added portion in these goods.

Compared to the robust growth of consumer electronics exports, Vietnam’s share in global integrated circuit (IC) exports is growing at a slower pace. The shortage of skilled labor has led to challenges in developing semiconductor manufacturing capabilities, prompting the government to seek ways to expand the semiconductor workforce in the coming years.

Additionally, the lack of skilled labor also impacts other sectors, such as logistics and maritime transport. Beyond expanding and enhancing vocational education at the national level, more initiatives are needed to encourage the participation of foreign companies in the domestic economy, which can help increase the benefits of increasingly complex FDI flows.

On the other hand, factors beyond tax considerations, such as infrastructure quality, also require proactive attention.

Measures such as leveraging digitalization for seamless trade processes, ensuring stable and “green” energy, and facilitating cargo transportation through infrastructure improvements, can influence the investment decisions of multinational corporations in the years ahead.

Encouragingly, there are signs that more complex knowledge and production processes are entering Vietnam. In 2022, Samsung established a research and development center in Hanoi to further develop its manufacturing capabilities and began producing some semiconductor components. Meanwhile, Apple has also increased its presence in Vietnam, allocating product development resources for the iPad.

In other sectors, HSBC assesses that in July, Vietnam’s trade continued to recover, with exports growing by 19% year-on-year, easily surpassing market expectations.

Meanwhile, inflation continued to inch closer to the State Bank of Vietnam’s (SBV) 4.5% ceiling. Full inflation increased by 0.5% from the previous month due to persistently high commodity prices and other volatile factors, such as higher health insurance contributions. As a result, year-on-year inflation stood at 4.4%, almost in line with market expectations. However, HSBC anticipates that the unfavorable base effect will soon fade, pushing inflation down to a low of 3.6% for the full year 2024.

With relatively controlled price pressures and the domestic sector needing more time to strengthen, HSBC expects the SBV to maintain its accommodative policy stance and keep policy rates stable throughout the forecast period at 4.5%. This is likely to help Vietnam achieve its 2024 growth target of 6.5%.